Shares of Constellation Brands Inc. (NYSE: STZ) were down 4% on Thursday despite the company beating expectations on its first quarter 2023 earnings results. The stock has dropped 7% year-to-date. Alongside its earnings, the brewer announced its decision to overhaul its share structure which created a buzz on the Street.

Quarterly performance

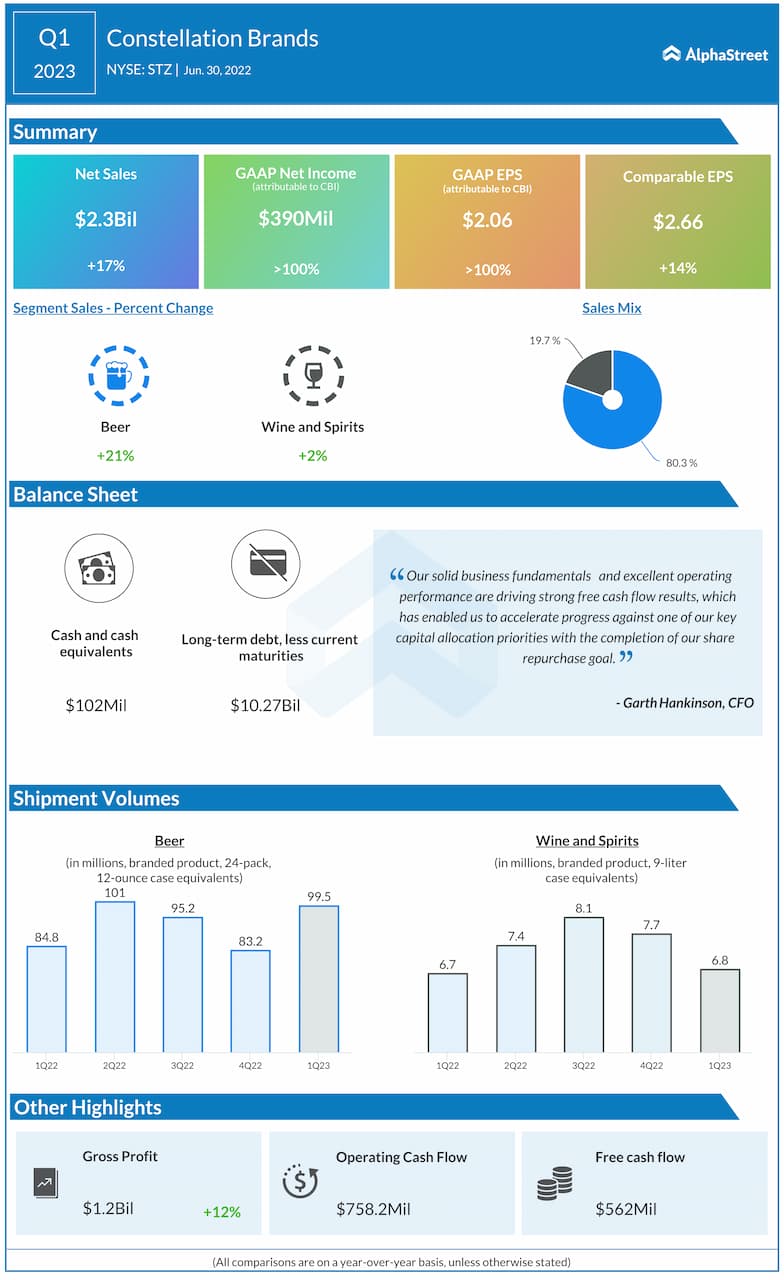

Constellation reported net sales of $2.3 billion in Q1, which was up 17% from the prior-year period and ahead of market estimates. On a reported basis, the company delivered net income of $390 million, or $2.06 per share, compared to a loss of $908 million, or $4.74 per share, last year. On a comparable basis, EPS rose 14% year-over-year to $2.66, beating projections.

Change to share structure

Constellation announced that it has entered into an agreement with the Sands family to eliminate its Class B common stock. As per the agreement, each outstanding share of the company’s Class B common stock, including those owned by the Sands Family, will be converted into the right to receive one share of Class A common stock plus cash consideration in the amount of $64.64 per share of Class B common stock, or a total amount of $1.5 billion. This will help simplify the company’s equity capital structure as well as provide operating cost savings and administrative savings.

Segment performance

The beer segment posted net sales growth of 21% in Q1 along with depletion growth of almost 9% driven by the strong performance of Modelo Especial and Corona Extra. Modelo Especial gained more than 15% depletion growth while Corona Extra posted depletion growth of over 4%. The company expects net sales in the beer segment to increase 7-9% in FY2023.

Net sales in the wine and spirits segment rose 2% YoY. Depletion growth remained positive driven by double-digit growth for Meiomi, The Prisoner Wine Company, High West Whiskey and Casa Noble Tequila. The fine wine and craft spirits portfolio achieved 16% depletion growth during the quarter. For FY2023, net sales in the wine and spirits segment is expected to decline 1-3%.

Outlook

For FY2023, Constellation now expects reported EPS of $10.50-10.80 versus the prior outlook of $11.15-11.45. Comparable EPS is expected to range between $11.20-11.50. Operating cash flow is projected to range between $2.6-2.8 billion while free cash flow is estimated to be $1.3-1.4 billion.

Click here to access the full transcripts of the latest earnings conference calls