Shares of Constellation Brands, Inc. (NYSE: STZ) dropped over 3% on Wednesday after the company delivered mixed results for the first quarter of 2025. Earnings beat expectations while revenue fell short of its target. The company updated its reported EPS outlook for the full year of 2025. Here are the key points from the report:

Mixed results

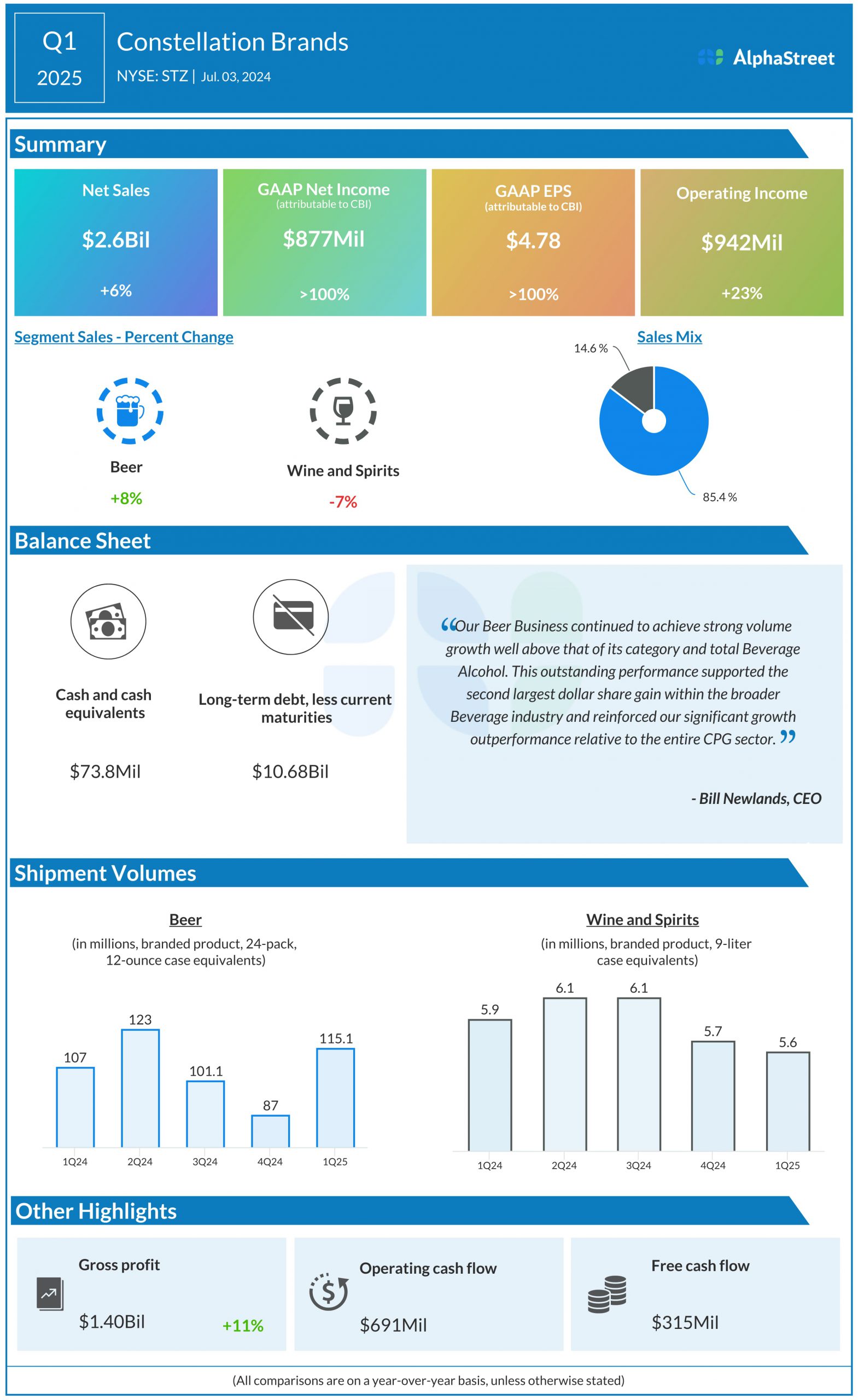

Net sales rose 6% year-over-year to $2.66 billion, but narrowly missed estimates of $2.67 billion. Comparable sales growth was also 6%. Reported EPS jumped to $4.78 from $0.74 last year. Comparable EPS grew 17% to $3.57, beating estimates of $3.46.

Segment performance

The beer business saw sales in the first quarter rise 8% YoY to $2.27 billion, helped by shipment volume growth of nearly 8%. Depletions grew 6.4%, helped by high demand across the portfolio, with particular momentum in the Modelo Especial, Pacifico, and Modelo Chelada brands. The beer business grew volume and dollar share as well during the quarter. For the full year of 2025, the beer segment is expected to see sales growth of 7-9%.

The wine and spirits division saw sales decline 7% to $389 million, driven by a 5% decrease in shipments. The drop was caused by challenging market conditions, mainly in the US wholesale channel, across most price segments in the wine category. Depletions were down 12.7%. Operating margins were hurt by lower volumes and higher cost of goods sold. The company expects sales for this segment to be down 0.5% to up 0.5% for the full year.

Updated outlook

For fiscal year 2025, Constellation expects enterprise net sales growth of 6-7%. It updated its reported EPS outlook to $14.63-14.93 and affirmed comparable EPS outlook of $13.50-13.80 for the year.