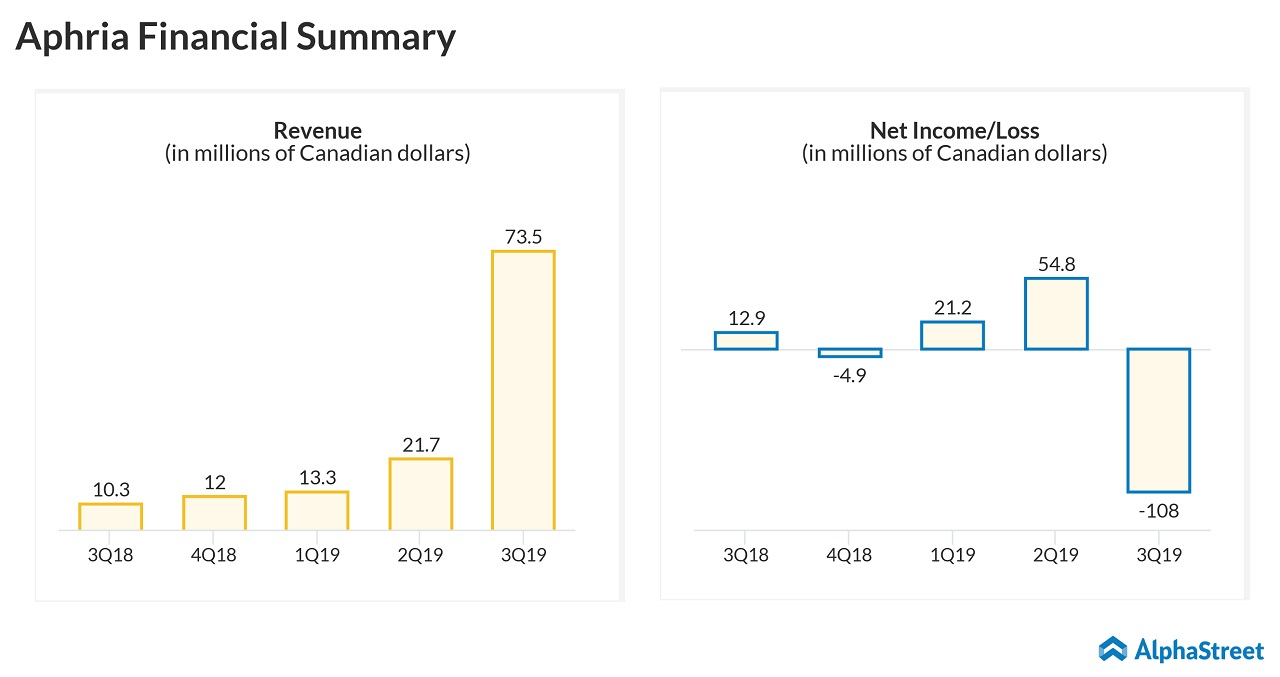

Shares of Canadian cannabis company Aphria Inc (NYSE:APHA) fell 8.9% during the pre-market hours on Monday after it reported a third-quarter adjusted loss of $0.15 (C$0.20) per share, much wider than the loss of 4 cents per share expected by the street.

On a reported basis, the weed giant swung to a loss of $0.32 (C$0.43) per share, from a profit of $0.06 (C$0.08) per share in the same quarter last year.

Net revenues, meanwhile, jumped more than seven times to $55.2 (C$73.6) million, driven by CC Pharma and ABP. Analysts were expecting $41.1 million.

During the quarter, the company saw a decline in cannabis revenue as well as kilograms sold, primarily due to operational transition and temporary distribution challenges, the company said.

The Aphria Board also announced the appointed two new independent directors, effective today. Walter Robb and David Hopkinson will fill two of the three current director vacancies.

In a separate release earlier today, the Ontario-based company said it has entered into a series of transactions that will accelerate the expiry date for the take-over bid by Green Growth Brands to April 25, 2019, and will terminate the arrangements with GA Opportunities Corp. for $89 million. In December, Aphria rejected Green Growth Brands’ $2.1 billion (C$2.8 billion) buyout offer stating that the latter’s proposal undervalued the former.

Late last year, Aphria shares got hammered following a report from Hindenburg Research, which stated that Aphria’s LATAM acquisition is worthless and accused that a network of insiders of Aphria diverted funds from shareholders and put them into their own pockets.

READ: EARNINGS OF BANK OF AMERICA, IBM, UNITED AIRLINES, PEPSICO ON QUEUE

The Canadian government has committed to regulating the sale of cannabis-infused products in 2019. Based on customer behavior and product preferences demonstrated in other existing legal markets, the Ontario, Canada-based cannabis firm believes cannabis-infused products could represent more than 50% of the total cannabis market upon becoming federally legal in Canada.

Earlier this month, Aphria’s German subsidiary received a license for the domestic cultivation of medical cannabis. Cannabis companies have started focusing on the beauty area. On April 1, Aphria launched CBD-based cosmetics product in the German market.

The stock, which started trading on the NYSE on November 2, 2018, has gained 81% since the beginning of this year.

Browse through our earnings calendar and get all scheduled earnings announcements, analyst/investor conference and much more!