Revenue and margins

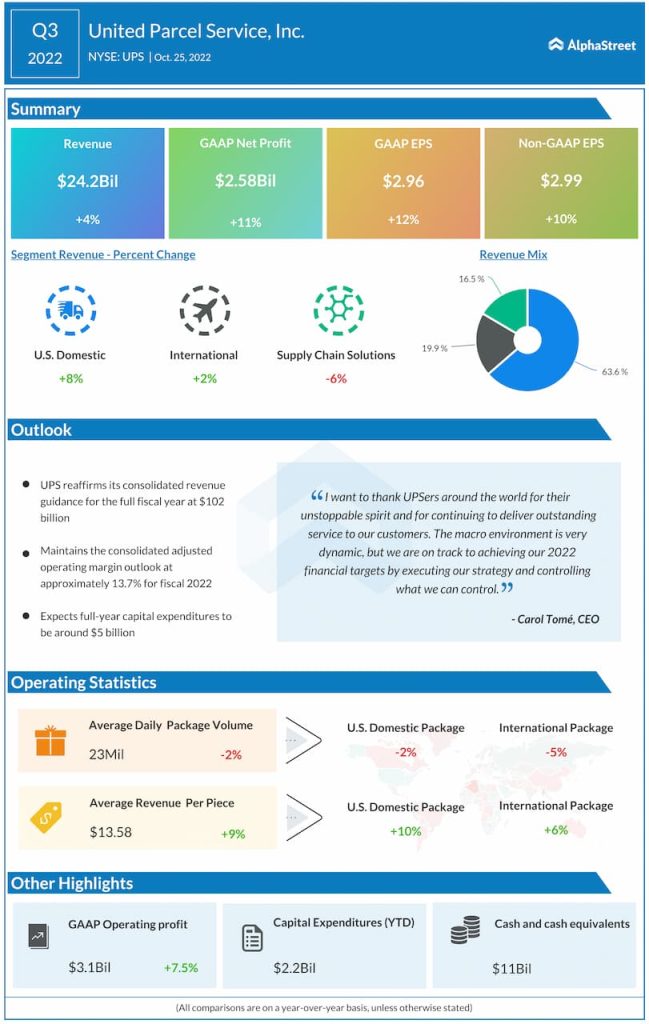

Despite these challenges, the company’s consolidated revenue increased 4.2% to $24.2 billion in Q3 2022 compared to the year-ago quarter. Adjusted EPS rose 10.3% to $2.99 while consolidated operating margin expanded to 13%, which was up 20 basis points from last year.

UPS stated that according to IHS, global GDP is expected to grow 2.8% and US GDP is expected to grow 1.7% for the full year. Both these numbers are lower than the forecasts provided at the beginning of the year. The company now faces a much different macroeconomic environment compared to the start of the year but by making adjustments to its network as well as other areas, it remains on track to deliver its full-year targets. For full-year 2022, consolidated revenue is expected to be around $102 billion while operating margin is projected to be about 13.7%.

US Domestic

In the US Domestic segment, revenue grew 8.2% to $15.3 billion in Q3, driven by a 9.8% increase in revenue per piece. Average daily volume was down 1.5% from the year-ago quarter. B2C average daily volume declined 2.2% driven by contractual agreements with certain enterprise customers. B2B average daily volume dropped 0.5% due to decreases in manufacturing volumes. This was partly offset by growth in retail B2B driven by returns volume.

For the fourth quarter of 2022, UPS expects US Domestic revenue to grow around 4.5% and operating margin to expand to around 12.4%. Average daily volume growth rate is expected to be lower in Q4 compared to Q3 due to the contractual agreements mentioned earlier. Cost per piece growth rate is also expected to be lower in Q4 versus Q3.

International

In Q3, revenue in the International segment rose 1.7% to $4.8 billion, driven by a 6.4% increase in revenue per piece. Average daily volume was down 5.2%. Total export average daily volume declined 0.6% year-over-year. In Q4 2022, International revenue is expected to be relatively flat compared to the year-ago period. Operating margin is expected to increase sequentially to around 21.5% in Q4.

Click here to read the full transcript of UPS’ Q3 2022 earnings conference call