The stock got a major boost this week after the management clinched a deal with Comcast (CMSCA) to offer OTT video streaming service Peacock on the platform. After surging to a new high, the stock is probably stabilizing. According to experts, right now the pros are outweighing the cones, offering a buying opportunity that most investors wouldn’t want to miss. While analysts are divided on the stock’s valuation, the impressive past performance shows Roku has the potential to create long-term value.

Evasive Profit

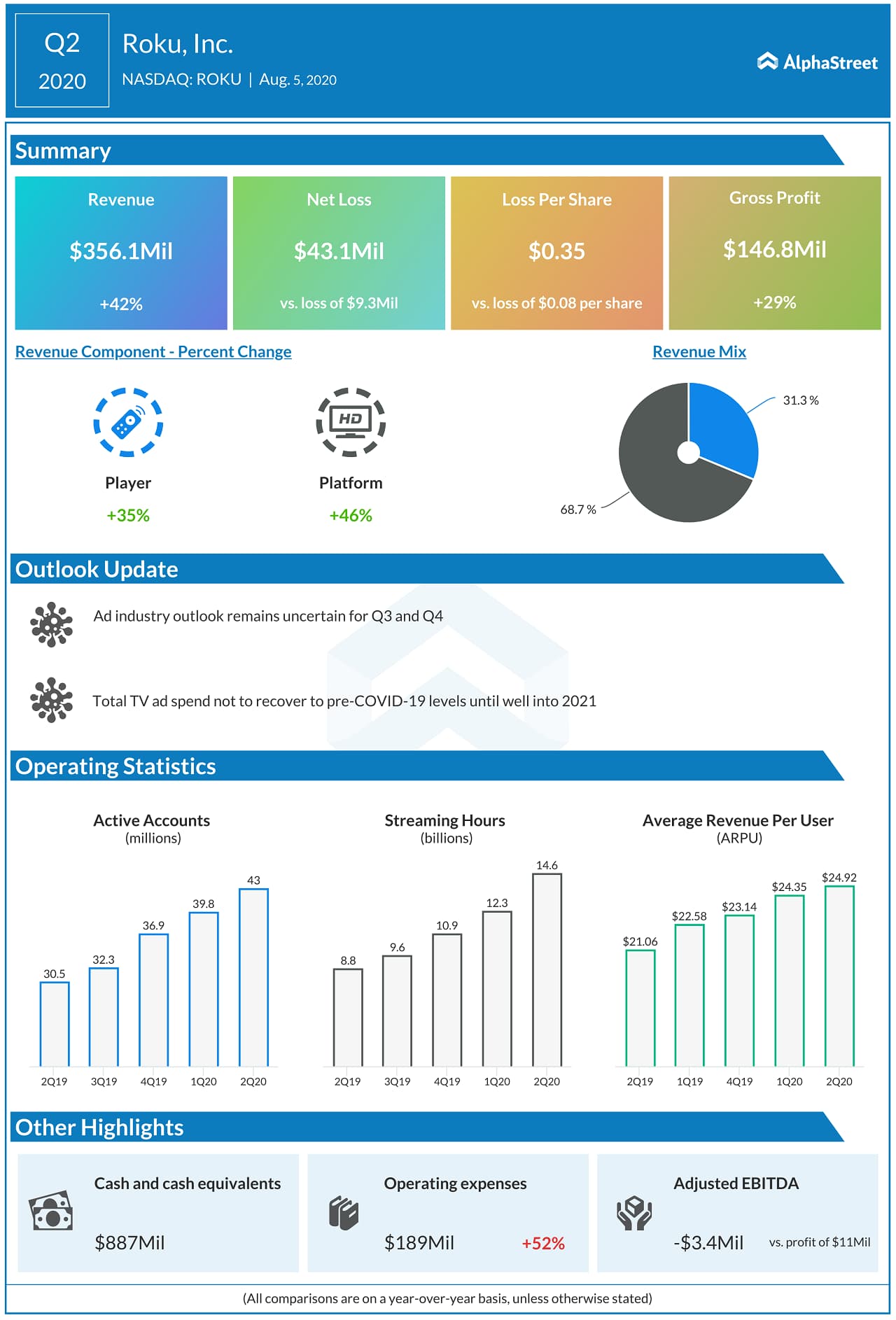

But skepticism will linger in the market until the company ends the losing streak and starts generating profit consistently, as the bottom-line has been dragged by costs related to investments in expansion projects. The near-term prospects don’t look very encouraging, given the constraints on television ad spending — especially among hospitality and travel companies. The downtrend in advertising, Roku’s primary revenue source, is expected to continue in the second half and beyond.

