Health insurance company UnitedHealth Group (NYSE: UNH) reported strong second-quarter results last week, triggering a stock rally. The company also strengthened its full-year earnings outlook, adding to investor confidence.

The healthcare conglomerate, which provides insurance coverage and benefits services to millions of people, saw its stock rising around 7% soon after the earnings announcement — one of the biggest one-day gains ever. The rally came as a much-needed boost to the stock which has been experiencing weakness since peaking nearly a year ago.

Valuation

UNH seems to be on the threshold of a major rebound, with market watchers predicting double-digit gains and a new high in the near future. Considering the reasonable valuation and the strength of the company’s diversified portfolio, it is an investment option worth trying. Recently, the dividend was raised by an impressive 14%, with a yield that is close to the S&P 500 average. The company has raised dividends consistently for more than a decade now.

The management believes that the impact of claims related to non-urgent medical procedures on profit would remain moderate due to the slow recovery of that healthcare segment from the pandemic-era lows. There was a decline in elective procedures as hospitals and clinics channelized their resources for COVID care during the pandemic. Insurance companies, in general, had benefited from the delay/postponement of non-urgent surgeries.

Good & Bad

The recent acquisition of Change Healthcare and its incorporation into Optum should contribute to revenues going forward. Meanwhile, outpatient care activity of seniors is increasing gradually and the medical cost ratio — the percentage of payout on claims compared with premiums — increased by 1.7 points in the most recent quarter. That said, being a market leader, UnitedHealth has the pricing power to maintain margins at sustainable levels.

UnitedHealth’s CEO Andrew Witty said in a recent interaction with analysts, “Even in this challenging funding environment, we continue to prioritize the stability and affordability our members have come to rely on from UnitedHealthcare. We’re confident that next year, we will once again grow at a pace exceeding that of the broader market. While of a much lesser impact than senior outpatient care, we also are seeing increased care activity in behavioral. Over the past few years, behavioral care patterns have been accelerating as people increasingly feel comfortable seeking services. Just since last year, the percentage of people who are accessing behavioral care has increased by double digits.”

Key Metrics

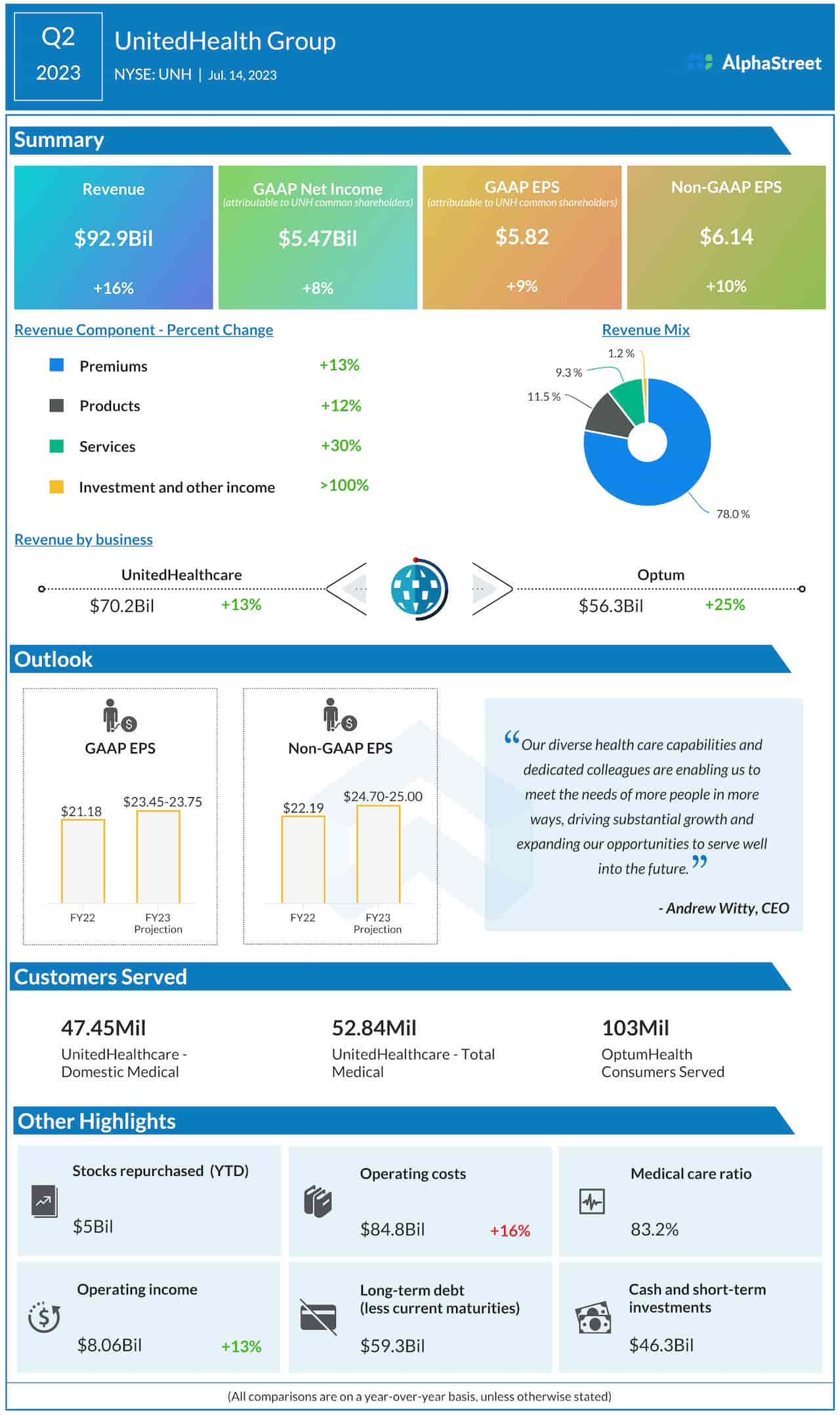

In the three months ended June 30, adjusted profit climbed 10% from last year to $6.14 per share. The bottom line also exceeded estimates, a trend the company has maintained since it started reporting financial results. At $92.9 billion, revenues were up 16% and above estimates. The topline beat estimates for the twelfth quarter in a row, with all business divisions performing exceptionally well.

The core UnitedHealthcare business expanded 13%, while Optum revenues jumped 25%. The management also narrowed the range of its full-year adjusted earnings target to $24.70-25.00 per share, thereby raising the mid-point.

UNH has been trading below its 12-month average since mid-April. On Monday, the shares traded higher and mostly stayed above $480.