Weakness in foodservice

The foodservice industry as a whole has been pummelled since the start of the pandemic last year and several companies felt the impact. Beyond Meat was no different. As the restrictions began to ease, there were hopes of a recovery but for the plant-based food products maker, this recovery was slower than expected due to lower traffic and limitations on restaurants’ operating capacity.

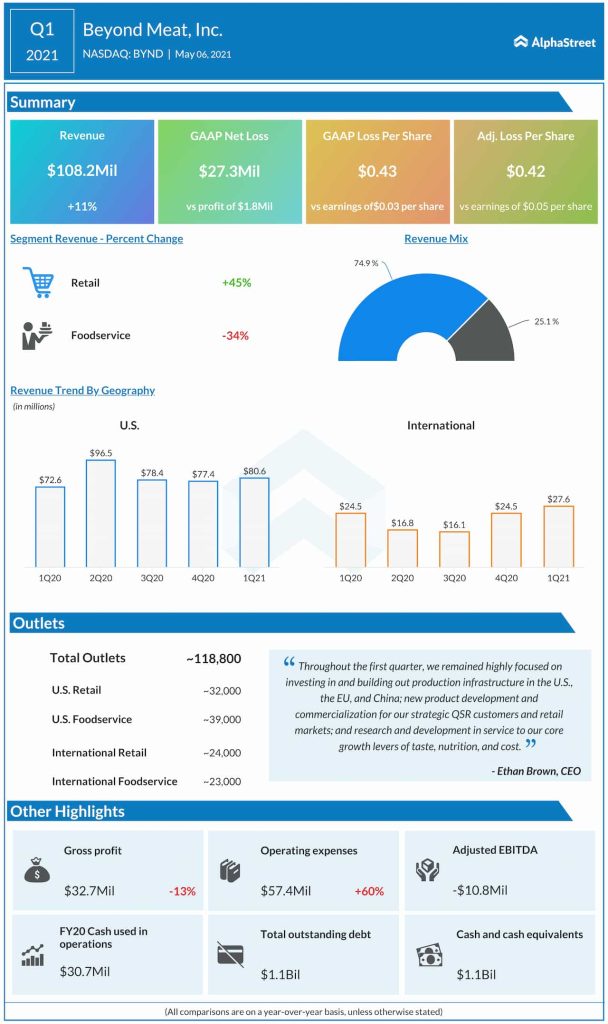

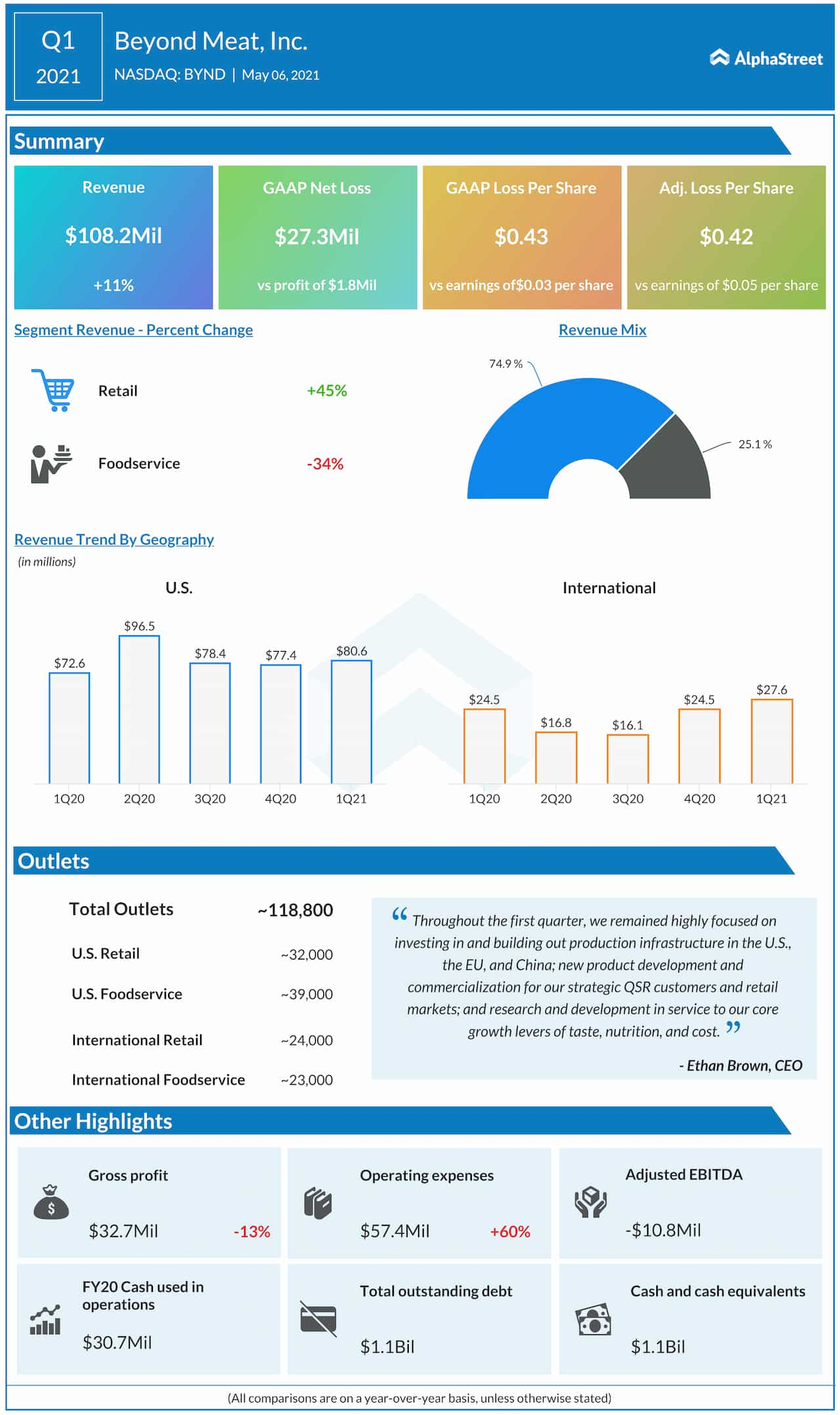

Revenues from the foodservice channel were down 34%, on the whole, in Q1. Foodservice revenues in the US dropped 26% while international foodservice revenues were down 44% compared to the same period a year ago. There are hopes that as the year progresses, restaurants will open and the foodservice channel will see a pickup in revenues but any resurgence in the pandemic or a slower-than-expected demand could dash these hopes.

Retail demand moderation

Beyond Meat’s retail channel has grown nicely with the number of outlets selling the company’s products reaching around 32,000 in March. Retail witnessed significant momentum during the COVID-19 pandemic as customers stocked up on groceries and food products and turned to having more meals at home. However, this demand has begun to moderate as customers are returning to their pre-pandemic shopping patterns.

