Alaska Air Group (NYSE: ALK) reported a profit for the second quarter of 2022, on an adjusted basis, compared to a loss last year as the airline company’s revenues increased in double-digits amid solid traffic growth. The numbers also exceeded analysts’ estimates.

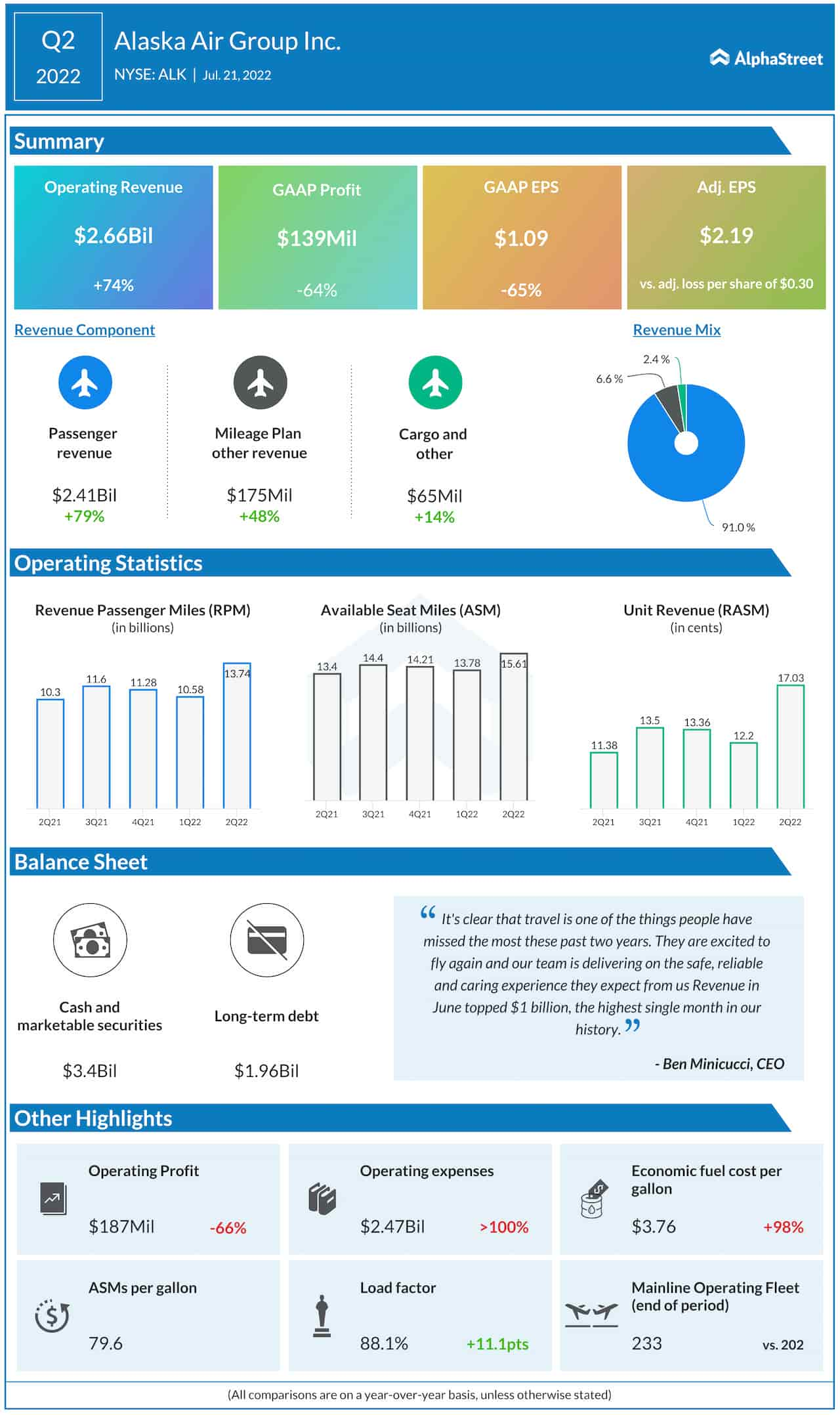

The company reported an adjusted profit of $2.19 per share for the June quarter, compared to a loss of $0.30 per share in the year-ago quarter. On an unadjusted basis, it was a net income of $139 million or $1.09 per share, up from last year’s profit of $397 million or $3.13 per share. Earnings beat Wall Street’s estimates.

The bottom line benefitted from a 74% surge in operating revenues to $2.66 billion. Market watchers were looking for slower growth.

Check this space to read management/analysts’ comments on Alaska Air’s Q2 2022 results

“It’s clear that travel is one of the things people have missed the most these past two years. They are excited to fly again and our team is delivering on the safe, reliable, and caring experience they expect from us. Revenue in June topped $1 billion, the highest single month in our history,” said Alaska Air’s CEO Ben Minicucci.