Unexpected Dip

Read management/analysts’ comments on CrowdStrike’s Q2 results

But the pullback looks temporary as the stock is on its way to breach the $300-mark in the coming months, according to experts. While market watchers are almost unanimous in their buy recommendation, the valuation looks high, after the steady gains, and that calls for caution. But CRWD is not a stock that can be ignored, rather it makes sense to keep an eye on it.

Nasdaq Recognition

Recently, CrowdStrike was added to the Nasdaq 100, Nasdaq Equal Weighted, and Nasdaq Technology indexes. The action, which is considered a major milestone for a relatively new player like CrowdStrike, could lift the value and trading volumes further. The company is comfortably positioned to take advantage of the rapidly growing demand for IT security solutions and achieve sustainable long-term growth.

The company’s Falcon platform is considered a more effective tool for endpoint protection than legacy security software and to deal with serious breaches wherein attackers exploit system vulnerabilities and weaknesses in identity architecture to sneak into computer systems, rather than using malware.

The lessons learned from recent attacks emphasized that a breach involves more than just malware, which is why companies need to employ a holistic breach prevention strategy rather than overly relying on malware prevention, regardless of its legacy or next-gen. As I’ve said before, nearly every breach you have ever heard of had two things in common, the victims had both a firewall and an antivirus solution, which is why we built the Falcon platform from the ground up to stop breaches and not just prevent malware.

George Kurtz, chief executive officer of CrowdStrike

Strong Q2 Numbers

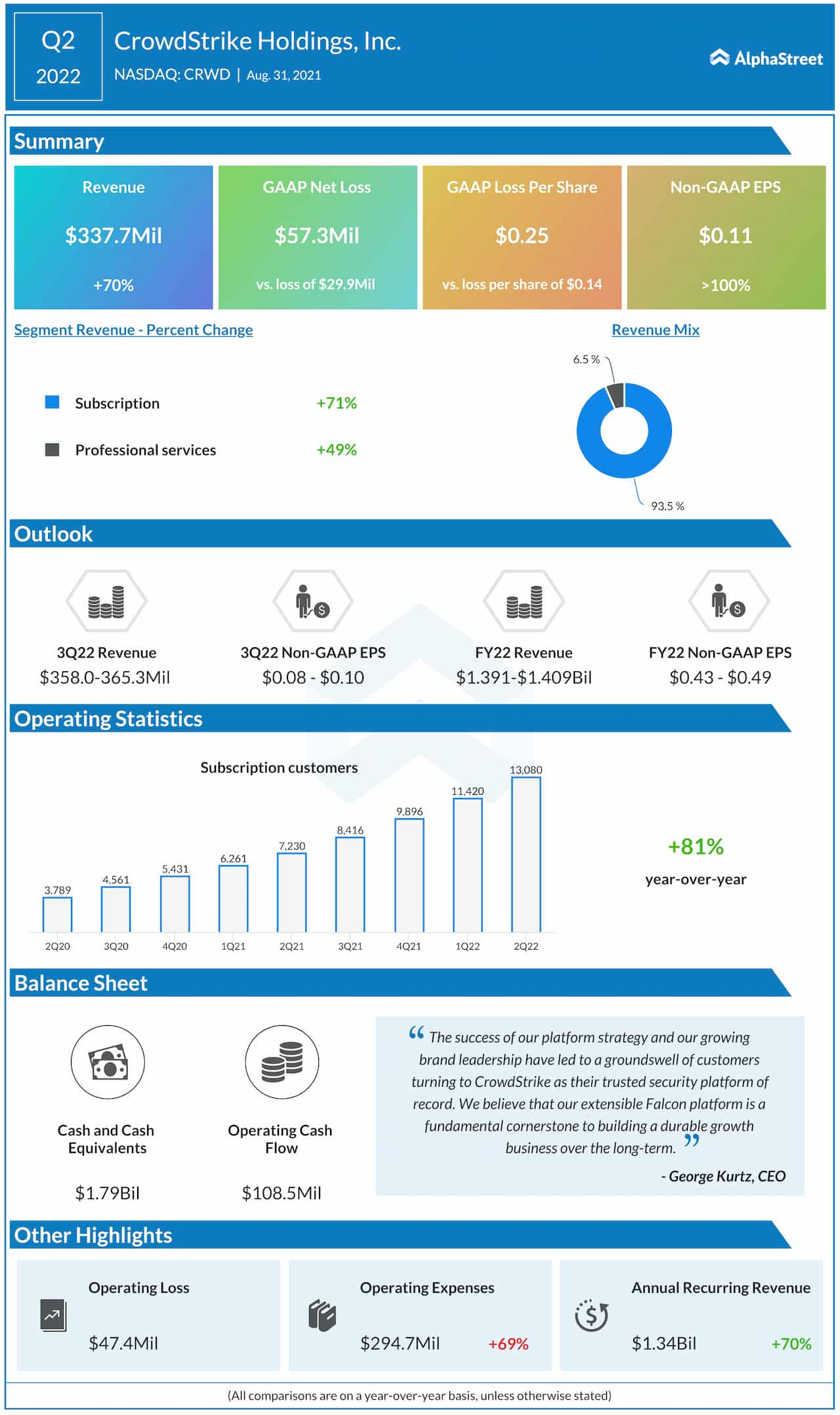

CrowdStrike’s quarterly earnings beat the estimates consistently since the company went public in mid-2019, reflecting the underlying strength of its operating model. At $338 million, second-quarter revenue was up 70% from last year. Supported by the stronger-than-expected topline performance, adjusted profit more than tripled to $0.11 per share and beat the Street view.

Buoyed by the positive outcome, the management raised its full-year outlook. Meanwhile, it is worth noting that the company is yet to generate profit in GAAP-basis — which stands for generally accepted accounting principles. Annual recurring revenue rose as much as 70% in the second quarter, but it was slower than the growth recorded in the prior quarter.

Microsoft shares slip on weak Xbox growth in Q4: Infographic

Though CrowdStrike has emerged as a market leader in SaaS-model cybersecurity services, rivals like Palo Alto Networks (NYSE: PANW) are fast catching up, offering next-gen cloud-native services.

CRWD opened Thursday’s session sharply lower but made modest gains in early trading. In the past six months, the shares gained around 21% and outperformed the broad market.