Carmaker Ford Motor Company (NYSE: F) has been on a reorganization drive for quite some time, aimed at better aligning the business with the rapidly changing auto industry. The focus is on revisiting the company’s legacy business and streamlining operations through initiatives like leadership change, rightsizing, and disciplined capital allocation.

Last week, Ford’s shares bounced back from their latest dip but continue to trade below the long-term average. ‘F’ is a comparatively cheap stock that has experienced significant fluctuations. It offers a good dividend yield that is well above the S&P 500 average. So, the stock is a favorite among income investors, especially after the recent dividend hike.

The Stock

The weak sentiment surrounding the stock is unlikely to change until there is a meaningful improvement in the company’s sales and margin performance. Going by the cautious outlook on the business amid production delays and negative reviews from a section of analysts, 2023 would likely be a mixed year for the company. When it comes to owning the stock, there are not many positive factors to consider except for the low valuation.

Meanwhile, the company has delivered stable sales and earnings performance after returning to profitability from the virus-induced losses more than two years ago. Also, it ended fiscal 2022 with a free cash flow of $9.1 billion, which came as a surprise to many. However, the management’s guidance points to a decline in free cash flow this year, a prediction that doesn’t bode well for the company’s capital allocation plan.

Roadblock?

Of late, Ford has been facing problems with its electric vehicle business, and the company was forced to slash thousands of jobs. Recently, it had to halt production of the F-150 Lightning pickup — a model well-received by customers after the launch — due to battery-related issues. It has come as a setback to “Ford+”, a plan laid down by the company with the goal of becoming a leader in digital electric vehicles. The management is bullish on the Ford Blue used-vehicle program and Ford Pro, a set of business productivity tools designed for comprehensive fleet management.

“Ford’s a different company today, we’re all building a stronger customer-focused business that generates sustainable, profitable growth and returns above the cost of capital. While our 2022 results fell short of my expectations, I’ve never been more excited about our future, because we have the right plan, the right structure to succeed, the best team on the field, and real strategic clarity. This year is about execution. It’s time for us to deliver and we will with relentless attention to our founding principles, drift, and growth, and we are hitting the ground running,” said CEO James Farley at the Q4 earnings call.

