Semiconductor company Advanced Micro Devices, Inc. (NASDAQ: AMD) is preparing to launch its flagship artificial intelligence chip this year, which would enable it to compete effectively with rivals like Nvidia. The company entered the second half of the year on a positive note, reporting stronger-than-expected results for the second quarter.

Meanwhile, it seemed investors became concerned about the sharp fall in earnings and revenues from last year. AMD’s stock declined after the announcement and the downturn continued in the following session. The market’s negative response also reflects weak sentiment over the unimpressive performance of the semiconductor industry, lately. That said, AMD has been performing quite well since the beginning of the year.

AI Power

Considering the growing demand for AI chips across industries, ramping up its AI capabilities is the main priority for the company right now. AMD’s aggressive investments in technology in recent years and M&A deals like the recent acquisition of Xilinx should catalyze its AI push.

While demand conditions remain encouraging, supported by stable data-center growth, there are mixed signals in certain areas of the market due to economic uncertainties and cautious customer spending. Also continued weakness in the global PC market would remain a drag on that segment of the business.

AMD’s CEO Lisa Su said at the earnings call: “Our AI strategy is focused on three areas: first, deliver a broad portfolio and multi — multi-generation roadmap of leadership GPUs, CPUs, and adaptive computing solutions for AI inferencing and training. Second, extend the open and proven software platform we have established that enables our AI hardware to be deployed broadly and easily. And third, expand the deep and collaborative partnerships we have established across the ecosystem to accelerate deployments of AMD-based AI solutions at scale.”

Mixed Outcome

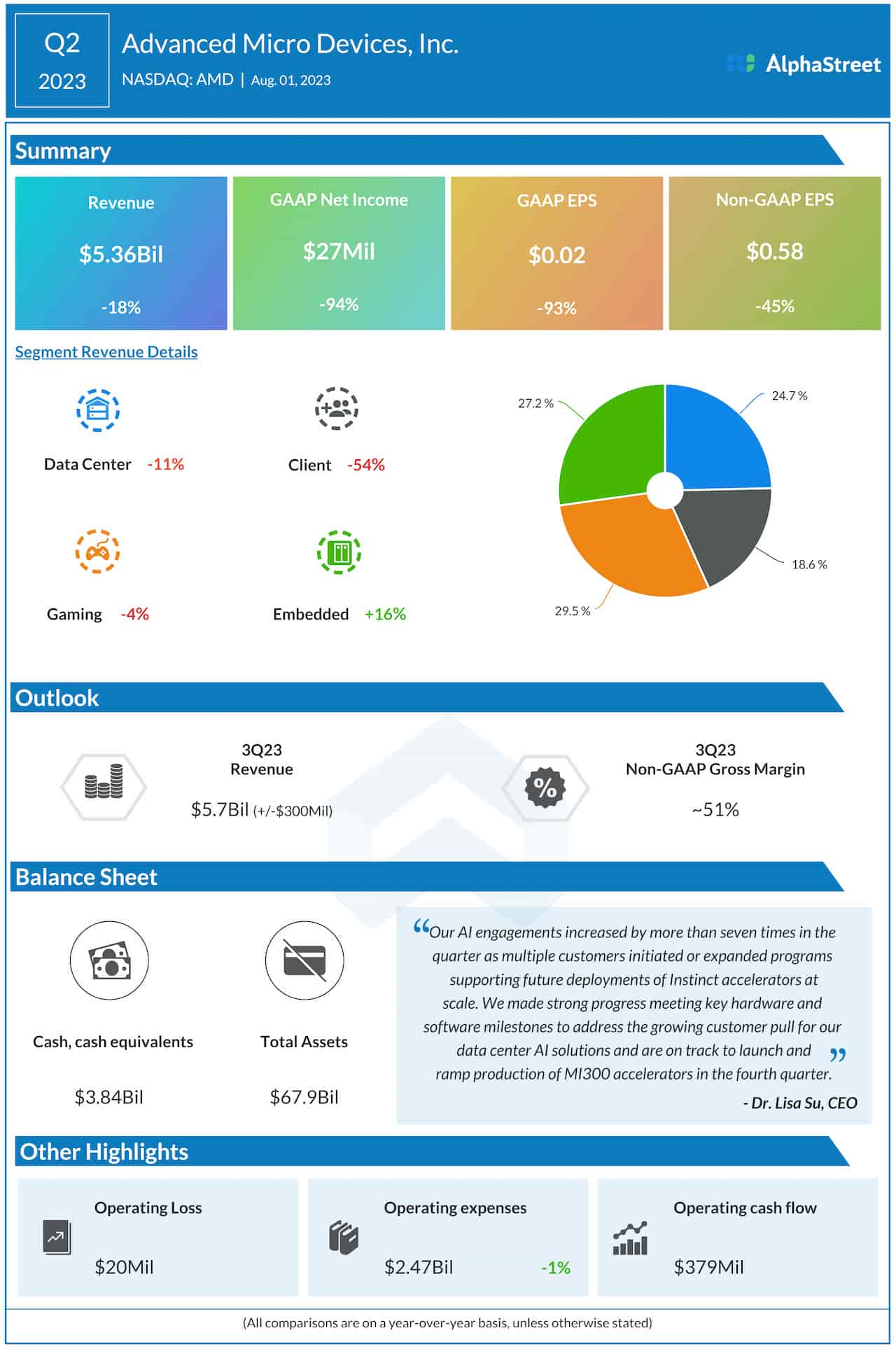

AMD’s earnings and revenues topped expectations for the third straight quarter, though June quarter earnings nearly halved year-over-year to $0.58 per share. Driving the earnings fall, revenues dropped 18% from last year to $5.36 billion. The key segments of the business – Data Center, Client, and Gaming – contracted.

The AI segment witnessed continued strong growth sequentially. The tech firm is looking to launch and ramp up the production of its MI300 accelerators in the fourth quarter. The company’s continued initiatives to expand its AI business could position its products as the best alternatives to the high-end AI chips offered by Nvidia.

The stock traded sharply lower on Wednesday afternoon, after suffering a selloff soon after the earnings report. However, in the past ten months, AMD’s value has nearly doubled.