Overview

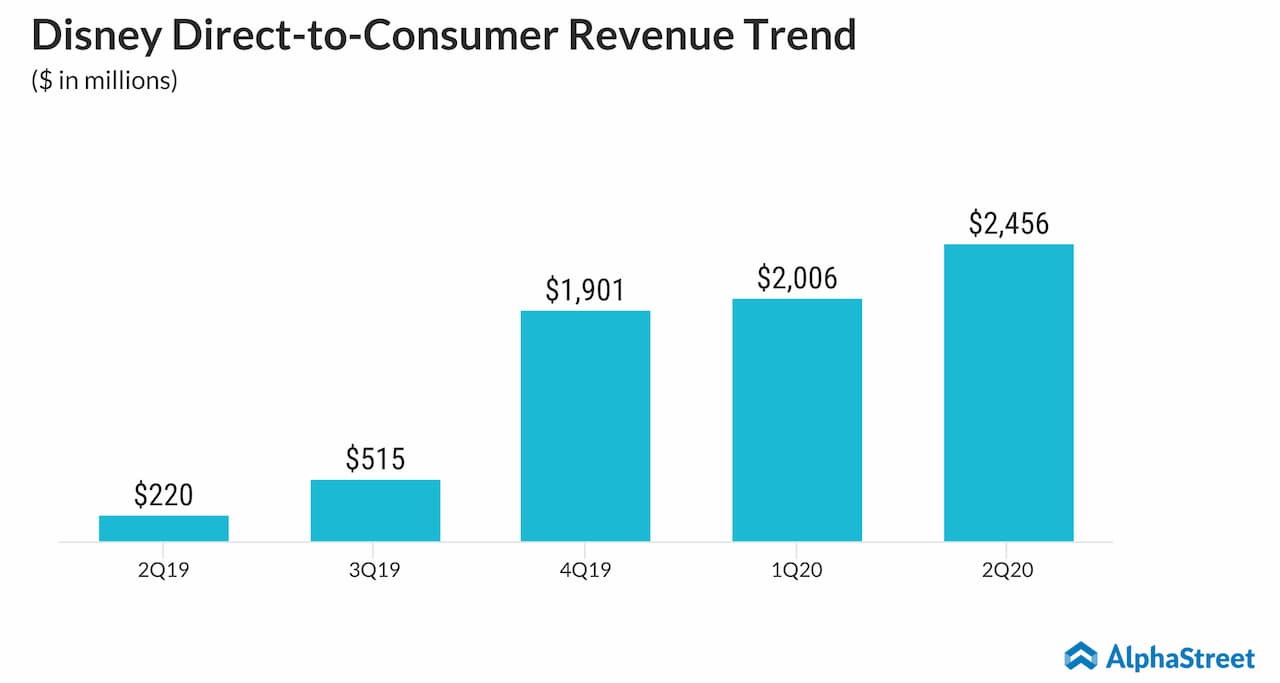

The company’s DTC businesses comprise streaming-based subscription services for entertainment programming that generate revenues through subscription fees and advertising sales. These services are offered through mobile and connected devices for a monthly or annual fee.

DTC services

ESPN+, which is devoted to sports programming, had approx. 3

million paid subscribers as of September 2019. This number increased to 7.9

million at the end of the second quarter of 2020. The average monthly revenue

per paid subscriber for ESPN + decreased to $4.24 from $5.13 due to the

introduction of a bundled subscription package of Disney +, ESPN + and Hulu in

November 2019.

Disney’s strategic acquisitions have helped it strengthen its content as well as expand into new markets. The purchase of the film and TV assets of 21st Century Fox was a huge gain for Disney as it provided the company with rich content and a strong footing in important markets through streaming services like Hulu and Hotstar.

Disney at first owned a 30% interest in Hulu which increased to 60% with the acquisition of Fox. The company obtained the 10% stake held by WarnerMedia and then went on to gain full operational control through an agreement with NBCU. Hulu was popular for original content like the series The Handmaid’s Tale which won several awards. In September 2019, Hulu had approx. 29 million paid subscribers. This number stood at 32.1 million at the end of March 2020.

The acquisition of Fox gave Disney another valuable asset in

the form of Hotstar, which is a leader in the streaming space in India. The

service, which offers content in English and in various regional languages,

provides Disney access to an important market with vast potential for further

growth. As of March 2020, Hotstar is estimated to have at least 300 million

active users.

According to a report

by Livemint, India’s online video market is expected to reach $4 billion by

2025, with subscription services contributing over $1.5 billion to this number.

Disney+ Hotstar is expected to acquire 25% of total online video revenues by

2025. The report also states that Disney+ Hotstar could reach 93 million paying

subscribers by 2025.

Now coming to Disney’s biggest streaming asset – Disney +. Disney launched its own streaming service Disney + in November 2019 in the US. The company has plans to launch in Western and Eastern Europe, Latin America and parts of Asia-Pacific in 2020 and 2021.

Disney + offers 7,500 series and 500 movies from its own

library of TV and film content and the company is also working on producing

original content for its streaming service. Its original series The Mandalorian is extremely popular and

has gained a loyal viewer base since its release last November.

At the end of March 2020, Disney+ had 33.5 million paid

subscribers. According to a report

by cnet, as of early May, Disney + had 54.5 million subscribers. This

brings it close to its estimate of reaching 60-90 million subscribers in about

5 years.

Streaming services market

The COVID-19 pandemic, which led to a global lockdown forcing

people to stay at home, benefited the online streaming services market. During

this period, several streaming services saw a hike in new users as people explored

new ways of entertainment.

According to a report

by Grand View Research, video streaming services saw a rise of around 10%

in viewership during the lockdown with major players like Disney+, Netflix (NASDAQ: NFLX) and Amazon Prime

Video seeing a spike in their viewership.

The report states that the global video streaming market size

was valued at $42.6 billion in 2019 and is projected to grow at a CAGR of 20.4%

from 2020 to 2027.

Competition

Disney + has formidable opponents in Netflix and Amazon’s (NASDAQ:

AMZN) streaming service, Amazon Prime Video. In its most recent quarter,

Netflix had 182.86 million paid members and this number is expected to increase

to 190.36 million in the second quarter of 2020. According to a report

by market.us, as of January 2020, there are more than 150 million Amazon

Prime Video users.

In summary, Disney’s biggest strength is its rich content which provides the company with a loyal fan base. This, coupled with its strategic investments, will help drive further growth going forward while also presenting the possibility of the company overtaking its competitors over time.

Check out the full transcript of Walt Disney Q2 2020 earnings conference call here