Stock Outperforms

Read management/analysts’ comments on Adobe’s Q2 earnings

With the work/learn from home trend gaining momentum across the globe, amid the continuing COVID-induced uncertainty, the demand for digital documents keeps growing. That bodes well for Adobe’s product suites Creative Cloud, Document Cloud, and Experience Cloud. In the most recent quarter, recurring revenue accounted for more than 90% of total revenues.

Unrivaled

While leveraging the current tailwinds, efforts are on to sustain the growth momentum by innovating the product roadmap and enhancing customer experience. It is worth noting that applications like Photoshop and After Effects continue to gain market share without any resistance. While most Adobe products face relatively less competition, close rival Autodesk, Inc. (NASDAQ: ADSK) is trying hard to keep pace with the company.

Interestingly, profitability and topline growth accelerated during the pandemic, reflecting the underlying strength of the business and elevated demand. Continuing a trend that persisted over the past several years, earnings topped expectations in every quarter since the onset of the pandemic.

Over the last year, we have seen the critical role creativity has played in the world. Creative Cloud is empowering everyone, from the most demanding professional to the high school student, to the next generation of social media creators, to tell their stories. Adobe is the leader in core creative categories such as imaging, design, video, and illustration and we are expanding our leadership in exciting new media types, including screen design and prototyping, 3D, and AR.

Shantanu Narayen, chief executive officer of Adobe

Impressive Earnings

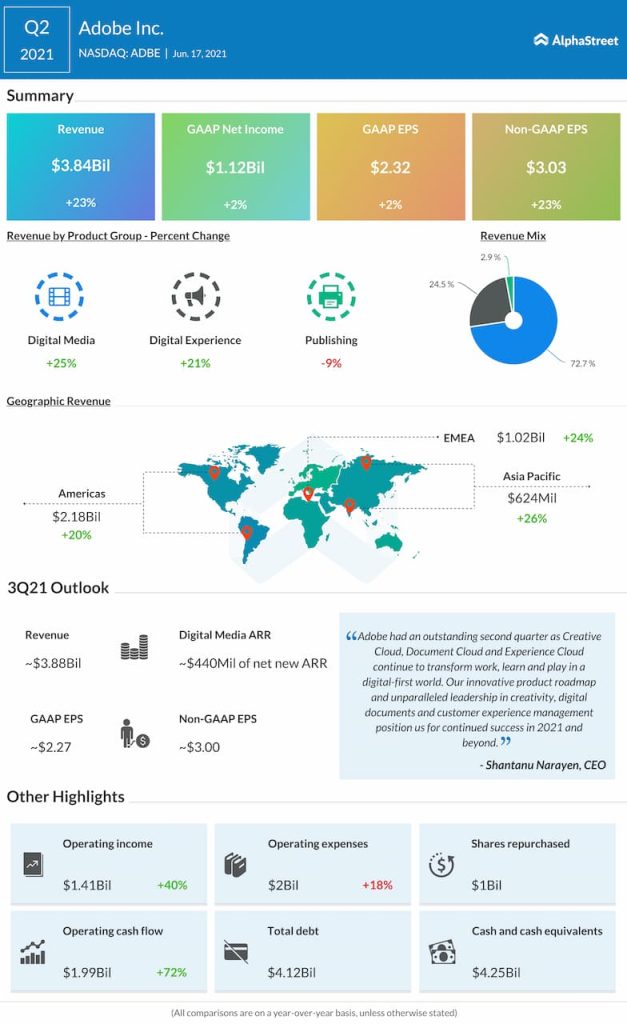

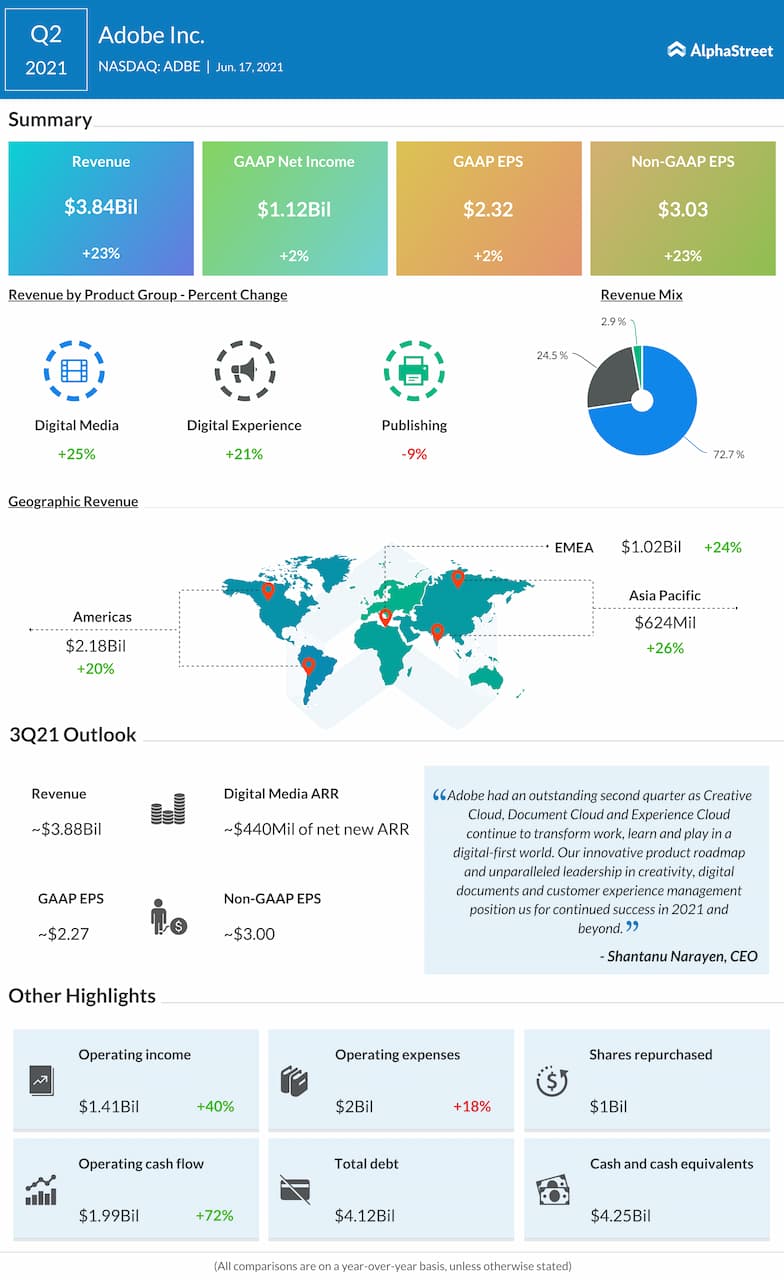

In the second quarter of 2021, total revenues climbed 23% to $3.84 billion and topped expectations as the main business segments of Digital Media and Digital Experience registered double-digit growth. Consequently, adjusted earnings moved up 23% to $3.03 per share, which is above the consensus forecast.

When the company reports third-quarter results on September 21 after the regular trading hours, market watchers will be looking for adjusted earnings of $3.01 per share — which is up 17% year-on-year –on revenues of $3.89 billion.

Oracle fast tracks cloud expansion. Is the stock a buy?

Adobe’s stock set a fresh record early this month after gaining steadily over the past several years, mostly staying above the long-term average. However, it lost some momentum since then amid the general weakness in tech stocks. The shares traded sharply lower on Friday and closed the session lower.