Shares of Alaska Air Group Inc. (NYSE: ALK) stayed green on Monday. The stock has gained 7% over the past three months. The airline is set to report its fourth quarter 2023 earnings results on Thursday, January 25, before markets open. Here’s what to expect from the earnings report:

Revenue

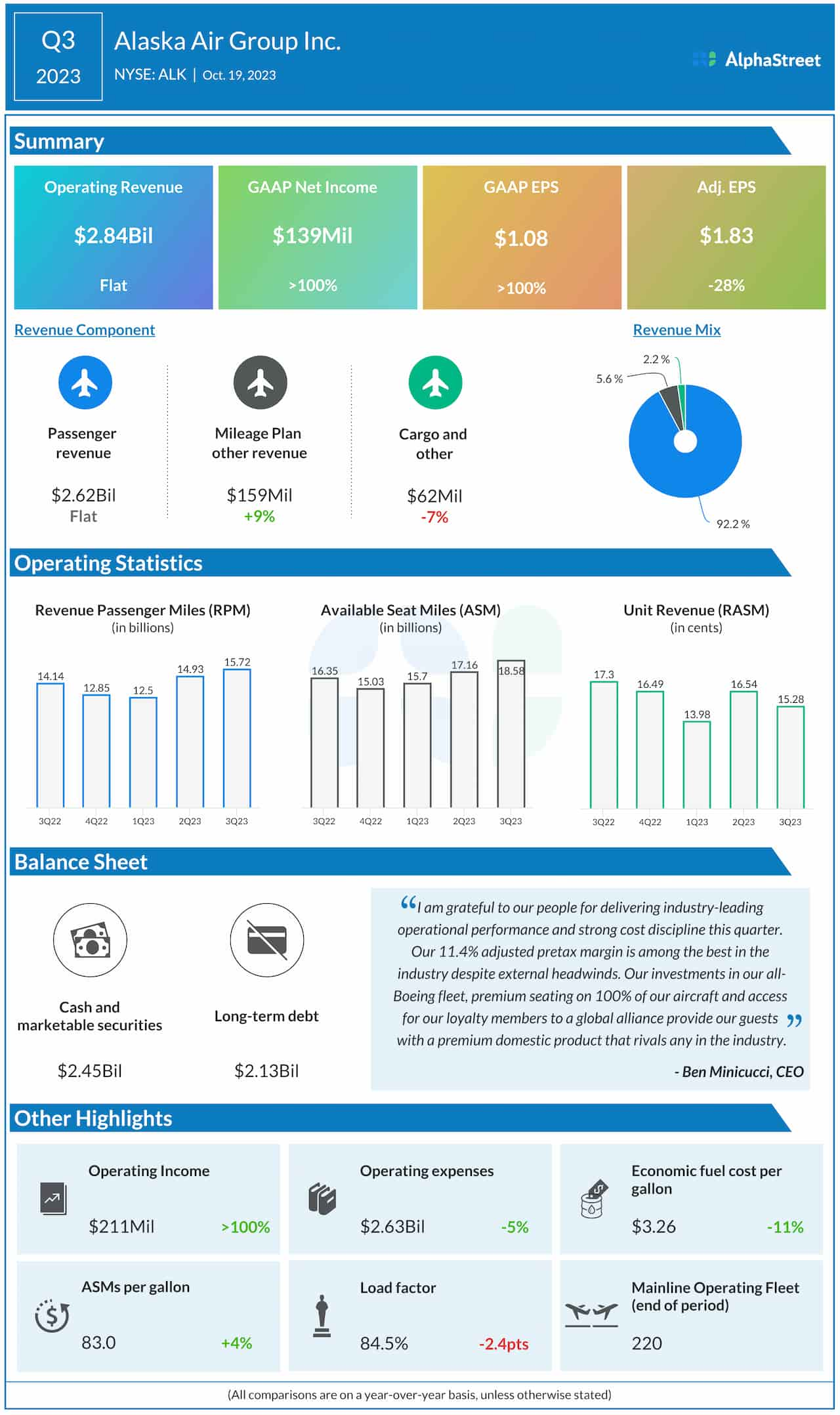

Alaska expects its total revenue for the fourth quarter of 2023 to be up 2.25-3.25% year-over-year. Analysts are projecting revenue of $2.55 billion for the quarter, which compares to $2.48 billion reported in the prior-year period. In the third quarter of 2023, operating revenues remained relatively flat YoY at $2.8 billion.

Earnings

The consensus estimate for EPS in Q4 2023 is $0.18, which compares to adjusted EPS of $0.92 reported in the year-ago period. In Q3 2023, adjusted EPS was $1.83.

Points to note

Alaska updated its original fourth quarter guidance based on strong holiday bookings and improved close-in demand. The company expects capacity for Q4 to be up 13-14% from the prior-year quarter. Cost per ASM, excluding fuel and special items, or CASMex, is now expected to be down around 5% helped by strong operational performance and cost execution.

Economic fuel cost per gallon is expected to be around $3.40 due to volatility caused by unplanned maintenance events. Adjusted pre-tax margin is expected to be approx. 1%.

Alaska has entered into an agreement to acquire Hawaiian Airlines for approx. $1.9 billion. The deal is expected to close in 12-18 months and generate high single-digit earnings accretion for Alaska within the first two years after closing. The transaction is anticipated to help unlock more destinations for consumers and expand access throughout the Pacific region, Continental United States and globally. Further updates on this deal are worth watching.

For the full year of 2023, Alaska expects total revenue to be up 7-8% YoY with capacity up 12-13%. CASMex is expected to be down 1-2%. Adjusted pre-tax margin is expected to be 7-8%. EPS for the full year is expected to range between $4.25-4.75.