“We expect strong consumer interest in the shift to TV streaming to continue but we are mindful of the potential for both retail and supply chain disruptions as well as changes to consumer buying behavior during important shopping periods in the second half of the year, including back to school and most importantly the holiday season. The ad industry outlook remains uncertain in the second half and we believe that total TV ad spend will not recover to pre-COVID-19 levels until well into 2021,” said Roku’s CFO Steve Louden at the latest post-earnings meet.

Beyond Crisis

The good news is that tough times don’t last forever. Television will continue to be a preferred medium for the consumption of visual content in the near future, thanks to the COVID-related movement restrictions and lack of access to cinema halls and theatres. After registering record user growth and adding several millions of streaming hours, the company is well-positioned to leverage the unfolding opportunities in home entertainment. Of late, Roku has been benefiting from the cord-cutting wave that triggered a migration of viewers from linear TV to modern streaming platforms.

The platform carries almost all the top streaming services, which gives it a competitive advantage and unique place in the segment. New players like Disney+ and Apple TV are reportedly in talks with the management for carrying their services on the Roku platform.

I think that a key thing to think about is that we’re growing — our ad business is growing strongly in what’s a down market for the advertising business. And also if you just think about the fact that all television is going to stream, that of course means all TV adds are going to screen, all advertising is going to switch to OTT for video and we’re just still in the very early days of that. It’s a huge opportunity ahead of us.

Anthony Wood, chairman and chief executive officer of Roku

Costs Weigh on Profit

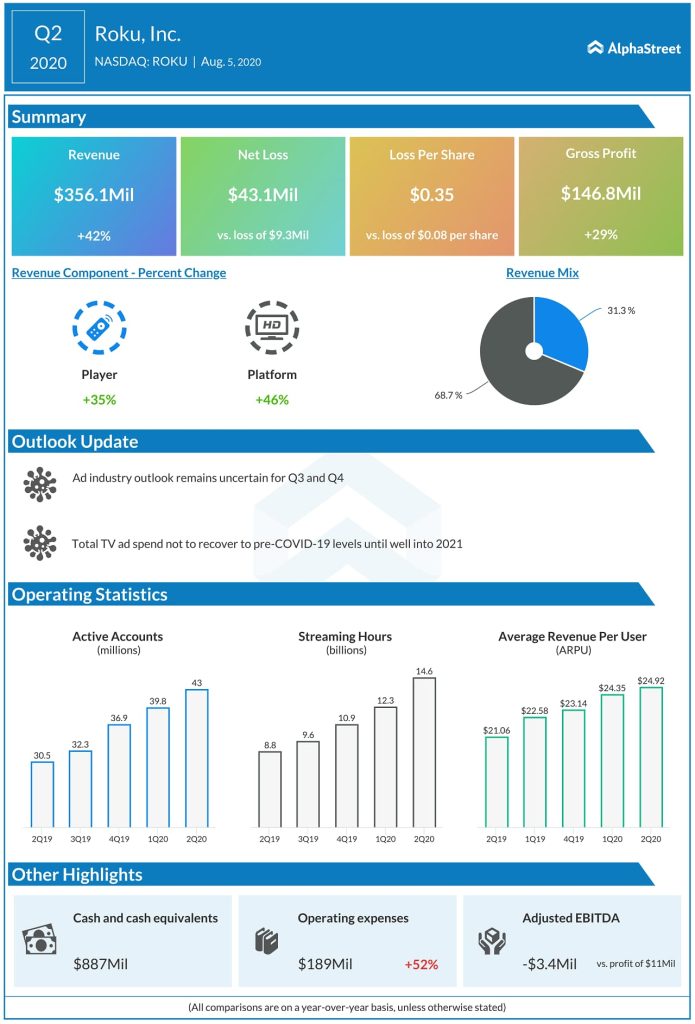

Roku’s second-quarter results were hurt by a spike in operating expenses, mainly due to costs related to acquisition and employee hiring, which more than offset a 42% growth in revenues to $356 million. The bottom-line remained in the negative territory, with net loss widening to $0.35 per share. Interestingly, the mixed performance came in an otherwise-promising quarter that witnessed strong user growth and a surge in streaming hours. While the results topped expectations, the management withheld the guidance citing a lack of clarity.

Related: Is Netflix a buy after rising 50% in 2020?

The market was not impressed by last month’s earnings report and the stock withdrew from its pre-earnings highs. But it regained momentum pretty quickly and maintained the uptrend since then, before climbing to an all-time high this week. The shares, which moved up 38% since the beginning of the year, closed Tuesday’s regular session at $193.79, up 2%. They have been underperforming the S&P 500 index for the past several months.