Retail net revenues grew 45% as a whole during the first quarter. US retail revenues increased 28% YoY while international revenues rose 189%. The overall growth rate was slower than previous quarters and there are concerns that this trend could continue in the coming months as well.

Competition

Beyond Meat faces tough competition in the rapidly-growing plant-based food products market from peers such as Impossible Foods and bigger rivals such as Tyson Foods (NYSE: TSN). Impossible Foods is a formidable opponent with its products selling in over 17,000 grocery stores in the US. Tyson is also rolling out its own set of alternative protein offerings under its Raised & Rooted brand which is gaining popularity.

Another interesting opponent is Tattooed Chef (NASDAQ: TTCF) which offers a range of plant-based food products such as zucchini spirals and riced cauliflower, which span beyond the usual burgers and sausages offerings. With rivals such as these, Beyond Meat needs to focus heavily on innovation to keep up in the market.

Losses and margins

Beyond Meat has been seeing continued losses over the past few quarters despite revenue growth. In Q1, adjusted net loss amounted to $26.2 million, or $0.42 per share. The company also saw gross margin drop to 30.2% in Q1 from 38.8% in the year-ago period due to higher costs. Beyond Meat continues to invest heavily to drive innovation and improve its product pipeline. These costs are expected to take a toll on margins in the near term. A return to profitability and an improvement in margins could give the stock a much-needed push.