Salesforce.com, Inc. (NYSE: CRM) has remained resilient to the COVID crisis so far — aided by the digital transformation wave — and consistently reported stronger-than-expected profit. But the market turned slightly skeptical this week after the management cautioned of a slowdown going forward. Also, reports of the cloud service provider’s multi-billion dollar deal to acquire instant messaging platform Slack Technologies, Inc. (WORK) did not go well with investors.

Is CRM a Buy?

The California-based tech firm continues to thrive on the demand growth spurred by the shift to home-based work/learning. After hitting a record high in early September, the stock retreated to the pre-peak levels in the following weeks and stayed almost flat until the latest earnings release. There have been concerns that work-from-home demand would drop in the coming months as markets are seen recovering sooner than initially expected. Recent reports indicate that COVID vaccines would be available by early next year.

However, the bullish target price shows that nothing can stop Salesforce’s stock in the near future. The recent moderation in value gives a unique buying opportunity that investors wouldn’t want to miss. Analysts overwhelmingly recommend buying the stock.

From Salesforce’s third-quarter 2021 earnings conference call:

“Now our customers are benefiting from the fast time-to-value we deliver with Customer 360, which has been critical during this pandemic and it’s going to remain so going forward. And with MuleSoft and Tableau every company can easily unlock any data from any source and see and understand in ways that are leading these faster, smarter decisions and the customer reactions, when they see this Customer 360s. Though eyes are lighting up because they have never seen their business quite like this.”

