“This is going to be a marathon and it’s going to be uneven and frustrating at times. Some of our sites are opening… others are not. Some schools will start in person and others will not. And as hot spots flare up and down over the coming months, local situations will quickly change.”

He also added that the company has to take a longer-term view of the new normalcy.

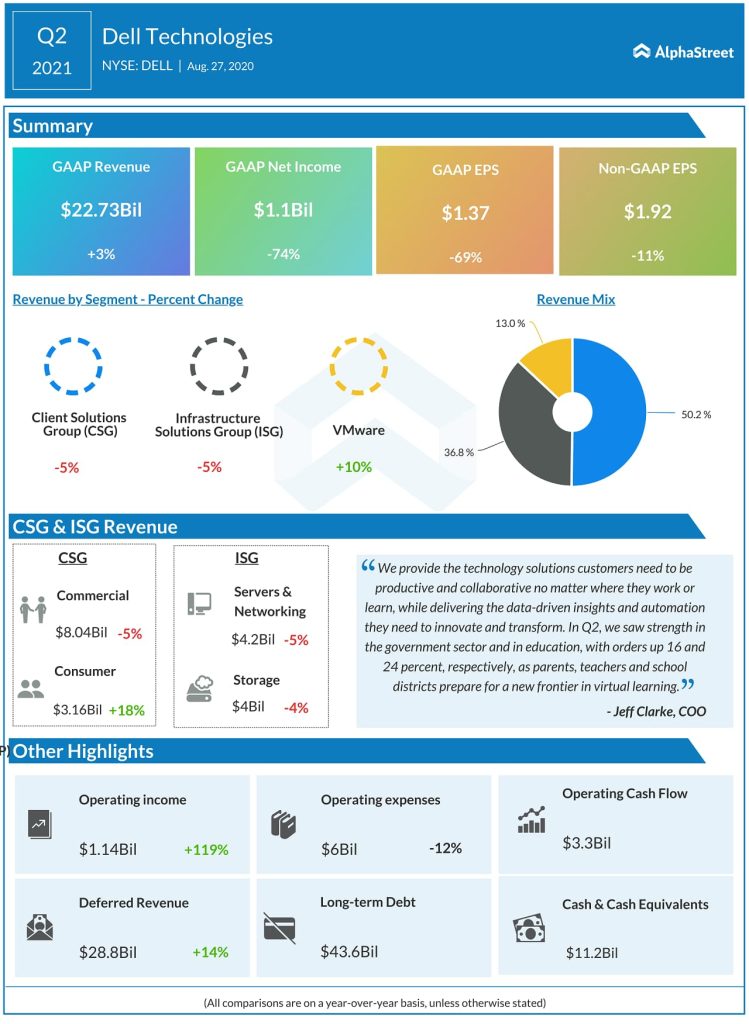

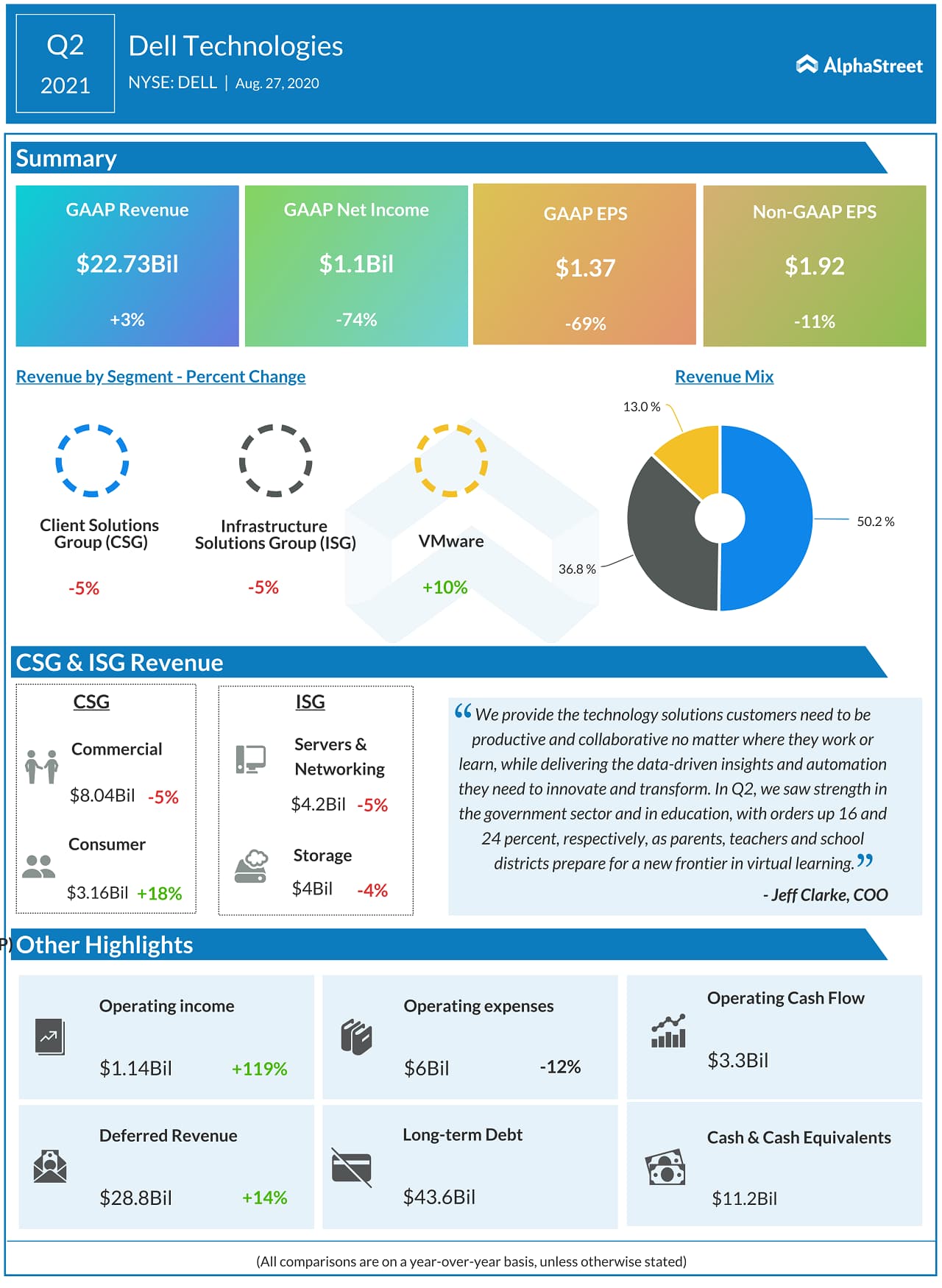

Q2 2021 results

Similar to Q1, Dell’s customers’ top digital priorities remained learning and working from home and the pandemic had certainly accelerated that trend in Q2 2021. During Q2, Dell had nine product and solution launches, all while working remotely. Recent data shows that work from home is likely to increase by 20 points across all-size companies across all sectors. The demand for the cloud and customers’ choice of using technology as a service also helped Dell in the recently ended quarter.

Also read: HP (HPQ) stock gains as Q3 earnings, revenue beat view

In Client Services Group, consumer direct and consumer direct online businesses were up 56% and 79%, respectively, based on orders. Dell witnessed strong double-digit growth across all consumer notebooks and gaming systems. Notebook momentum continued with orders up 8%, driven primarily by growth in consumer and commercial notebook needs at home and for remote work and learning. In the Infrastructure Solutions business, the company saw double-digit orders growth for data protection and VxRail in the second fiscal quarter and mid-single-digit orders growth for high-end storage.

VMware

VMware (NYSE: VMW), in which Dell owns 81%, had another strong quarter, delivered $2.9 billion of revenue, up 10%. In the second quarter, demand from the government stayed strong, while education demand ramped, with orders up double digits for both verticals. Small and medium business demand improved through the second quarter as businesses opened back up once government restrictions were lifted.

Dell is planning to spin off VMware, which the market watchers expect to happen in the second half of next year. This potential deal could unlock value for Dell shareholders.

