Campbell Soup Company (NYSE: CPB) is coming out of a rough patch after the packaged food company’s sales and earnings got affected by the pandemic, due to the widespread movement restrictions and shift to remote work. The management is betting on its efforts to achieve better price realization and the strength of the brand to boost sales and profitability.

The company’s stock, which experienced fluctuations after peaking in the final weeks of last year, is gaining strength ahead of this week’s earnings. It opened Monday’s session higher and maintained the momentum in the early hours of the session. Though Campbell executives have been working to reduce long-term liabilities, the company still has relatively high debt. From the investment perspective, recent improvements in financial performance and the decent dividend yield are the main positives, but the stock’s performance has been sluggish for quite some time. Currently, CPB is almost where it was five years ago.

Resilience

It is worth noting that the company managed to maintain satisfactory sales volumes and margins in recent months despite the high inflation and weak consumer sentiment. Going forward, the improvement in the supply chain should help reduce operating costs and boost margins. While things are improving for the company, it might take some time for the positive trend to bear fruit.

Campbell Soup will be reporting third-quarter 2023 results on Wednesday before the market opens. On average, analysts following the company expect a 7% annual decrease in earnings to $0.65 per share. Meanwhile, revenue is seen rising 5% from last year to $2.24 billion. Over the past five years, earnings mostly beat estimates, and the trend is expected to continue this time.

Financials

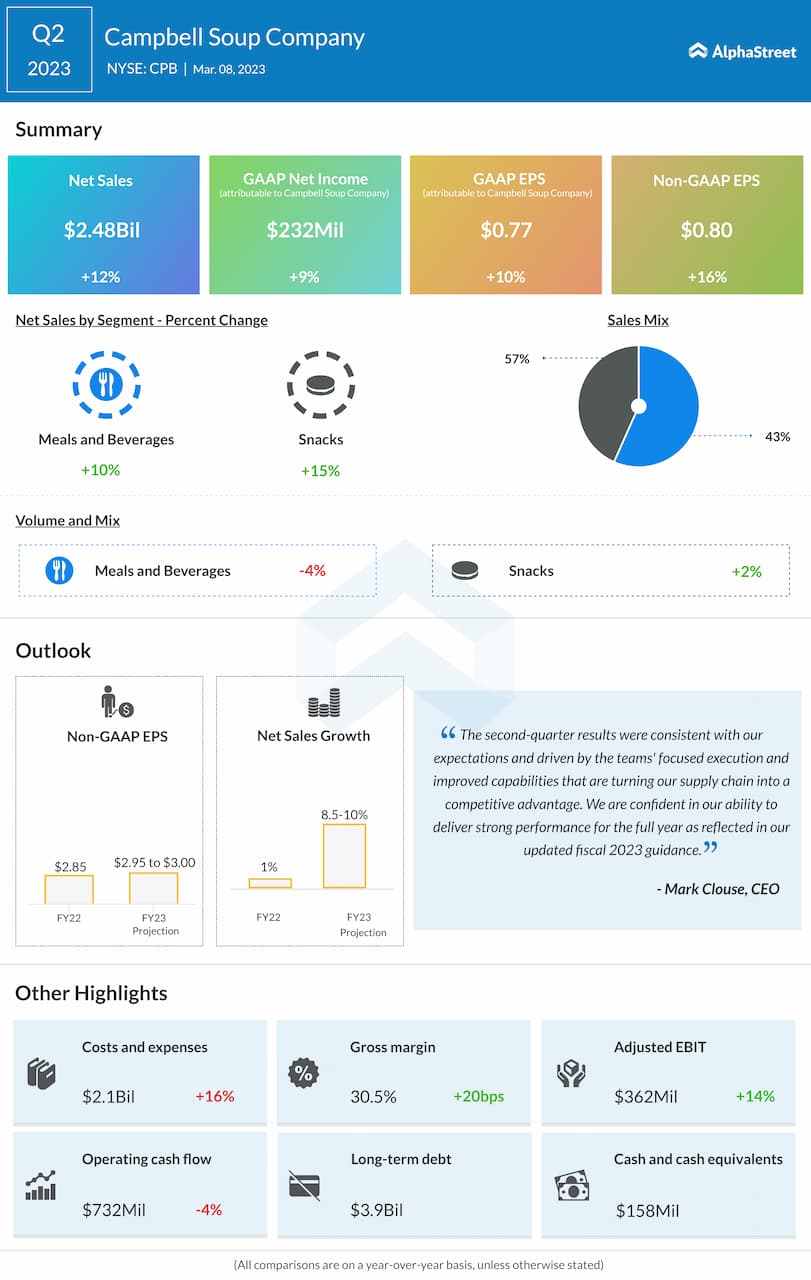

In the January quarter, a volume drop in the core Meals and Beverages segment was more than offset by an increase in the Snacks division, and total sales climbed 12% annually to $2.48 billion. Organic sales rose 13%, aided by the recent price hikes. As a result, adjusted earnings increased in double digits to $0.80 per share, though growth was restricted by a sharp increase in operating costs.

Encouraged by the positive outcome, the management raised its full-year guidance, and currently expects adjusted earnings per share to be in the range of $2.95 to $3.00, and sales growth between 8.5% and 10%.

“Our strong business fundamentals, together with the strength of the first half performance and the continued health of our brands, give us the confidence to raise our net sales guidance as well as raise the midpoint of the adjusted EBIT and adjusted EPS guidance we previously communicated for the 2023 fiscal year. This reflects continued momentum on the top line with greater confidence in our profit and earnings despite some additional pressure from lower pension income.” Said Mark Clouse, chief executive officer of Campbell Soup.

On Monday, the company’s stock traded slightly above the $50 mark. It has gained about 14% in the past twelve months.