Another Strong Quarter

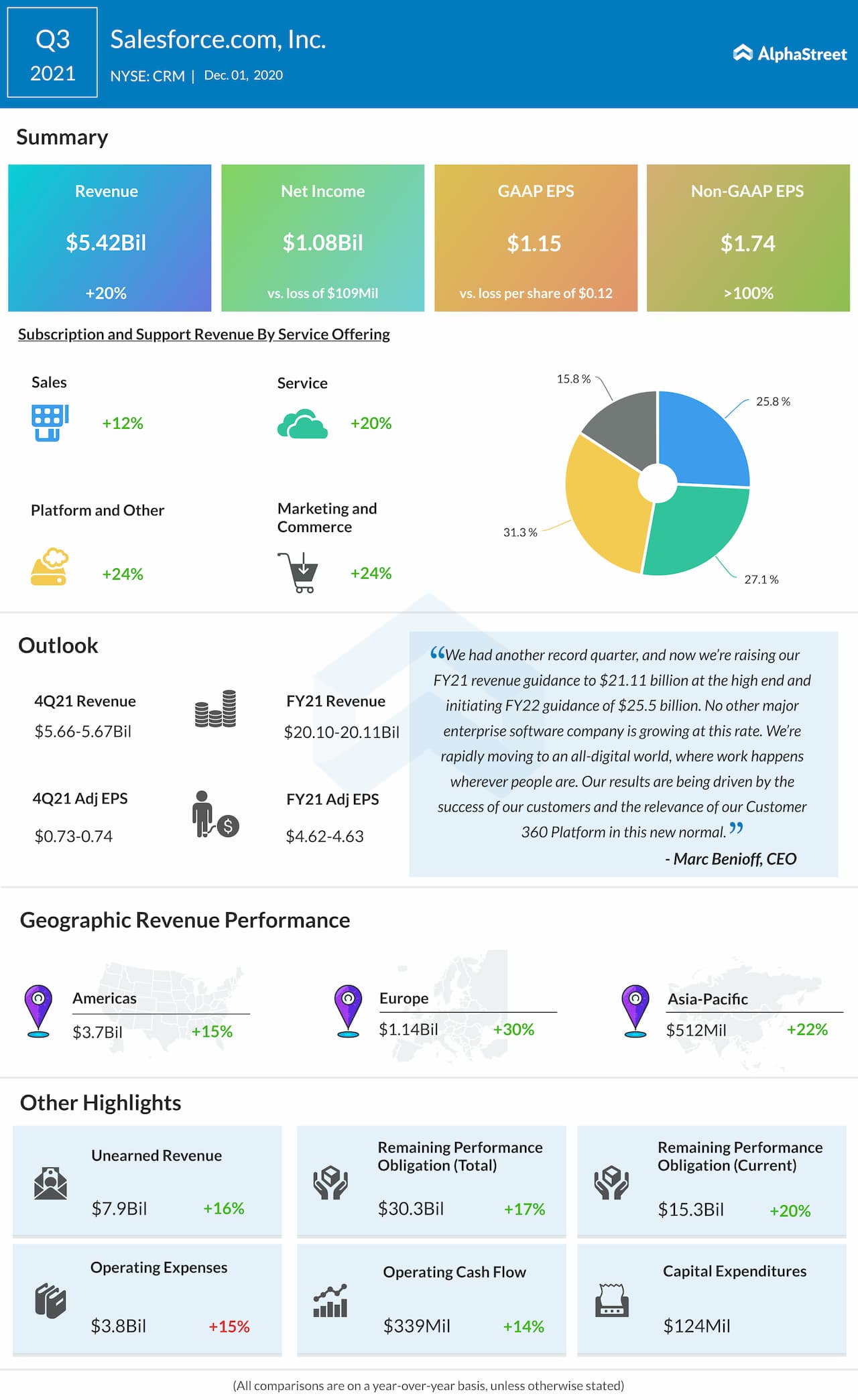

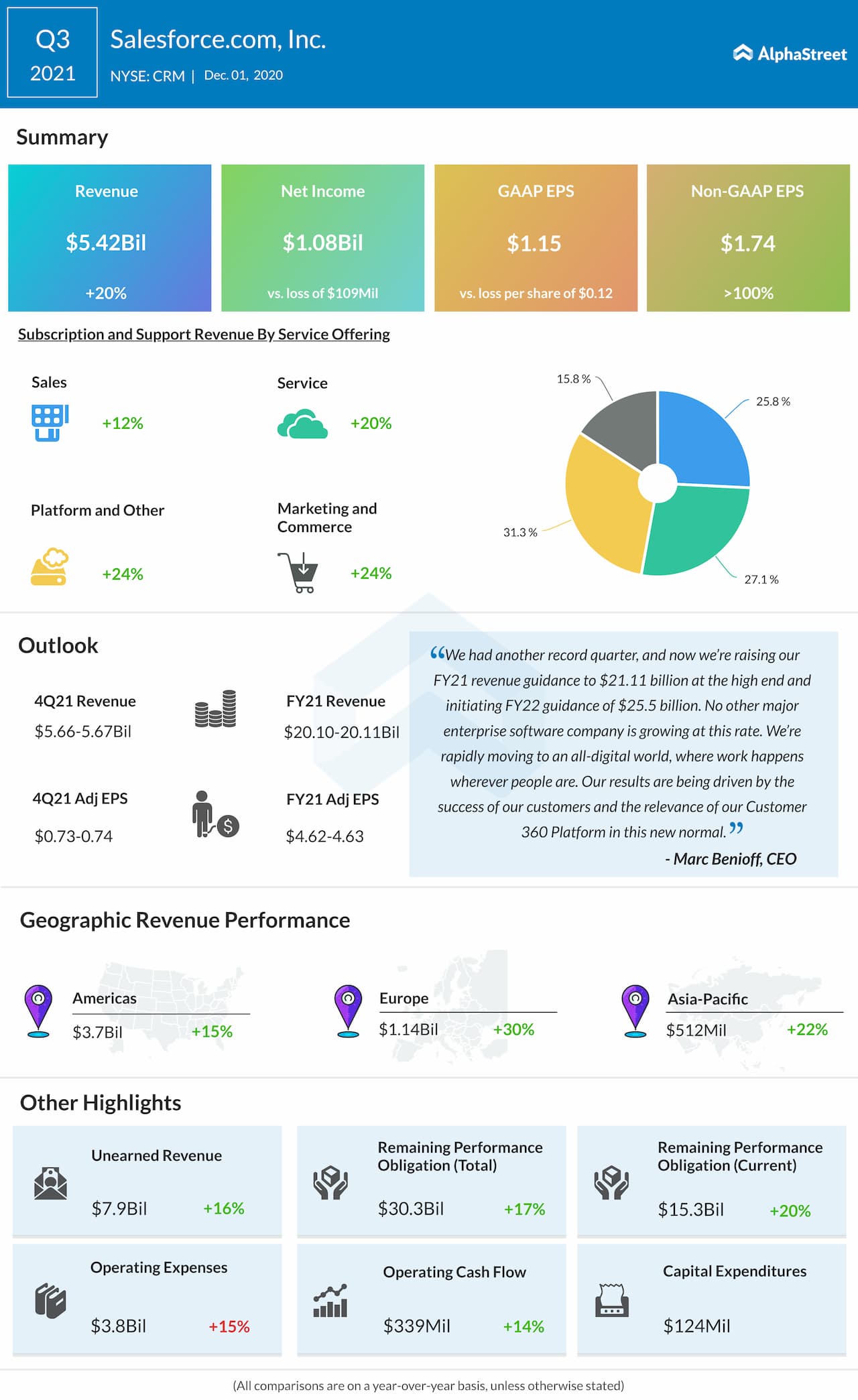

All the business segments and geographical regions registered double-digit growth in the October-quarter when total revenues increased by a fifth to $5.4 billion. Consequently, earnings more than doubled to $1.74 per share and exceeded the market’s projection. While maintaining its positive guidance, the management warned of growth slowing down modestly in the coming quarters.

Read management/analysts’ comments on Salesforce’s Q3 earnings

Earlier this week, the company signed an agreement to acquire Slack for about $28 billion, which represents a premium of more than 50% to the closing price prior to the deal. There are concerns that the premium is a bit too high, in relation to Slack’s financial performance. By adding Slack into its fold — the largest buyout by Salesforce in terms of value – the company aims to compete with the likes of Microsoft Corp. (MSFT) and stay relevant in the business world that is rapidly shifting to the digital mode. The transaction is expected to close in mid-2021.

We are entering into this all-digital work anywhere world and every executive that I talk to and every industry is doing this not as something temporary, but really a moment that accelerated the digitization of the economy. ….Behind all this is fundamental shifts in the way we work, fundamental consumer behaviors and fundamental changes in behaviors in every interaction and I think we really view Slack is really the system of engagement for every employee, for every partner, and for every customer interaction.

Bret Taylor, chief operating officer of Salesforce

ADVERTISEMENT

Stock Performance

The stock suffered a big loss after the third-quarter earnings announcement this week and maintained the downtrend since then. However, it regained a part of the lost momentum on Thursday and traded higher during the early hours. The shares have gained about 28% since the beginning of the year.