Headwinds

Cost-cutting actions resulted in 12% reduction in operating expenses for Dell during Q2. Some of these cost benefits are shorter-term reductions that will phase out over time. Dell expects cost benefits from lower employee benefit claims, lower facilities-related costs and reduced advertising and promotional spending in certain verticals to normalize moving through the remainder of the year. ISG results in Q2 were softer than expected. However, Dell expects ISG’s results to improve as the overall economy and IT spending rebound.

When answering a question on operating margin target for the rest of the year, CFO Thomas Sweet commented,

“I do think that we might see a bit more downward pressure on operating margin in the back half of the year right now. We’ll obviously have to watch it. And part of that would be dependent upon how do the mix dynamics play out as well as the component cost environment, which we still believe is inflationary in Q3.”

Outlook

There continues to be a high degree of uncertainty for the remainder of this year. The latest global GDP and industry data indicate continuing, but moderating, declines for the second half of the year. Similar to Q2, Dell expects Q3 revenue to be seasonally lower than in prior years, which has typically been flat to down 2% sequentially.

The pandemic has resulted in companies reinventing their business models for a more connected, digital, automated, data-intensive and distributed future. With hybrid cloud and its technology solutions, Dell believes this digital future to create opportunities for the company’s long-term growth.

Stock performance

On Friday, DELL stock closed up 6.05% at $66.21. Shares of the Round Rock, Texas-based firm had gained 29% since the beginning of this year and 46% in the past 12 months. VMW shares ended up 2.23% at $146.09 on Friday. Dell’s peer HP Inc (NYSE: HPQ) also reported its quarterly results Thursday after the bell. The better-than-expected results from the Palo Alto-based company sent its shares up 6.15% on Friday.

Also read: Hewlett Packard Enterprise (HPE) crushes Q3 2020 estimates; provides Q4 and FY20 outlook