Shares of Constellation Brands (NYSE: STZ) stayed in red territory despite the company reporting better-than-expected results for the third quarter of 2022. Both revenue and earnings beat estimates and the company updated its adjusted EPS outlook for the full year.

Quarterly performance

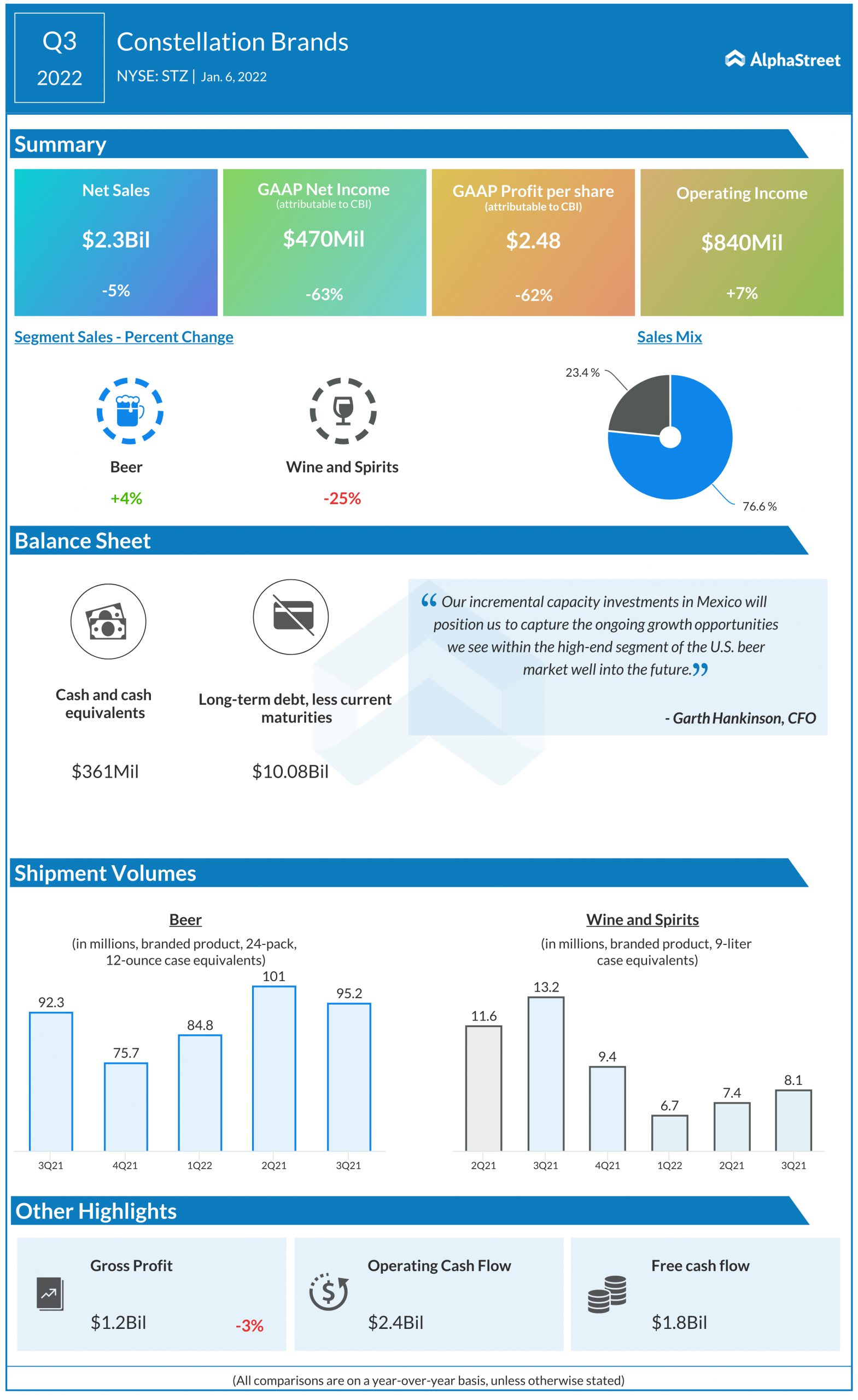

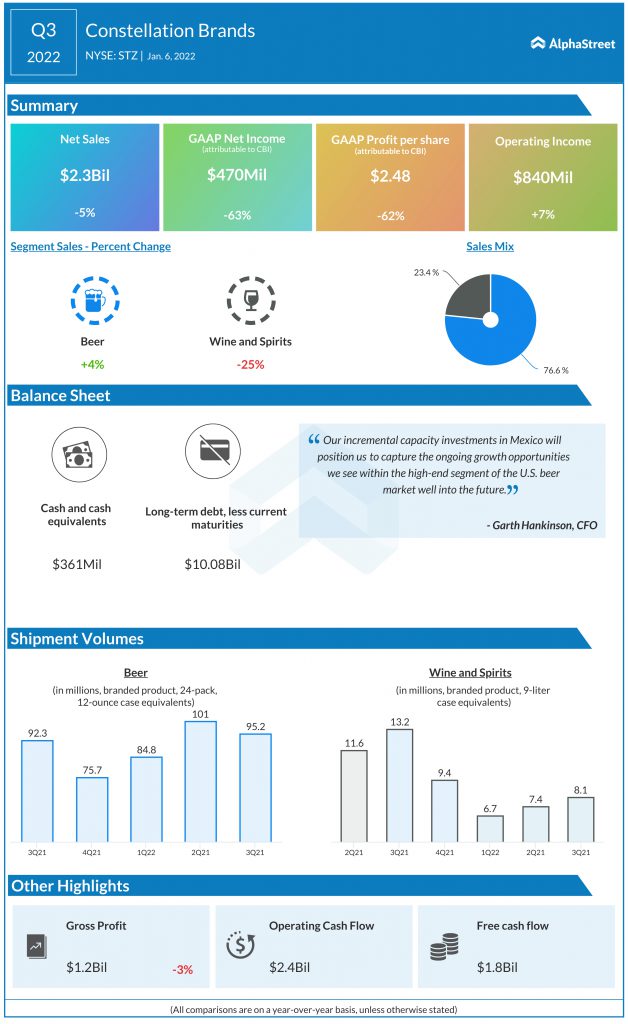

Net sales declined 5% year-over-year to $2.32 billion on both a reported and comparable basis but surpassed market estimates. Net income attributable to CBI was $470.8 million, or $2.48 per share, compared to $1.28 billion, or $6.55 per share, in the year-ago period. On a comparable basis, EPS rose 1% to $3.12. Excluding Canopy losses, EPS rose 8% to $3.42, exceeding expectations.

Trends

Within the Beer segment, net sales increased 4% year-over-year to $1.75 billion. Strength in Modelo Especial and explosive growth from Corona Extra helped drive depletion growth of more than 8% for the segment. Modelo Especial achieved a depletion growth of 13% while Modelo Chelada posted 35% depletion growth. Corona Extra reported depletion growth of 11%. All these brands witnessed share gains during the quarter.

Within Wine and Spirits, net sales declined 25% to $568 million. Organic net sales increased 3%. The Prisoner Brand Family, Kim Crawford, and Meiomi brands contributed to the company’s share gains in the high-end of the US wine market. Constellation’s Wine business outpaced the US wine market by double-digits in the 3-Tier ecommerce channel during the quarter. This was led by a 27% growth in Meiomi.

