The Good and Bad

Going forward, the company’s prospects look good given the positive cues on the global economy and optimistic business outlook. The post-COVID recovery in international travel and Mastercard’s strong global presence should boost cross-border spending and enable the business to return to the pre-pandemic levels this year.

Meanwhile, volumes will be affected by variations in consumers’ spending power. Of late, consumer sentiment has been hit by high inflation and economic uncertainties. Also, the lingering coronavirus threat raises concern that a potential emergence of new virus variants would result in another travel crisis.

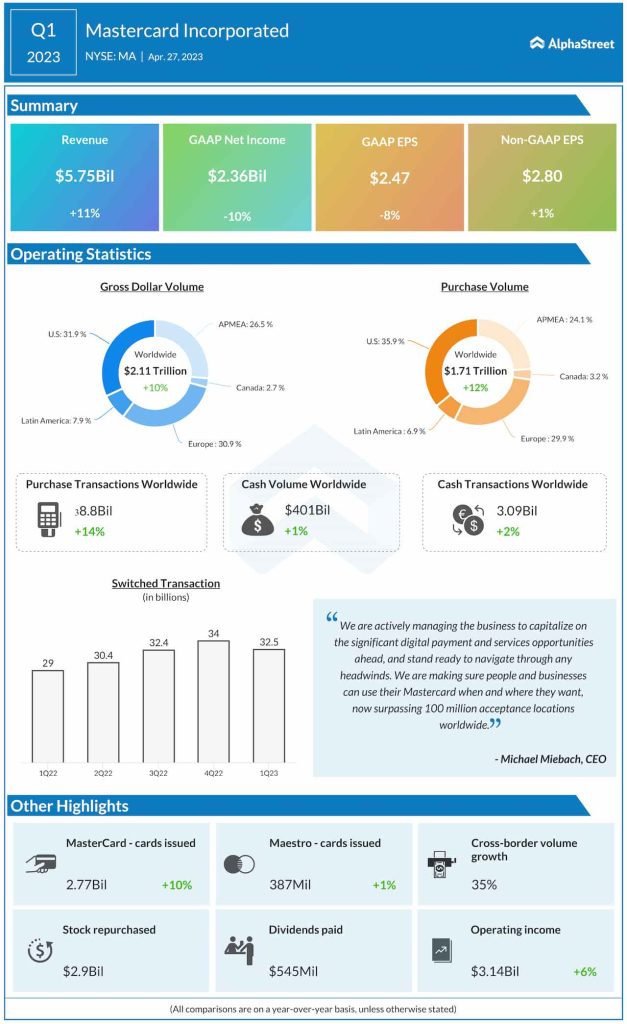

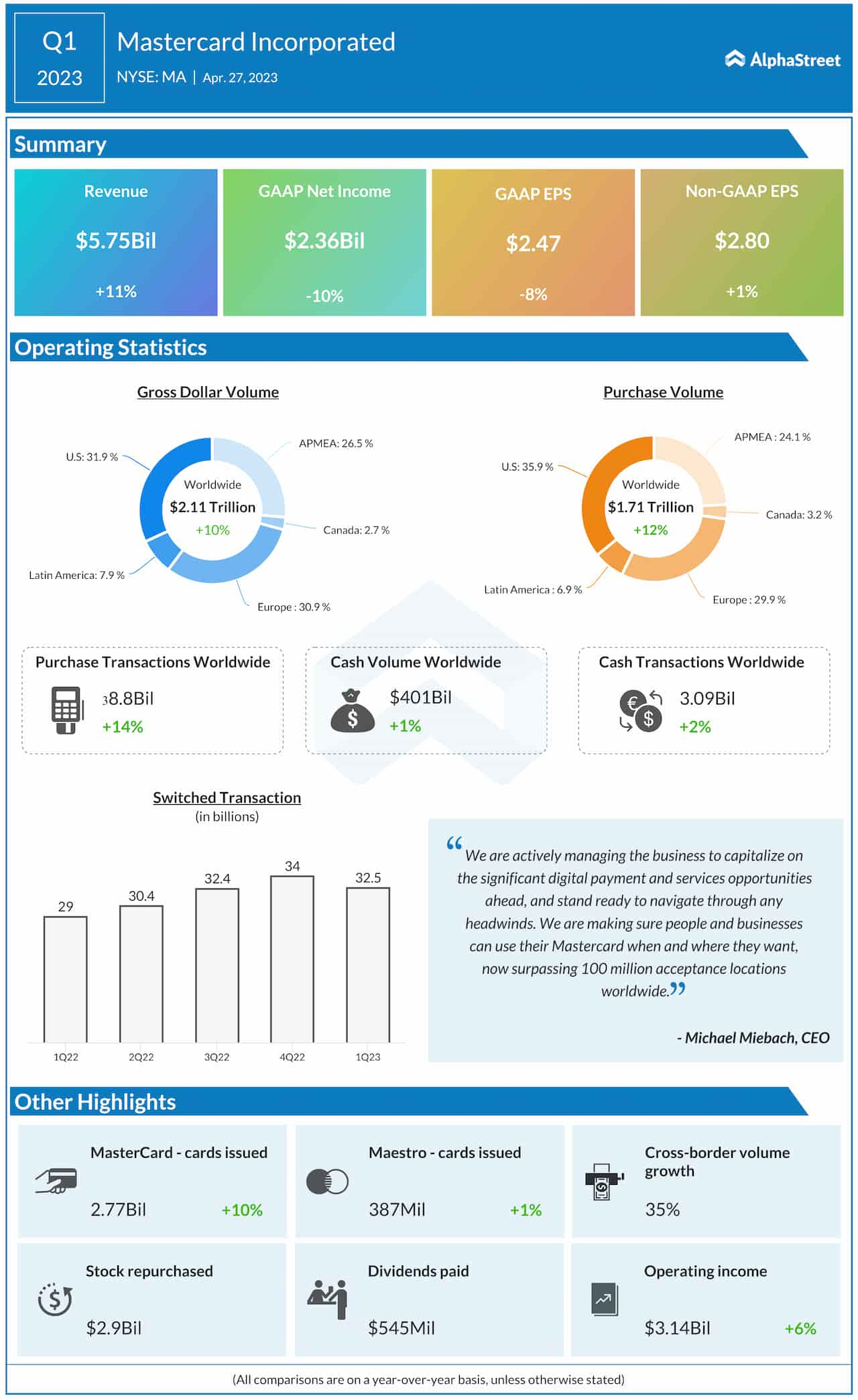

Key Numbers

Mastercard’s bottom line performance has been quite stable in recent quarters. In the first three months of 2023, adjusted profit edged up 1% year-over-year to $2.80 per share. Earnings also topped expectations, marking the third consecutive beat. At $5.75 billion, revenues were up 11% from last year and above analysts’ estimates. Worldwide Gross Dollar Volume and Purchase Volume increased in double digits to $2.11 trillion and $1.71 trillion, respectively. At the end of the quarter, there were 2.77 billion issued Mastercards, which is up 10%.

From Mastercard’s Q1 2023 earnings conference call:

“…we delivered another strong quarter of revenue and earnings growth, reflecting a resilient consumer and a continued recovery of cross-border travel. We will continue to watch the environment closely and are prepared to act as circumstances dictate. We see significant opportunity ahead, having now surpassed 100 million acceptance locations worldwide. And our focused strategy, diversified and resilient business model, and strong relationships around the globe position us well through economic cycles.”

Safety Push

Extending its commitment to serve customers better, the company recently acquired cloud-based cybersecurity company Baffin Bay Networks to better help businesses deal with the increasingly challenging nature of cyber-attacks. The deal complements Mastercard’s multi-layered approach to cyber security and helps to stop attacks while mitigating exposure to risk across the ecosystem. It also strengthens the company’s broader service offerings and value beyond the payment transaction.

Though Mastercard’s shares retreated after the post-earnings rally, they regained momentum this week. The stock traded higher in the early hours of Wednesday’s session.