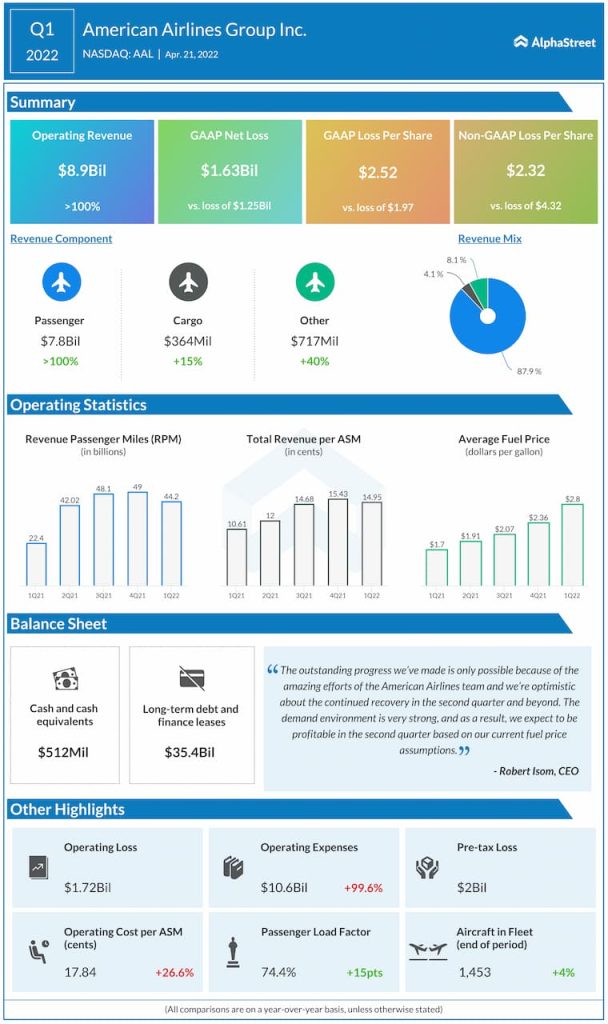

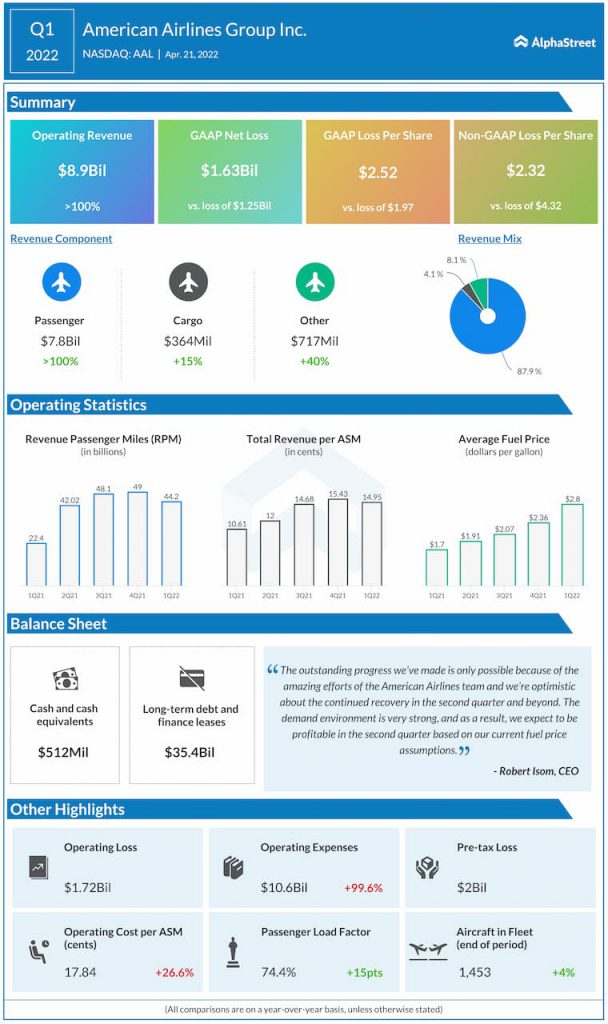

Better-than-expected results

Upbeat guidance

For the second quarter of 2022, American Airlines expects its total revenue to grow 6-8% compared to the second quarter of 2019. Capacity for Q2 2022 is expected to be approx. 92-94% of what it was in Q2 2019.

Strong demand

The airline is seeing a sharp rise in demand thanks to the easing of the pandemic and the related restrictions as well as a massive pent-up demand for travel. These factors helped American achieve a net profit in March, its first monthly profit since July 2021.

Domestic leisure travel stayed significantly ahead in March, surpassing the traffic and revenue levels seen in 2019. Corporate and government travel also witnessed strong sequential improvement. Demand in this segment is estimated to be about 80% recovered, with small to medium business revenue nearing a full recovery and corporate revenue around 50% recovered.

Corporate bookings have seen a strong increase and this is expected to continue as offices reopen. In the second quarter of 2022, overall business revenue is expected to be around 90% recovered. International travel has also seen a remarkable pickup in demand as several countries lifted their restrictions. Long haul international revenue was around 50% recovered in Q1.

Fleet

American’s fleet remains significantly fuel efficient. The company completed its narrow-body fleet harmonization project that covers over 500 aircraft and is expected to improve revenue generation and unit cost production.

In Q1, American took delivery of nine Airbus 321 Neos and reactivated seven Boeing 737-800s. It also inducted eight dual class regional aircraft and parked three 50-seat Embraer 145s. The company has updated its fleet order book and the timing of future deliveries in order to better meet the demand strength in domestic and short haul international markets.

American is planning for the delivery of seven 788 aircraft in 2022 and six 788s in 2023. The delivery of four 789 aircraft, which were earlier planned for late 2023, will now take place in 2024.

Click here to read the full transcript of American Airlines’ Q1 2022 earnings conference call