Stock Performance

The long-term performance of the company’s stock is marked by a series of ups and downs, as it often failed to maintain momentum. After slipping into a two-decade-low in early 2020 – after margins were hit by coronavirus — KSS quickly returned to the growth path and recouped most of the losses in the following months. But it changed course and once again entered a downward spiral this year. Trading below its 52-week average, currently the stock is in the bear market and that calls for caution. It would a good idea to hold buying/selling decisions for now and wait for valid cues on future growth.

Read management/analysts’ comments on quarterly reports

Recently, CEO Michelle Gass quit, ending her four-year stint at the top post, and stepped down from the board of directors. Of late, Gass was having a tough time as her leadership constantly came under criticism. While Gass prepares to join Levi Strauss & Co. (NYSE: LEVI) as president early next year, Kohl’s has initiated the search for a new chief.

Mixes Results

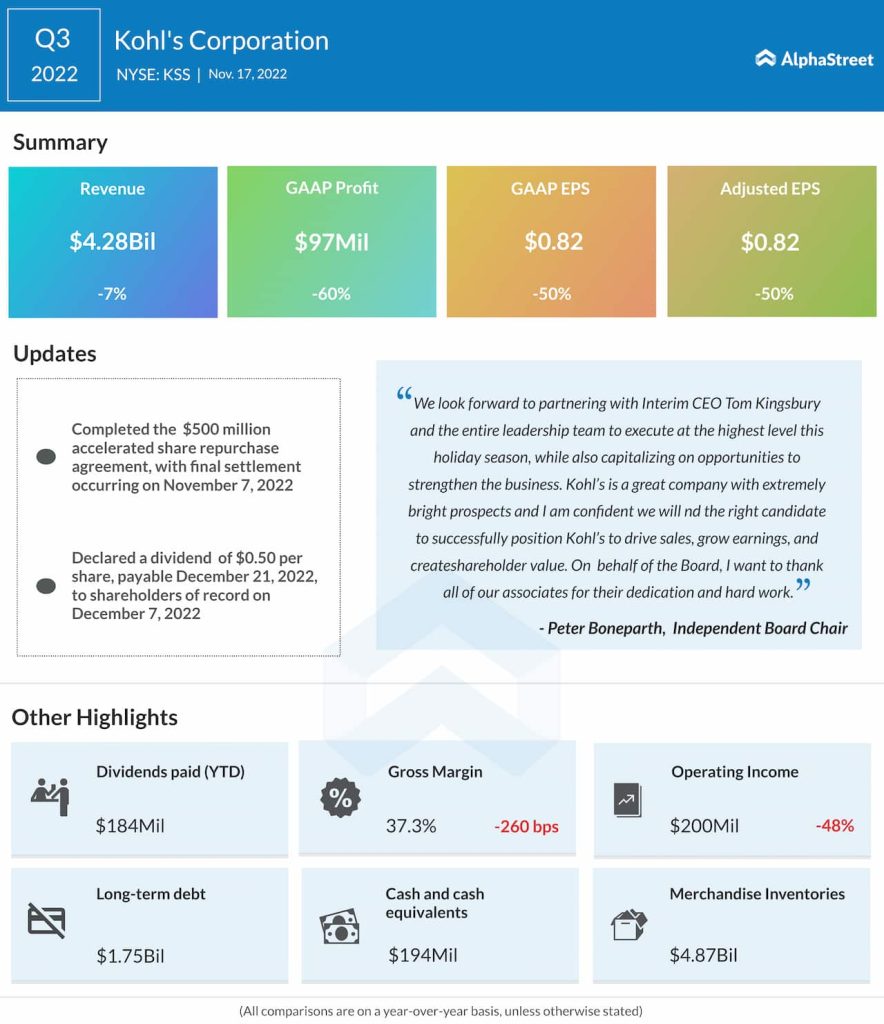

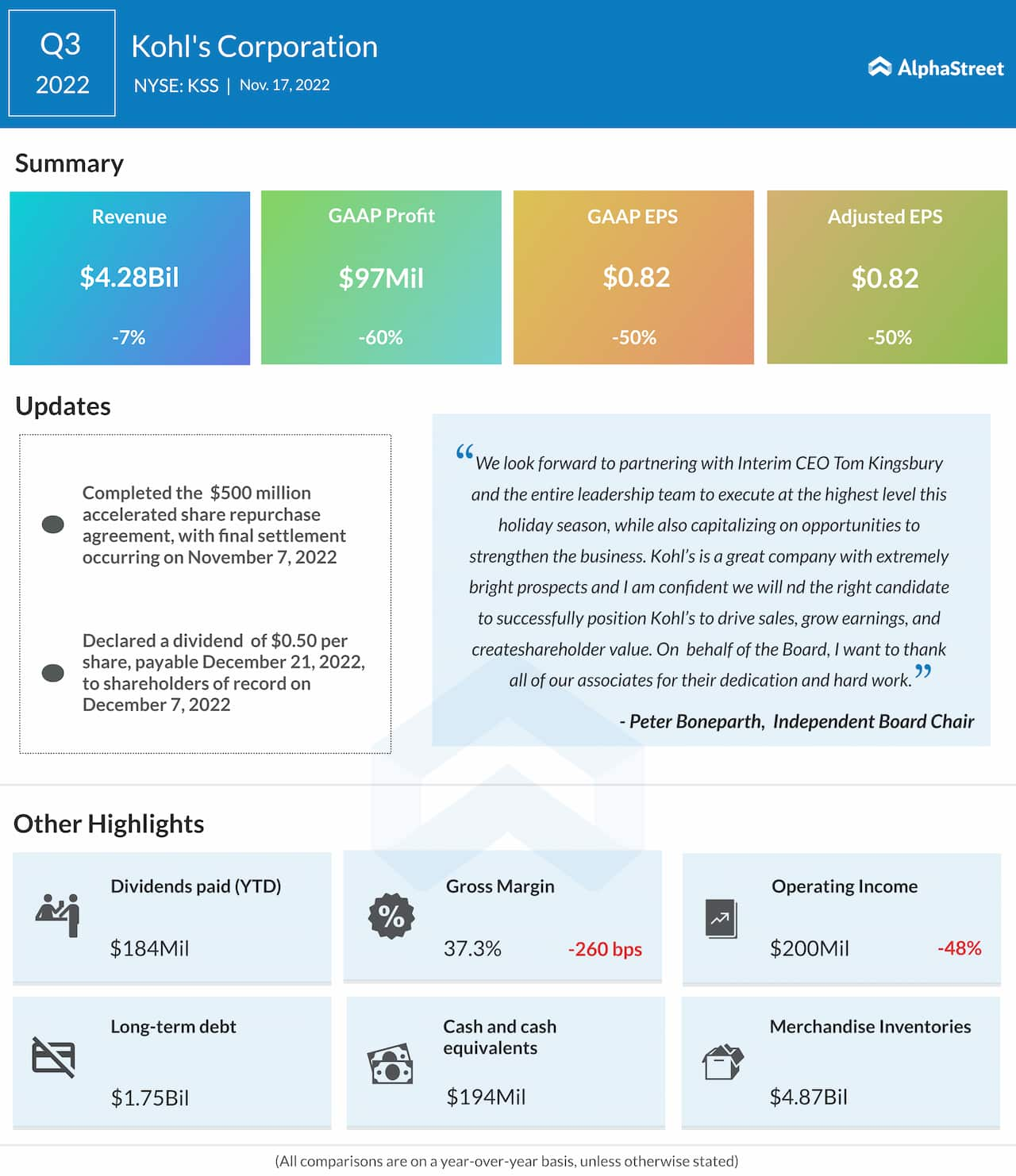

Kohl’s third-quarter earnings topped expectations after two consecutive misses. But the year-over-year decrease in profit and sales indicates underlying weakness. In a sign that the slowdown has extended into the current quarter, Kohl’s executives withdrew their full-year outlook citing macroeconomic uncertainties and the general retail slump. Adjusted profit, on a per-share basis, fell 50% to $0.82 in the October quarter, reflecting a 7% drop in sales to $4.28 billion. Revenues, however, beat estimates.

After a strong Q3, Walmart gears up for a challenging holiday season

Unlike last year, when holiday sales started early as people feared merchandise shortage due to supply chain issues, this time there is excess supply and lower demand. Typically, middle-income consumers account for the bulk of Kohl’s sales and they are among the worst affected by the high inflation.

From Kohl’s Q3 2022 earnings conference call:

“For holidays, knowing how important value is to customers this year, we are amplifying our value messaging through our holiday brand campaigns, as well as by featuring our private brands more prominently in our marketing and leaning into our iconic Kohl’s Cash and Kohl’s Rewards programs across key promotional events. Our key product focus areas include an expanded Sephora gifting assortment; increased newness and greater exclusivity in toys, tech, and pet; active and cozy apparel; and special occasion outfitting such as holiday dresses.”

Kohl’s stock traded lower Friday afternoon. Over the past six months, it has been mostly trading sideways.