Quarterly performance

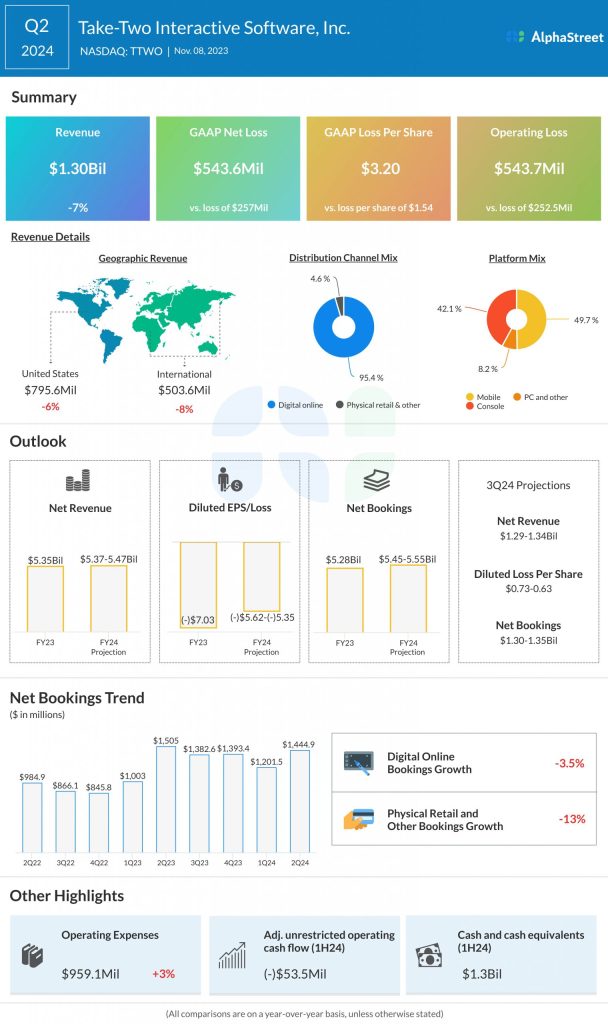

Net bookings, which is defined as the amount of products and services sold digitally or sold-in physically, decreased 4% to $1.44 billion. Recurrent consumer spending, which is generated from ongoing consumer engagement and includes virtual currency and in-game purchases, was down 9% in the quarter and made up 77% of total revenue.

Franchise strength

The biggest contributors to revenue in the second quarter were Grand Theft Auto Online and Grand Theft Auto V, Red Dead Redemption 2 and Red Dead Online, NBA 2K23 and NBA 2K24, Empires & Puzzles, Toon Blast, Merge Dragons!, Words With Friends, Zynga Poker, and the company’s hyper-casual mobile portfolio.

Grand Theft Auto V and Grand Theft Auto Online continue to perform well. Grand Theft Auto V has sold-in approx. 190 million units to-date. The announcement that the first trailer of the next Grand Theft Auto will be out in December has created a buzz as the GTA franchise is one of the company’s most popular ones and the new release is anticipated to drive significant growth. Red Dead Redemption 2 is also doing well and has sold-in more than 57 million units to-date.

Outlook

For the third quarter of 2024, Take-Two expects net revenue of $1.29-1.34 billion and net loss per share of $0.63-0.73. Net bookings are expected to be $1.30-1.35 billion, compared to $1.4 billion in the prior-year quarter. Recurrent consumer spending is expected to be down by around 5%, assuming a modest decline in the mobile business.

For the full year of 2024, net revenue is expected to be $5.37-5.47 billion. Net loss per share is expected to range between $5.35-5.62. Net bookings are projected to range between $5.45-5.55 billion. Take-Two expects the US to account for 65% of net bookings and international to account for 35%. Recurrent consumer spending is expected to grow 4%.