Constellation updated its capacity investment plans in Mexico which were expected to support the growth of its high-end Mexican beer portfolio. The investment will support an additional 25-30 million hectoliters of total capacity and includes the construction of a new brewery in Southeast Mexico. It also includes the expansion of the existing sites at Nava and Obregon. Total CapEx for the Beer business is now expected to be $5-5.5 billion over FY2023 to FY2026.

Constellation has entered into an agreement with The Coca-Cola Company (NYSE: KO) to bring the FRESCA brand into beverage alcohol through the launch of FRESCA Mixed, a line of ready-to-drink cocktails. According to its research, adult alternative beverages is an approx. $8 billion segment projected to grow at a CAGR of 15-17% over the next three years. These investments are expected to help Constellation expand its portfolio and drive growth over the long term.

Outlook

Constellation revised its earnings outlook for FY2022. On a reported basis, the company now expects a loss of $0.25 per share to $0.10 per share. On a comparable basis, it expects EPS of $10.50-10.65. In the Beer segment, net sales are expected to grow 10-11% and operating income is estimated to grow 6-7%. In the Wine and Spirits segment, net sales are expected to decline 21-22% while operating income is expected to decline 23-25%. On an organic basis, net sales are expected to grow 4-6%.

Click here to access the full transcript of Constellation Brands’ Q3 2022 earnings conference call