Hold It?

Shares of the Orlando-based firm, which owns popular brands like Olive Garden, are currently trading below the long-term average but they’ve managed to resist pessimism linked to the weakness in the broad market and economic uncertainty. It is very likely that the current uptrend would gather momentum in the coming months, but the best thing prospective investors can do is to adopt a wait-and-watch strategy.

Read management/analysts’ comments on quarterly reports

Also, keeping a tab on the macro issues and pandemic situation would help in taking informed decisions when it comes to buying or selling the stock. Though the valuation is tempting from a long-term perspective, a little bit of patience now would pay off in the future, considering the growing recession fears.

Recovery

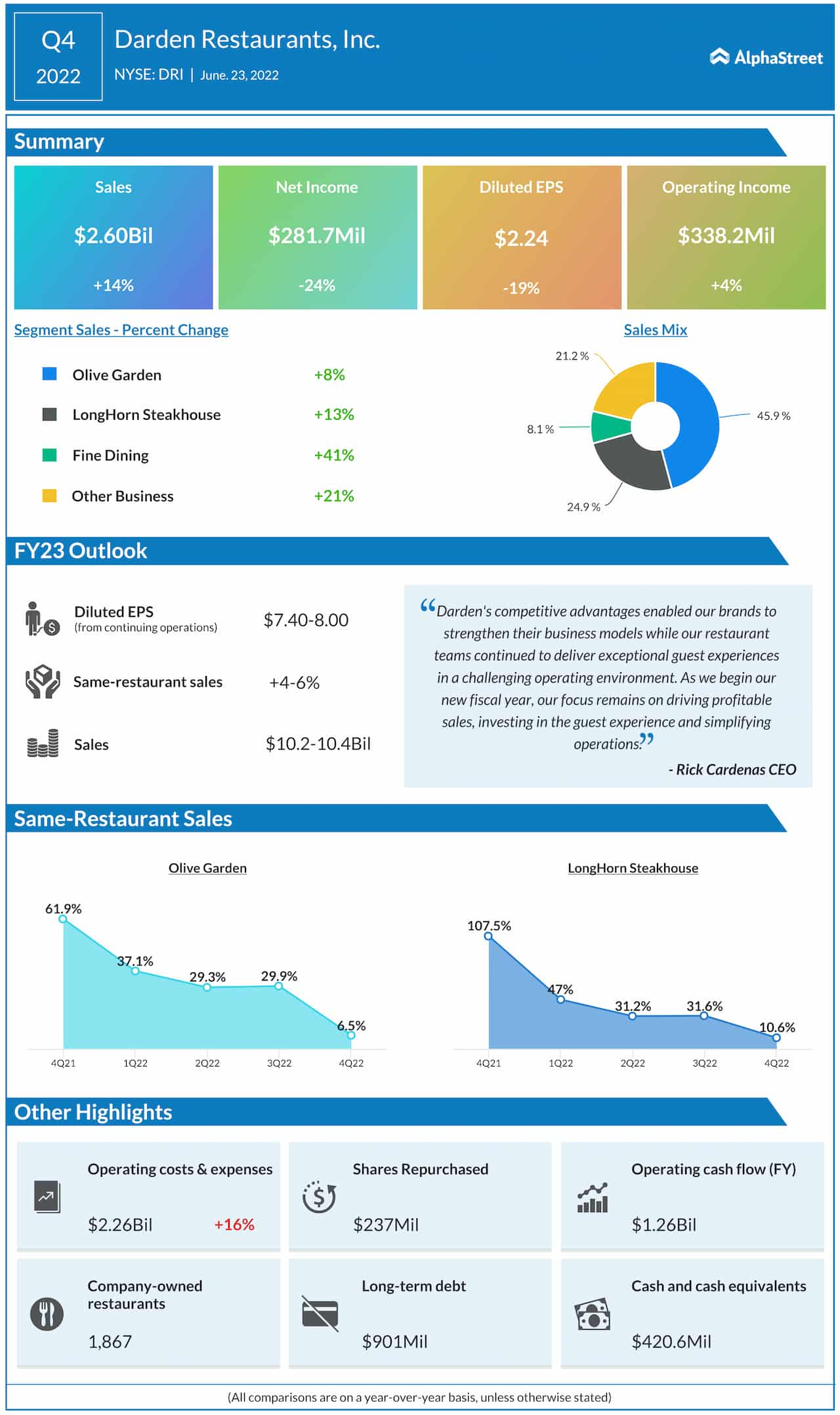

As part of its efforts to enhance sales and profitability, the company is investing in guest experience and taking steps to simplify operations. The idea is to return to the performance levels seen towards the end of 2021 when sales bounced back — people returned to the habit of dining out after restricting themselves to home-based food for many months. But the recovery proved to be short-lived then, to some extent, due to the resurgence of COVID cases.

