Investing in BIDU

Baidu’s fundamentals remain impressive and the healthy cash flow, together with a favorable debt-to-equity ratio, has helped maintain a strong balance sheet. It has enough liquidity to repay debt and pursue growth initiatives like strategic acquisitions wherever needed.

Read management/analysts’ comments on Baidu’s Q2 earnings

Online marketing, the company’s primary business, recovered in the first half after a prolonged slump but growth slowed sequentially in the most recent quarter. The weakness, despite favorable demand conditions, can be attributed to growing competition from rivals like Tencent’s WeChat and TikTok owner ByeDance. However, the country’s digital advertising market is growing fast, offering ample growth opportunities for companies.

Focus on Cloud

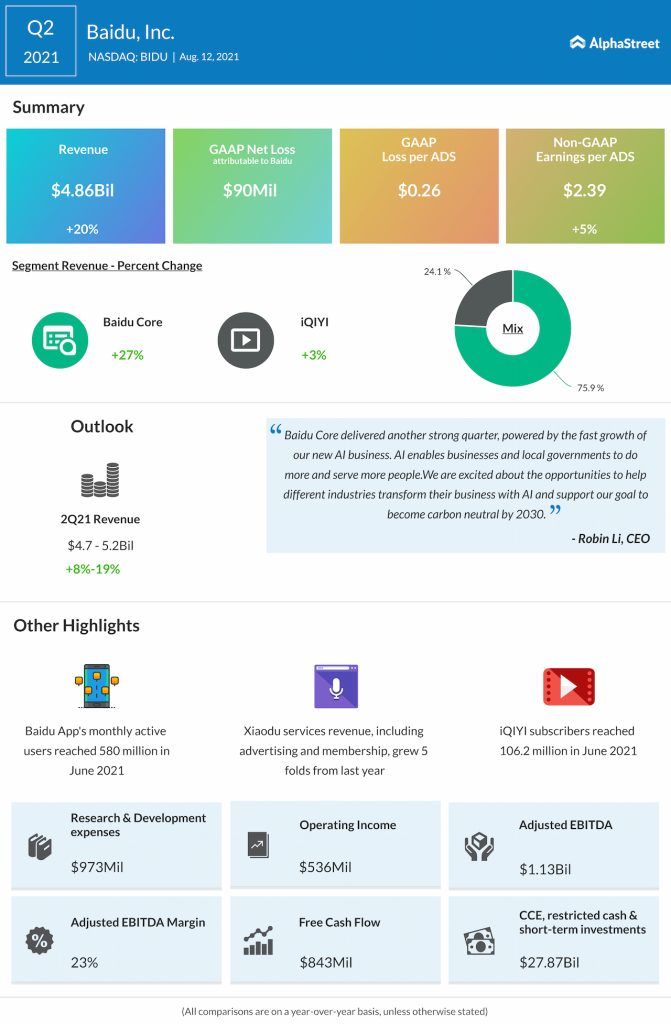

The steady expansion of Baidu Core and streaming platform iQIYI, Inc. (NASDAQ: IQ) has helped offset the weakness in other areas to some extent, but those segments need to grow at scale to contribute meaningfully to the bottom line. While the company enjoys a three-fourths market share in internet search, the prospects of the cloud business would depend on how effectively it competes with the likes of Alibaba (NYSE: BABA) and Huawei.

From Baidu’s Q2 2021 earnings conference call:

“We are entering a new era where technology is becoming more powerful and we are benefiting from the deployment of technology to upgrade China’s industrial competitiveness, digitize urban cities, and improve mobility. As China plans for the next stage of growth, it rests upon us to recognize the need to align our business strategy with the environment that we’re operating and the future that we want to build with our stakeholders.”

Going forward, the new compliance norms set by the US government for Chinese firms and regulatory scrutiny back home could be a concern for Baidu and other technology companies. The Evergrande crisis and fears of the real estate behemoth collapsing under its huge debt have added to the weak sentiment.

Mixed Results

Baidu’s quarterly earnings increased consistently over the past couple of years and each time beat the estimates as the COVID-driven spike in technology adoption lifted revenues. In the June quarter, the top-line rose by a fifth to $4.86 billion, pushing up adjusted earnings to $2.39 per ADS. AI cloud grew a whopping 71% during the three-month period. Meanwhile, investor confidence was hit by the management’s weak guidance for the third quarter, citing the new wave of coronavirus and continuing uncertainty.

Alphabet Q2 revenue and earnings smash estimates thanks to strength in advertising

This week, the stock traded well below its 52-week average, after suffering steady losses in the recent past. The past six months were marked by high volatility and BIDU ended up losing 24% during that period. The shares opened Wednesday’s session higher and traded near the $155 mark in the early hours.