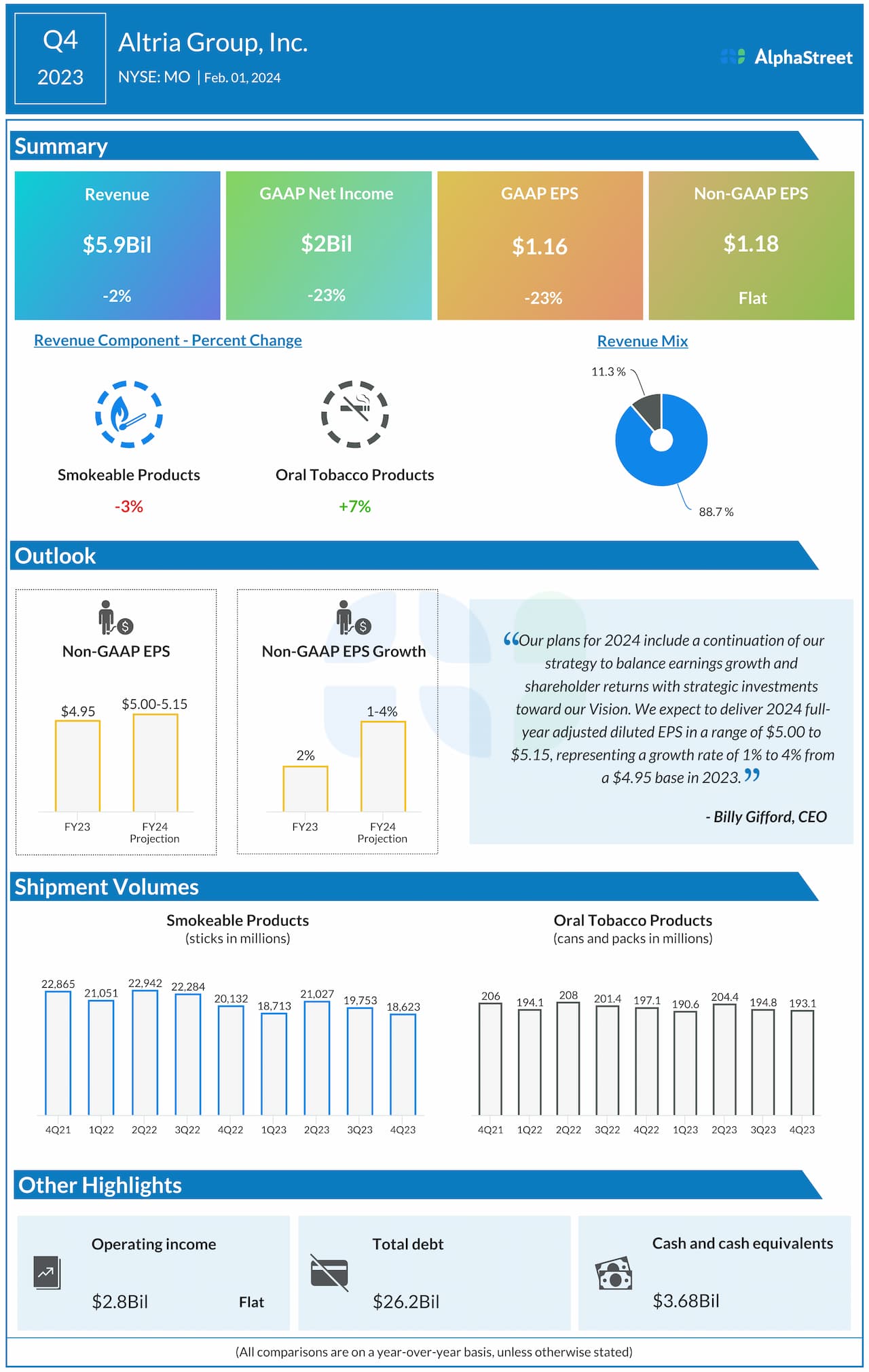

Shares of Altria Group, Inc. (NYSE: MO) were down over 1% on Friday. The stock has dropped 12% over the past 12 months. The company saw revenue and earnings decline in the fourth quarter of 2023 as it continues to face a challenging environment in tobacco. At the same time, its efforts in expanding its portfolio of smoke-free products are expected to help in navigating the evolving nicotine space.

Challenges in tobacco

On its earnings call, Altria said that inflationary pressures weighed on tobacco consumers’ discretionary income during the fourth quarter. These pressures, coupled with the growth of illicit e-vapor products, led to an estimated 8% decline in industry cigarette volumes last year.

In Q4, the company saw revenues decline by 3.3% in its smokeable products segment, caused mainly by a 7.5% drop in shipment volume. Domestic cigarette shipment volume decreased nearly 8% during the quarter. Even so, its Marlboro brand showed resilience, with its retail share of 42.2% remaining unchanged in Q4 versus the prior-year quarter. In addition, Marlboro’s share in the highly profitable premium segment grew to 59.2%.

Smoke-free products performance

On its call, Altria said it continues to see adult smokers move to smoke-free alternatives, which now make up around 40% of the total nicotine space. Of this, e-vapor is the largest smoke-free category, and it is estimated to have grown around 35% in 2023.

Altria’s acquisition of NJOY is expected to help it expand in the e-vapor space. The company has been taking steps to strengthen its supply chain, close inventory gaps at retail, and expand the distribution of ACE.

Shipment volumes of NJOY consumables and devices were approx. 11.1 million units and 0.9 million units, respectively in Q4. NJOY’s retail share in the US multi-outlet and convenience channel was 3.7%. In addition, during the fourth quarter, Altria expanded the distribution of ACE to over 75,000 stores, surpassing its target of 70,000 stores.

In Q4, Altria recorded a 6.6% growth in revenue from its oral tobacco products segment. Retail share for this segment stood at 40.1%, with sizable growth in oral nicotine pouches. The nicotine pouch category now represents 35.9% of the US oral tobacco category. Shipment volumes for on! nicotine pouches grew around 33% in the fourth quarter.

Outlook

Altria believes the external environment will remain dynamic in 2024. The company will continue to monitor the behaviors of tobacco consumers as well as changes in market conditions. It will also continue to invest in the research and development of its smoke-free products. Altria expects its adjusted EPS for the full year of 2024 to range between $5.00-5.15, representing a year-over-year growth of 1-4%.