More than the virus-related uncertainty, what worries the management is the growing cost pressure in key areas of the operation like logistics, raw material inputs, and labor. While higher menu prices can ease the impact on margins to some extent, more measures are needed to strike the right balance between pricing and maintaining competitiveness.

Stock Watch: Here’s What You Need to Know before investing in Kellogg

“As we begin our new fiscal year, our focus remains on driving profitable sales, investing in the guest experience, and simplifying operations. Darden’s strategy, and our strong balance sheet, position us well regardless of the operating environment,” said Darden’s CEO Rick Cardenas during an interaction with analysts this week.

Mixed Q4

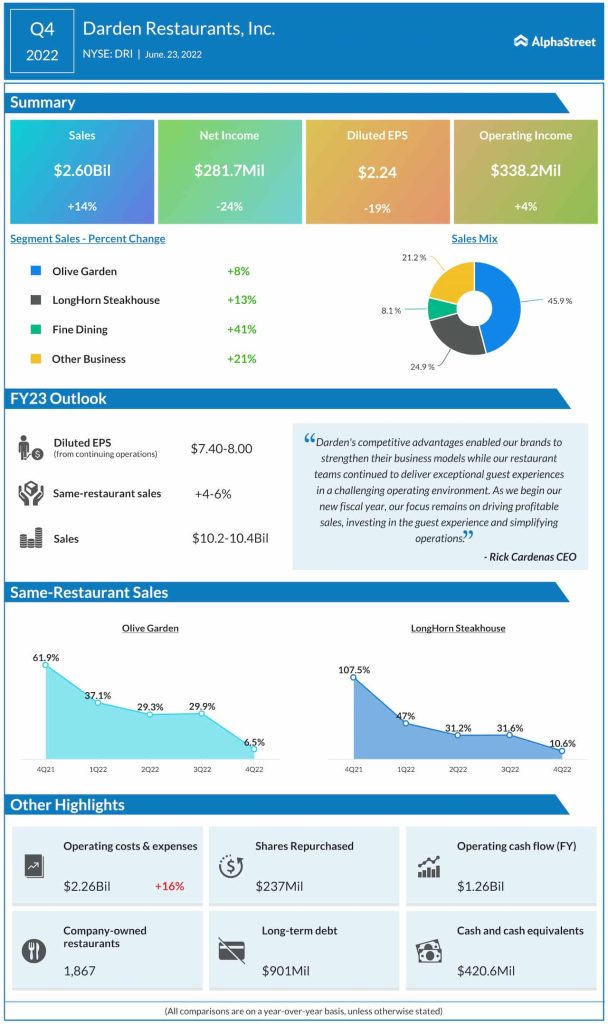

For the final three months of fiscal 2022, the company reported earnings that beat estimates. In the previous quarter, the bottom line had missed estimates for the first time in about five years. At $2.6 billion, net sales were up 14% year-over-year in the fourth quarter and above the market’s projection. However, earnings decreased to $2.24 per share from $2.78 per share last year.

DRI’s value shrank by a fifth so far this year but the stock mostly outperformed the market during that period. It traded up 2% on Friday afternoon.