Is CRM a buy?

Read management/analysts’ comments on Salesforce’s Q1 report

With an impressive history of earnings surprises, Salesforce has always been an investors’ favorite. The recent slowdown has made it more attractive. Currently, the main tailwind to the business is the growing need among enterprises to automate business processes. Under the SaaS model, the company expanded its subscription base steadily over the years, giving stiff completion to rivals like Oracle Corp. (NYSE: ORCL) and Adobe, Inc. (NASDAQ: ADBE).

What’s in Store

The Silicon Valley tech firm enjoys the rare distinction of registering strong earnings that either matched or beat estimates consistently for more than a decade. Going by experts’ forecast, the trend was maintained in the second quarter of 2022, the results for which will be published on August 25 after the regular trading hours. Meanwhile, it is estimated that earnings fell 36% year-on-year to 92 cents per share, on revenues of $6.24 billion.

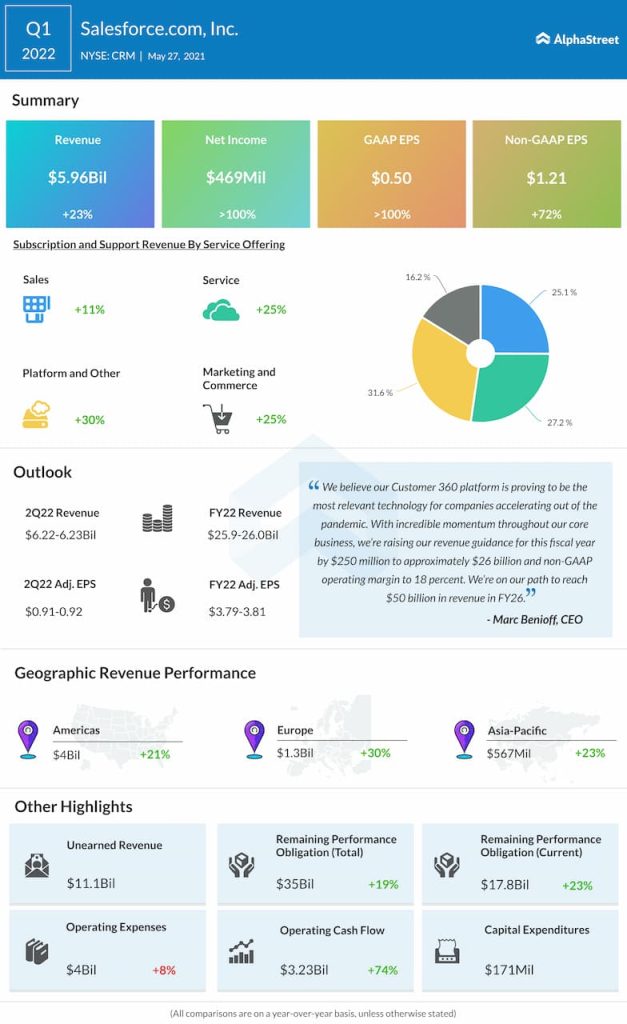

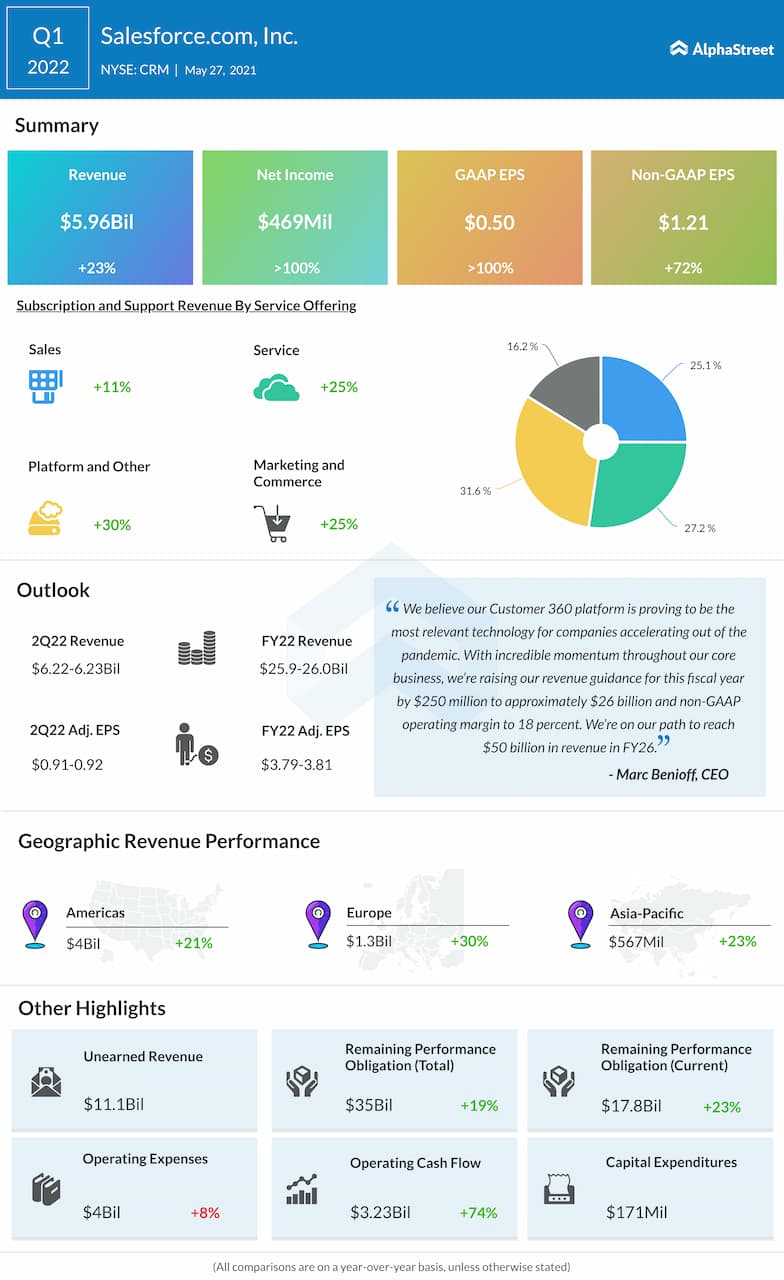

In the first quarter, all the four operating segments expanded in double digits, lifting total revenues to around $6 billion. As a result, adjusted earnings per share jumped 72% annually to $1.21, far exceeding estimates.

Salesforce is facing competition from relatively smaller players too, which keeps it on its toes in terms of safeguarding market share. Also, elevated costs – the company still spends heavily on research and development – continue to weigh on profitability.

In Expansion Mode

Last month, Salesforce closed the acquisition of workplace collaboration app Slack Technologies in a $28-billion deal, creating what the management refers to as a ‘digital headquarters for employers and employees.’ There is no doubt that synergies from the combination would strengthen the business further. As part of its expansion plan, the company is all set to launch a video streaming service next month, targeting office workers.

We’re taking a huge leap forward because Dreamforce is coming back in person in 2021 to San Francisco, as well as simultaneously in New York, Paris, London, it’s going to be a global Dreamforce. And we’re going to have thousands of people at every venue. We’re going to work closely with local officials. And we’re going to do an amazing show. I hope all of you will be there, September 21 to 23.

ADVERTISEMENTMarc Benioff, chief executive officer or Salesforce

Stock Performance

Continuing their recovery from the recent slump, Salesforce shares gained about 6% in the past 30 days and stayed above the long-term average. The stock opened Friday’s session at $253 and traded higher throughout the session.