Strong results

Trends

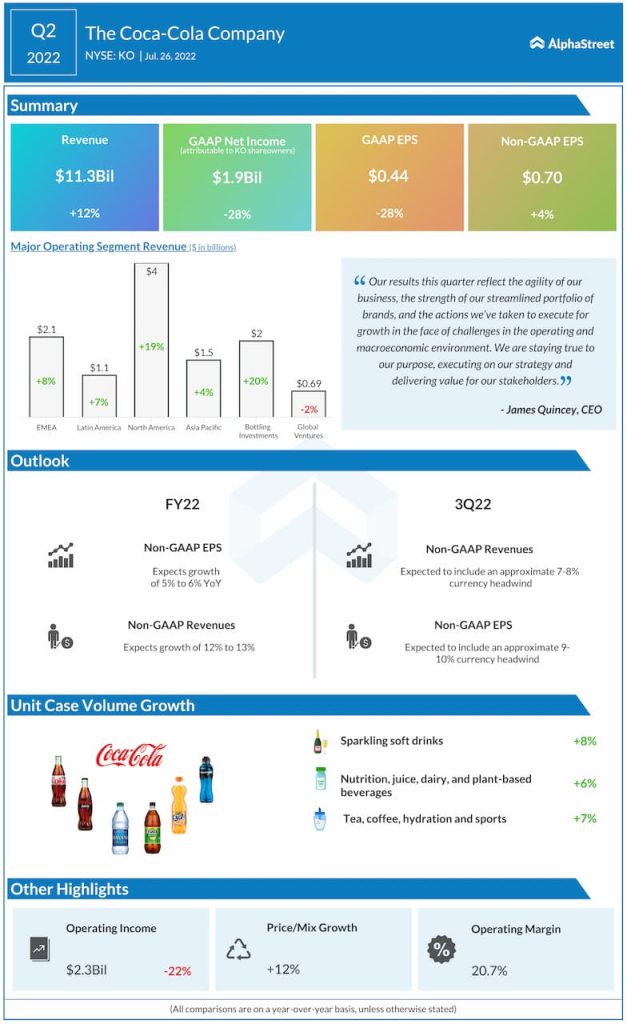

Revenue growth in the quarter was fueled by an 8% increase in unit case volume which was driven by recovery in away-from-home channels and investments in the marketplace. Volume growth was broad-based across all segments.

On its quarterly conference call, the company said it saw macro strength in some regions while others continue to experience inflationary pressures. Although consumer elasticities have been better-than-expected thus far, the company is watching out for changes in consumer behavior as the year progresses and the average cost of the consumer basket goes up.

In the South Pacific region, macro fundamentals remained strong despite supply chain headwinds. The company added new customers and transactions grew ahead of volume. It also increased distribution across key entry packs and multi-packs. In North America, Coca-Cola gained both volume and value share despite headwinds like higher labor and freight costs.

In Latin America, the company’s flavoured alcohol beverage business is seeing strong growth. It continues to gain share in the direct-to-consumer business and is reaching approx. 6.3 million consumers through digital channels.

Outlook

Coca-Cola raised its revenue guidance for the full year of 2022. The company now expects organic revenue to grow 12-13% versus its previous range of 7-8%. The beverage giant expects to see a 1-2% impact to net revenues and operating income due to the suspension of its business in Russia.

Coca-Cola expects comparable EPS for FY2022 to grow 5-6% compared to FY2021. The company expects the impact of commodity price inflation to be in the high single-digit percentage range. Comparable revenues for the third quarter of 2022 are expected to include a currency headwind of around 7-8%.

Click here to access the full transcripts of the latest earnings conference calls