Quarterly numbers

Performance

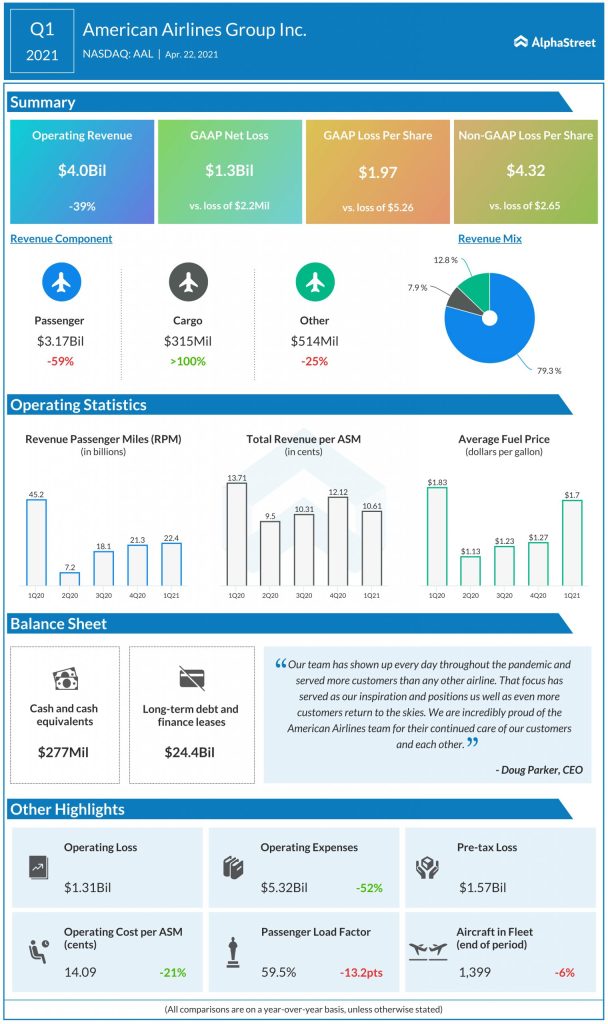

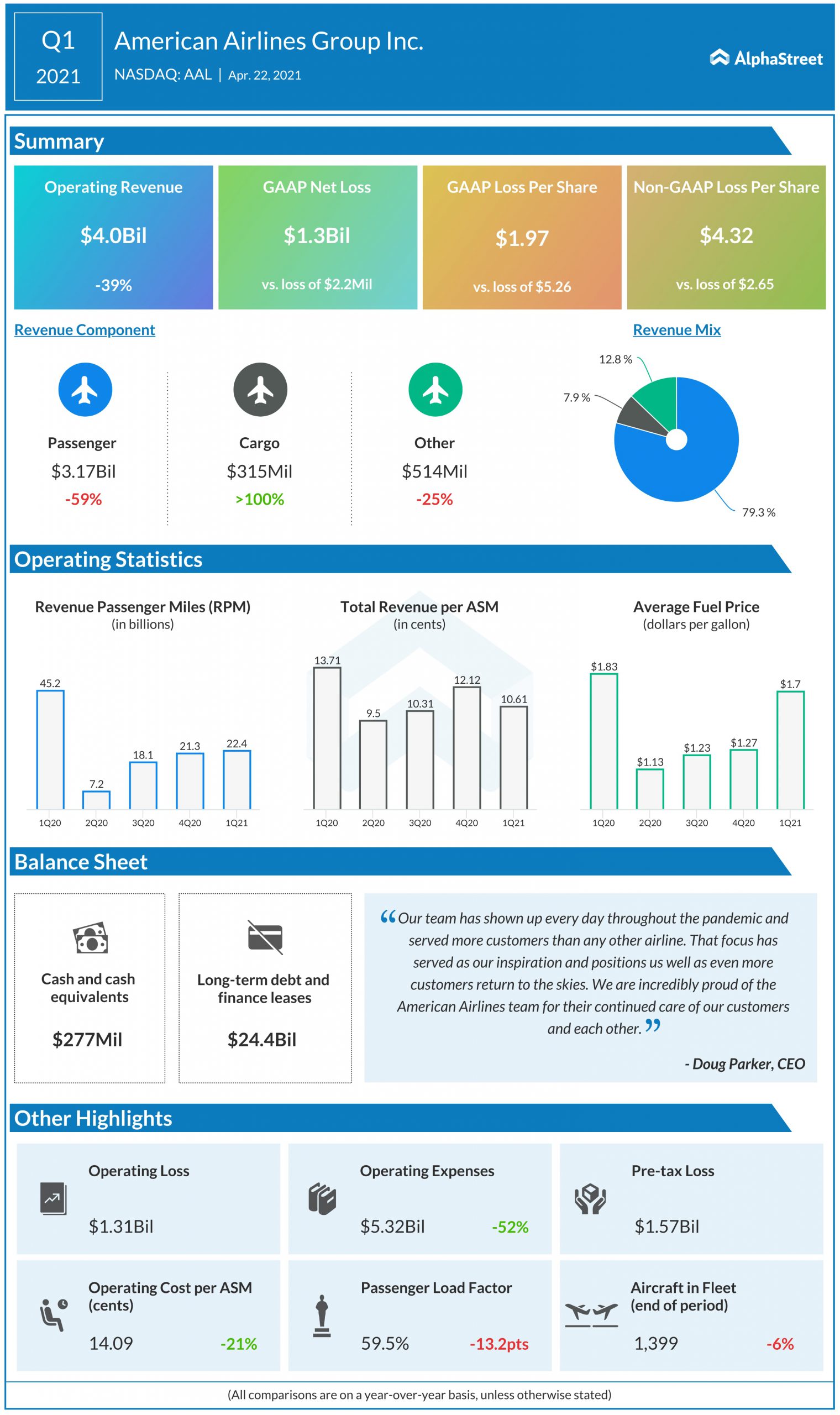

During the quarter, American saw a 50% drop in traffic along with a 39% decrease in capacity. Load factor dropped to 59.5% from 72.7% in the year-ago period, coming below analysts’ projections. Passenger revenue per available seat mile fell 32% while total revenue per available seat mile decreased 22.6% year-over-year. Domestic passenger revenue dropped 54% to $2.65 billion while international passenger revenue fell 72% to $524 million.

Like its peers, American Airlines has indicated that it is seeing signs of a pickup in demand and believes it is well-positioned to take advantage of this trend. The airline industry appears optimistic that with the vaccine distribution and pent-up demand, leisure travel could see an improvement as the year progresses. International travel is likely to stay muted while business travel could take a while to gain pace.

American plans to reduce costs by another $1.3 billion in 2021. The company has deferred the deliveries of 18 of its Boeing 737 MAX aircraft previously slated for 2021 and 2022 and these will now be delivered in 2023 and 2024. As per an agreement with Boeing, American will get five of its 787-8 aircraft converted to 787-9 aircraft and delivered in 2023. American will have 14 of its 787-8 aircraft delivered by the end of Q1 2022.

The company managed to reduce its average cash burn to approx. $27 million per day in Q1. American had estimated an average daily cash burn of approx. $4 million for March but excluding approx. $8 million per day of debt principal and cash severance, the cash burn rate turned positive in the month. American was also able to lower its debt by $2.8 billion during the quarter through its credit facilities.

Outlook

American expects its total revenue for the second quarter of 2021 to be down approx. 40% compared to the second quarter of 2019. Based on its current booking trends, the company expects its capacity to be down 20-25% compared to Q2 2019. American expects to end Q2 2021 with approx. $19.5 billion in total available liquidity.