Advanced Micro Devices, Inc. (NASDAQ: AMD) reported strong results for the third quarter when the chipmaker benefited from an acceleration in the sales of its Zen 4 server and client processors. The company is working to expand its AI capabilities across the entire product portfolio, taking a cue from the high demand for AI-supported solutions.

Stock Gains

AMD’s stock dropped soon after the earnings announcement this week but bounced back quickly and maintained the uptrend in the following sessions. The stock has grown a whopping 73% in the past twelve months and is probably on its way to setting a new record in the coming months. Though the stock is not cheap at the current price, it offers a good buying opportunity that long-term investors wouldn’t want to ignore.

The ambitious target of achieving $2 billion in AI sales in 2024 reflects AMD’s aggressive efforts to gain a foothold in the market that is currently dominated by Nvidia. The company bets on its superior memory architecture and competitive pricing to increase market share. According to the management, the MI300A and MI300X AI chips are on track for volume production soon.

AI Push

As part of expanding its AI software ecosystem, the company recently signed an agreement to acquire open-source software company Nod.ai. When it comes to achieving the sales goal, the high demand and tight supply will act as a tailwind for the company through next year and beyond. However, AMD executives issued fourth-quarter sales guidance that is below analysts’ forecast, as they expect weakness in the non-AI business including Gaming to persist in the near term

From AMD’s Q3 2023 earnings call:

“Dell, HPE, and Lenovo announced an expanded set of workstations powered by new Threadripper PRO processors as we focus on growing this margin-accretive portion of our client business. Looking forward, we are executing on a multiyear Ryzen AI roadmap to deliver leadership compute capabilities built on top of Microsoft’s Windows software ecosystem to enable the new generation of AI PCs that will fundamentally redefine the computing experience over the coming years.”

Q3 Results Beat

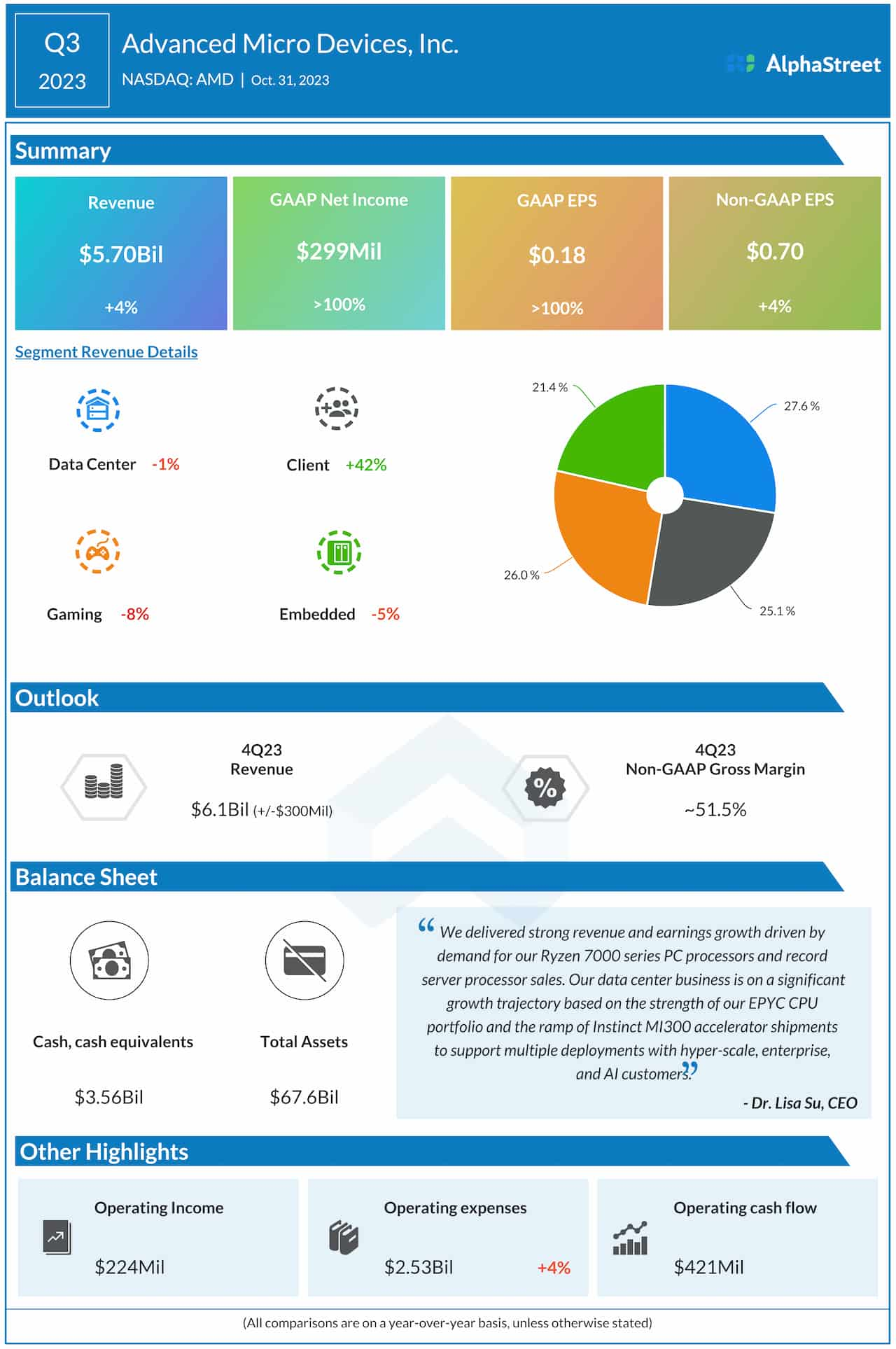

Revenue increased to $5.70 billion in the September quarter from $5.57 billion a year earlier and exceeded analysts’ estimates, as it did in each of the trailing three quarters. Third-quarter earnings, excluding special items, rose to $0.70 per share from $0.67 per share in the corresponding quarter of 2022. The bottom line exceeded estimates, marking the fourth beat in a row. On a reported basis, net income was $299 million or $0.18 per share in Q3, compared to $66 million or $0.04 per share in the prior-year period.

Shares of the company traded higher on Thursday, after closing the previous session above the $ 100 mark.