Cost Concerns

There has been a spurt in home improvement and repair activities since the onset of the pandemic as the shelter-in-place orders and movement restrictions prompted people to take up such projects. Also, people are relocating to safer and more convenient locations and the process involves renovation and remodeling. Home improvement is a top priority for most households when it comes to spending the money they save while staying at home – by not traveling, eating out, or going to the cinema. Another contributing factor is the historically low bank rates.

Looking Ahead

Home Depot has been witnessing unusually high demand for do-it-yourself products in recent months. The market will be closely watching the company’s performance in the final months of the year, considering the holiday season. Supply chain and logistics should remain intact for the company to be able to fulfill the high demand. It bets on the improved digital platform to take orders effectively and the extensive store network to fulfill them.

As we turn our attention to the fourth quarter, we are excited about the upcoming holiday season and believe we are in a great position for continued customer engagement. During the quarter, we will be hosting our annual holiday, Black Friday, and Gift Center events.

ADVERTISEMENTTed Decker, chief operating officer of Home Depot

Record Comp Sales

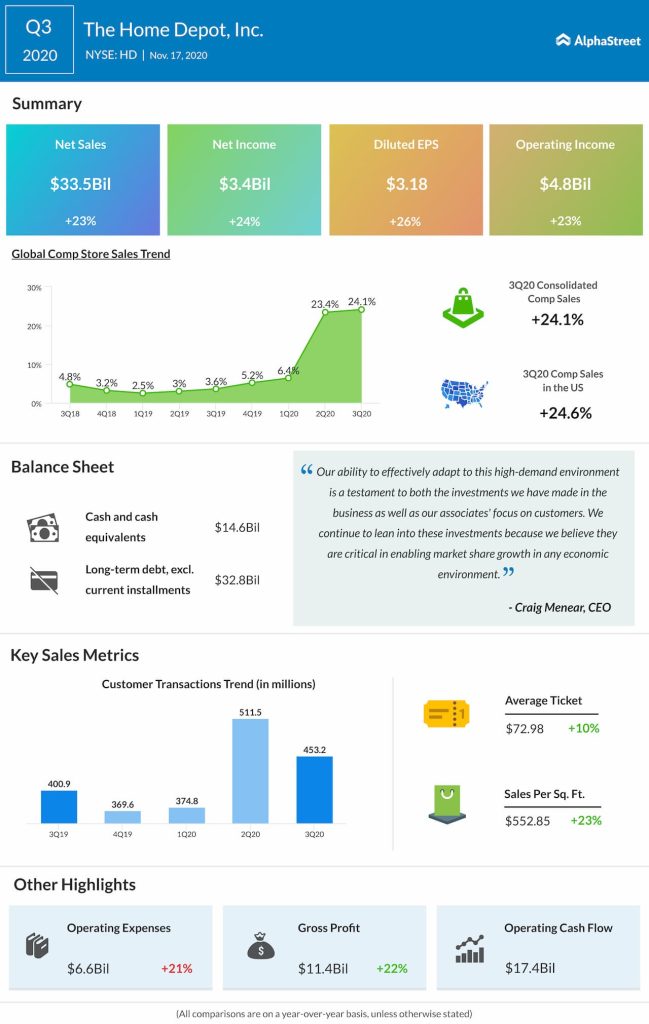

Comparable store sales increased at a record pace of 24.1% in the third quarter, extending the boom seen in the previous quarter. At $33.5 billion, net sales were up 23% year-over-year and above the consensus estimate. Consequently, earnings climbed to $3.18 per share and topped the Street view. Meanwhile, the management plans to make permanent some of the temporary worker compensation programs announced during the pandemic.

“During the third quarter, each of our merchandising departments posted double-digit comps, led by our lumber, and decor and storage departments. The growth in our comp average ticket was driven primarily by the continuation of project demand we saw in the second quarter, customers trading up to new and innovative items, as well as inflation in certain commodity categories like lumber,” said Home Depot’s chief operating officer Ted Decker during his post-earnings interaction with analysts.

Earlier this month, the company agreed to acquire former subsidiary HD Supply Holdings Inc. (HDA) in an $8-billion deal that is scheduled to close in the fourth quarter. It is expected to boost sales and be accretive to earnings in fiscal 2021, thanks to HD Supply’s large customer base and broad assortment.

Peer Performance

Rival home décor retailer Lowe’s Companies (LOW) reported record-high comparable sales for its most recent quarter, with all the merchandising departments and geographical regions registering double-digit growth. Earnings climbed 40% to $1.98 per share, supported by a 28% sales growth.

Read management/analysts’ comments on Home Depot’s Q3 earnings

Home Depot’s stock has moved up 26% since the beginning of the year. It recovered pretty quickly from the COVID-induced sell-off a few months ago and reached a record high in August.