CrowdStrike Holdings, Inc. (NASDAQ: CRWD) has steadily expanded its subscriber base over the years, riding the ever-growing demand for cybersecurity solutions. As digital adoption continues — which accelerated after the COVID-related movement restrictions came into effect – there has been an increase in incidents of cyberattacks and data breaches.

The Austin-headquartered company has remained largely unaffected by the macroeconomic challenges so far, leveraging the stable demand for its products due to the mission-critical nature of cybersecurity. As of October 2022, the company had around 40 state governments as customers. CrowdStrike’s stock suffered a sharp fall this week despite the company reporting strong revenues and earnings for the October quarter. Investors were disheartened by lower-than-expected recurring revenue, while the weak guidance for the fourth quarter added to the gloom.

Valuation

Currently, CRWD is trading at its lowest level in about two years. The dip in valuation can be seen as an entry point, given the positive outlook on the stock that is expected to rebound in the coming weeks. Being one of the safest investments, CrowdStrike should find a place in investors’ portfolios.

Read management/analysts’ comments on quarterly reports

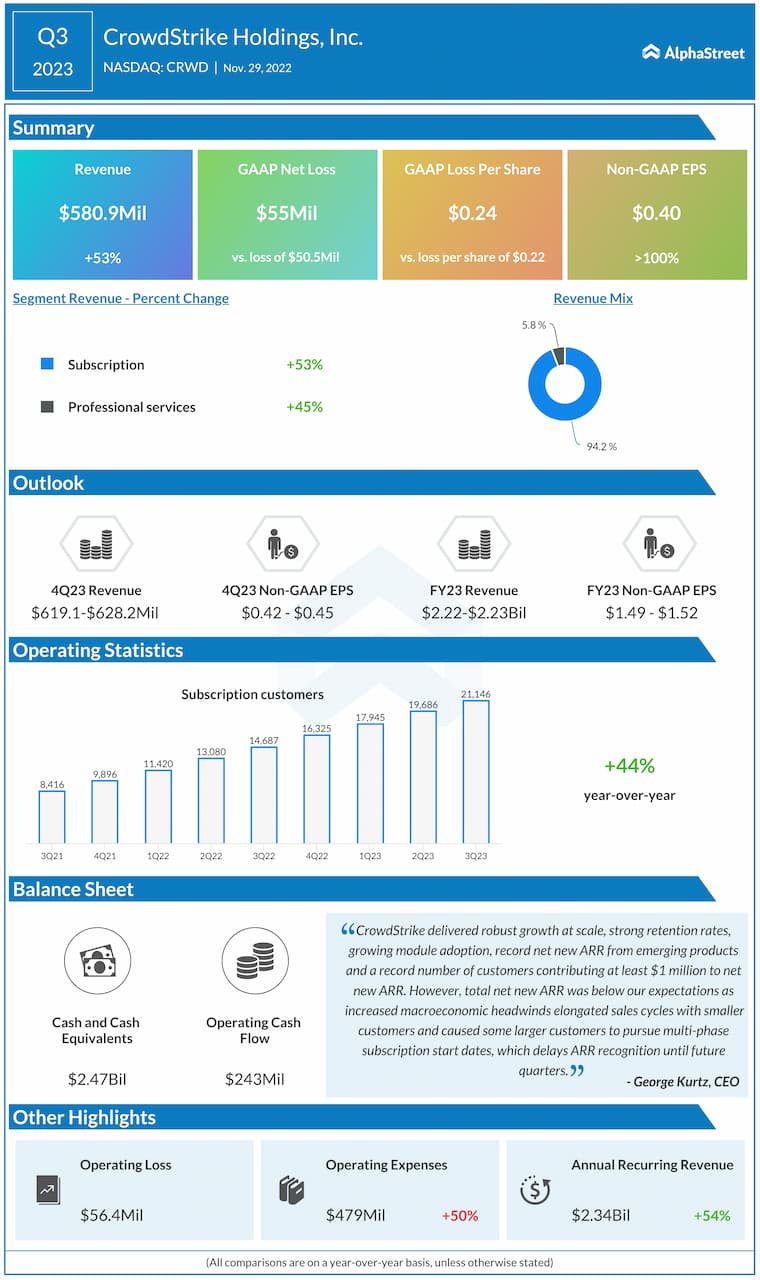

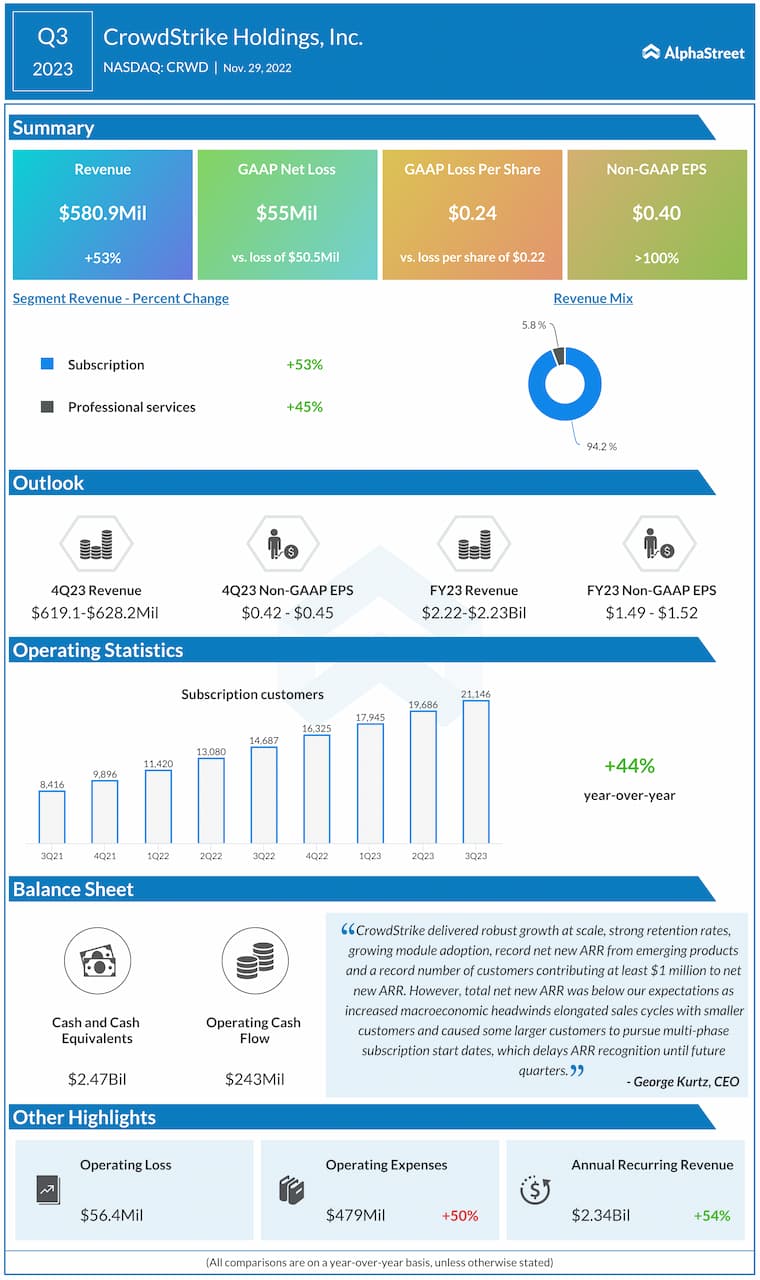

The company enjoys the rare distinction of beating earnings estimates in every quarter since going public more than three years ago. The trend continued in the third quarter when adjusted profit more than doubled to $0.40 per share. Driven by continued strong growth in the core subscription division, which accounts for more than 90% of the total business, revenues grew sharply by 53% from last year to about $581 million and topped expectations.

High Demand

The dollar-based net retention rate remained elevated as more customers standardized the company’s flagship Falcon platform and adopted extra modules. Anticipating the momentum to continue, the management issued strong guidance for the remainder of the year and fiscal 2023. However, the fourth-quarter revenue forecast fell short of experts’ expectations, causing the stock to fall after the announcement.

From CrowdStrike’s Q3 2023 earnings conference call:

“We believe today’s macro pressures on businesses and the escalating threat environment make Falcon’s value proposition as a consolidator more important today than at any other time in CrowdStrike’s history. In order to solve agent bloating complexity within the security and IT stack while also protecting the business from cyber adversaries and reducing operating costs, companies need to consolidate on a truly integrated platform, not acquired technologies stitched together by an invoice.”

The stock closed Wednesday’s trading session sharply lower, extending the weakness experienced after the earnings release. The current value of around $117 is sharply below CRWD’s long-term average.