Better-than-expected results

Favorable trends

Campbell witnessed strong demand for its products during the quarter with consumption rising 4% YoY. Organic net sales in the Meals & Beverages division increased 9% in Q3. The rising inflation levels appear to be supporting at-home food consumption trends. In-market soup consumption continued to grow, rising 5% YoY.

Despite a low to mid double-digit increase in average prices, Campbell witnessed volume growth in its soup and Italian sauce categories, meaning customers are still buying them regardless of the price increases. Consumption of Prego increased 7% YoY in Q3.

Campbell is rolling out a pipeline of new products that cater to consumers’ needs of cooking quick meals at home and seeking new specialty flavors to enhance their meals. The company will launch its Pacific ready-to-serve soups and chilis in the fourth quarter of this year.

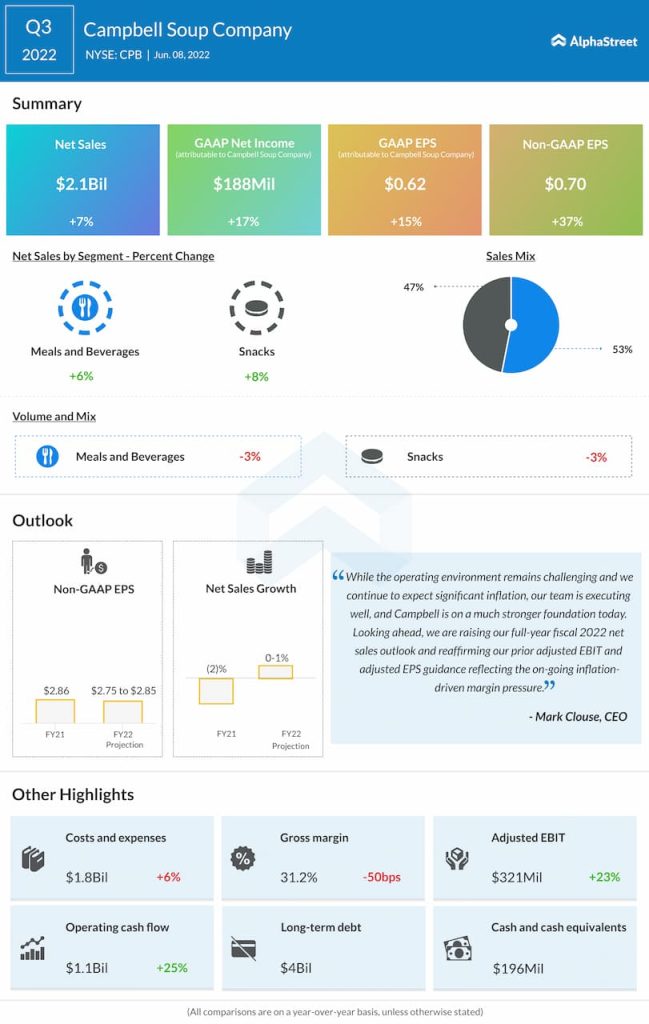

The Snacks division saw organic net sales growth of 8% in the third quarter. In-market consumption grew 6% helped by strong performances from its power brands. The company’s largest snacks brand Goldfish saw consumption grow 8% in Q3 and strategies to broaden its consumer base are paying off.

Outlook

Campbell expects to see strong demand for its brand portfolio along with supply recovery in the coming months. Based on this expectation, the company raised its sales guidance for the full year of 2022. Net sales growth is expected to be flat to up 1% while organic net sales growth is expected to be 1-2%. The company expects to face continued margin pressure from inflation through the year and is guiding for adjusted EPS of $2.75-2.85.