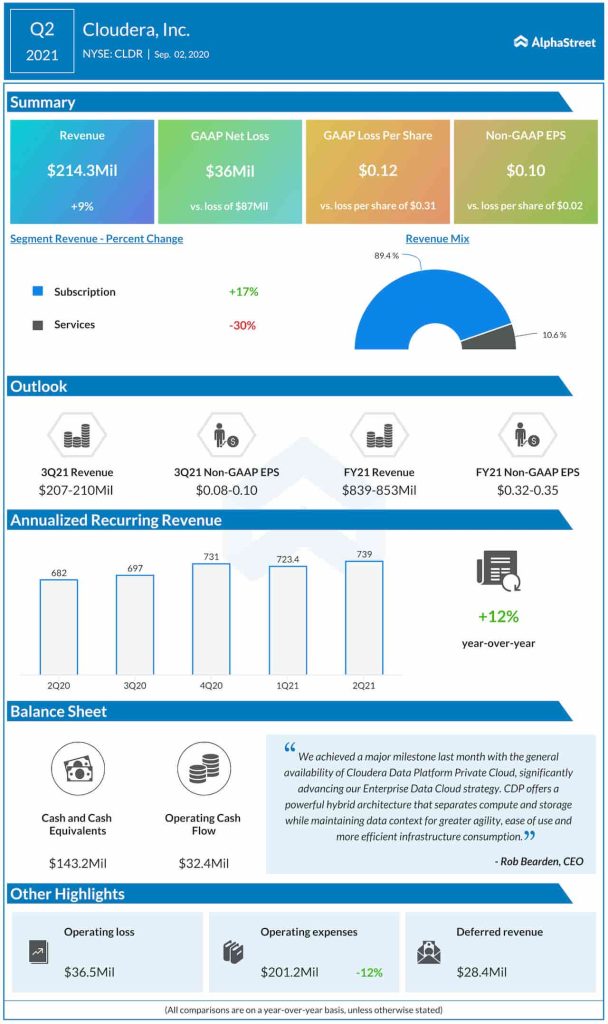

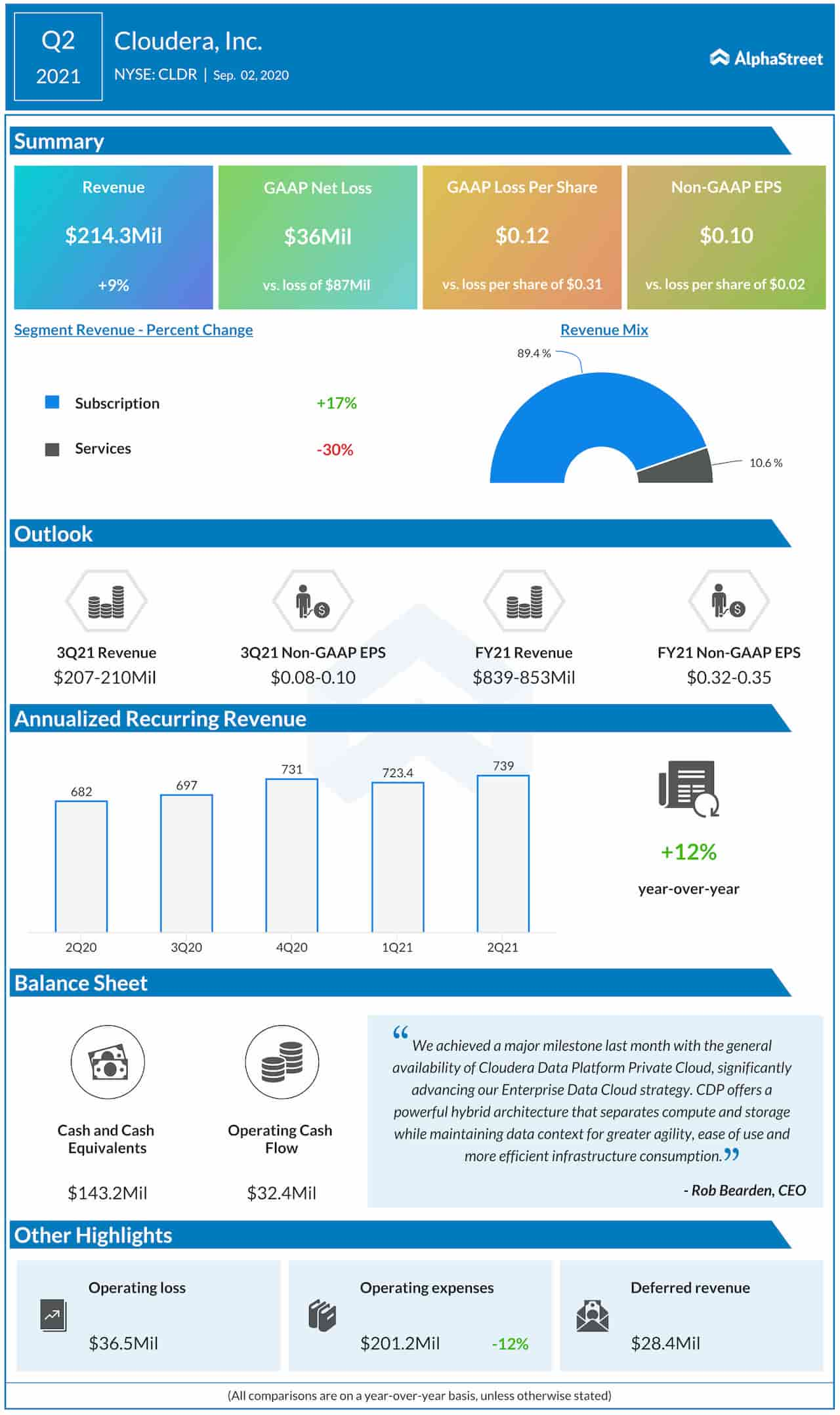

Q2 results

The Palo Alto, California-based company swung to profit on an adjusted basis in the second quarter. The bottom line and topline results exceeded analysts’ estimates. Subscription revenue rose 17% to $192 million. Annualized recurring revenue of $739 million, increased 12% from last year, driven by increased growth in both new and expansion bookings.

Also Read: DocuSign (DOCU) reports a 45% revenue growth in Q2 2021

Customers

During the earnings conference call, CFO Jim Frankola said that the company has been expanding the net new public cloud customers. He also added that non-paying users started to pay in Q2 and the existing customers decided to stay with Cloudera.

“As of Q2, we now have more new customers coming on board due to the changes in licensing paywall than we’ve had saves. So that was the surprising piece of the new story this quarter. Not sure how long it will repeat, but we’re confident that it will be a net add for a long period of time.” – Jim Frankola, CFO

Cloudera expects an increase in the total customer count and the customers who exceeded $100,000, during the next year, but not much this year.

Outlook

Cloudera projected subscription revenue to grow 13% in the third quarter of fiscal 2021. The company expects services revenue to remain at or close to Q2 levels until the economy recovers. This is a result of the slowdown in professional services revenue due to the pandemic and associated global recession.

Also Read: Cloudera (CLDR) Q2 2021 Earnings Call Transcript

For fiscal year 2021, Cloudera expects revenue to grow 7% year-over-year. Subscription revenue is projected to grow 14% for FY21.

CLDR stock, which has remained flat during the year-to-date period, was trading down about 1% in the pre-market trading hours today.