Key Numbers

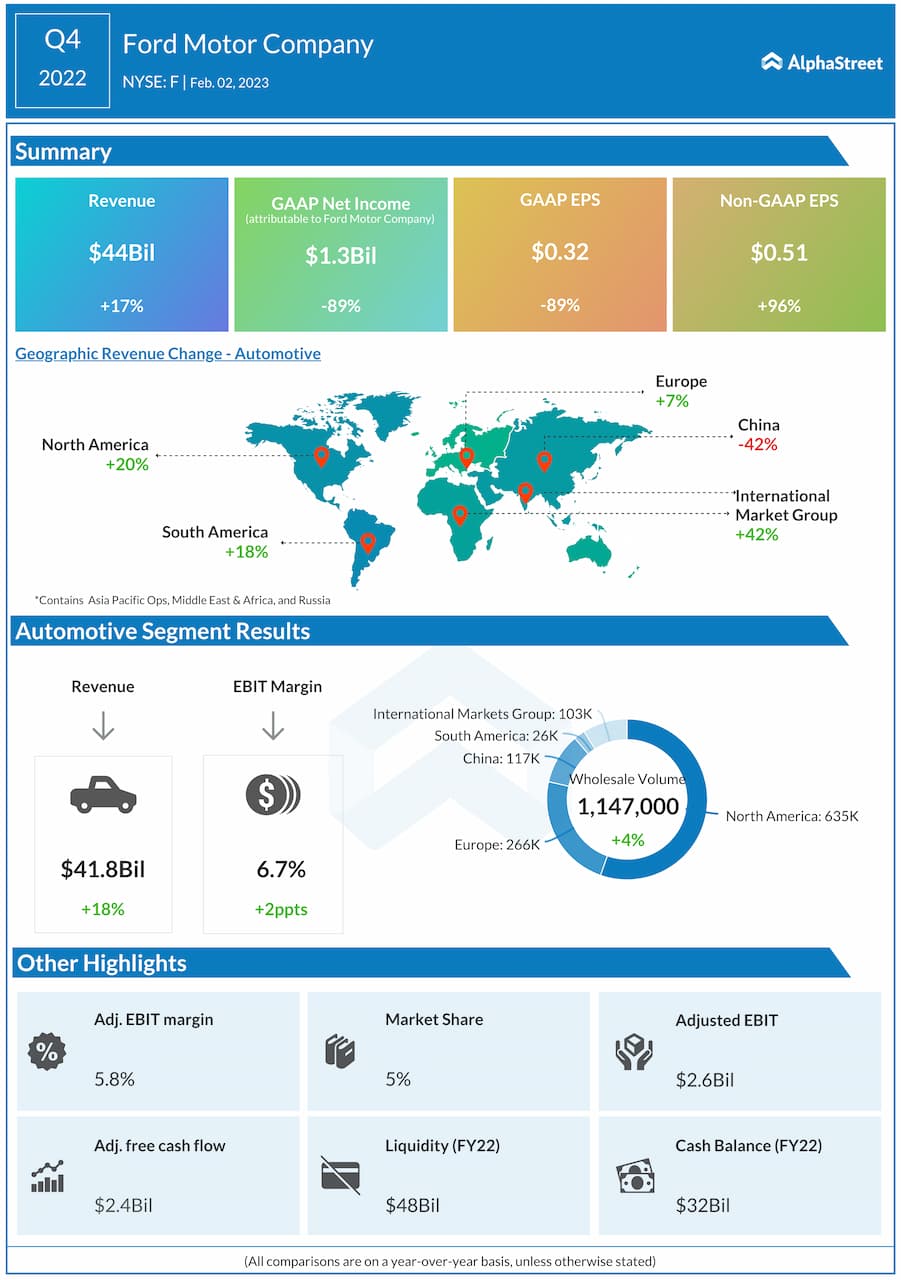

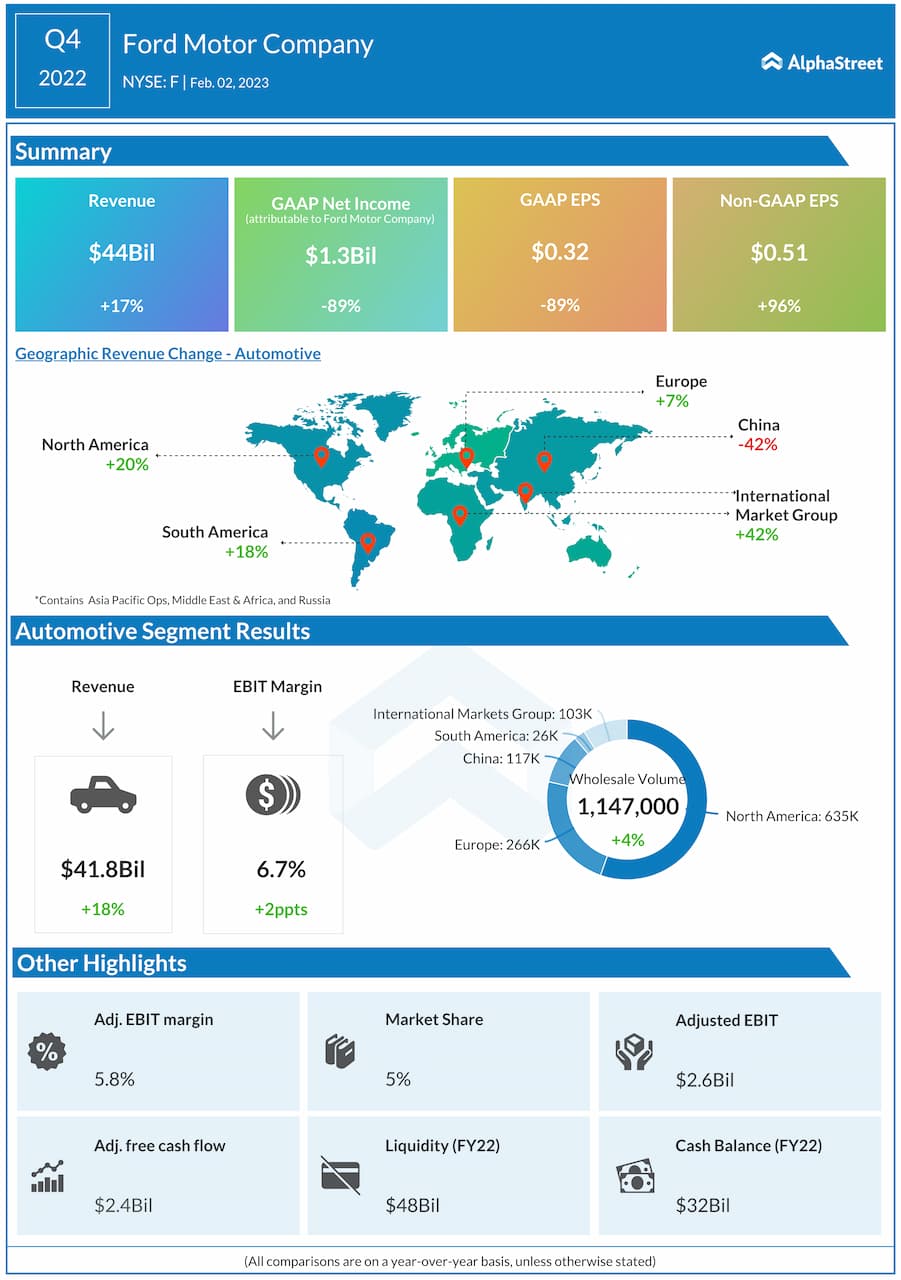

In the final three months of fiscal 2022, sales increased in all geographical segments except China where the economy is experiencing a slowdown due to the resurgence of COVID-19 cases. Total revenues climbed 17% from last year to $44 billion, which is broadly in line with the market’s projection. Consequently, adjusted earnings nearly doubled to $0.51 per share but fell short of expectation, marking the second consecutive miss after beating consistently for several quarters. The company expects adjusted free cash flow to be $6 billion and capital expenditures between $8 billion and $9 billion in fiscal 2023.

After a weak start to the session, Ford’s shares picked up momentum and traded higher on Friday afternoon. It is down 25% from twelve months ago.