DocuSign (NASDAQ: DOCU) is scheduled to report first-quarter 2020 earnings results on June 6, Thursday, after the closing bell. The San Francisco-based firm is expected to report another strong quarter, as it continues to add partners and clients, thanks to the increased adoption of electronic signatures.

Wall Street projects Q1 earnings of 4 cents per share on revenues of

$208.5 million, up 34% year-over-year. The revenue projection falls right in

the middle of the company’s Q1 outlook range of $205-210 million. DocuSign management

has also projected adjusted gross margin for this period in the range of 78-80%.

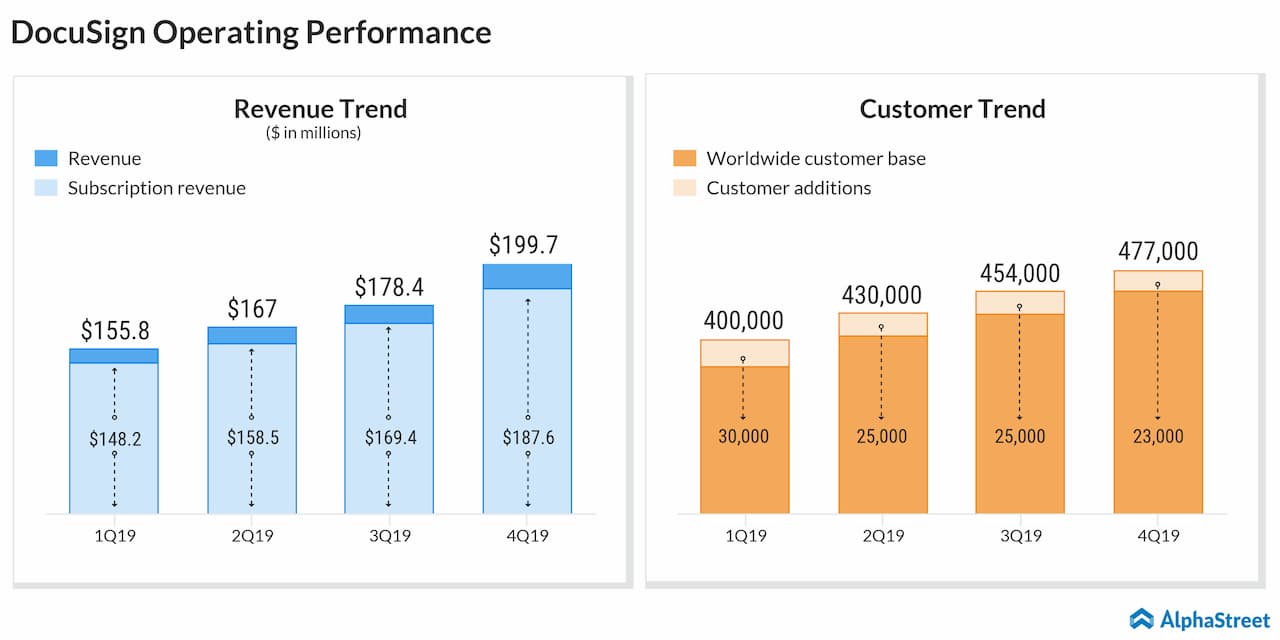

Over the past four quarters, the company has delivered consistent growth in customer additions and this is expected to continue in the first quarter. In the last-reported quarter, DocuSign said it added 23,000 customers, taking its global customer base to 477,000.

There has been a significant increase in market competition with the arrival of Adobe (NASDAQ: ADBE) and Dropbox (NASDAQ: DBX). However, DocuSign is yet to show a slowdown due to the entry of these new players.

According to Reports Monitor, the e-signature industry is set to grow at

a yearly pace of 31% over the coming six years, hence there is plenty of headspace

for growth.

DocuSign surprised Wall Street by reporting a profit in the fourth quarter of 2019, helped by a marked increase in revenues.

Revenues climbed

34% to $199.7 million in the fourth quarter, beating analysts’ estimate of

$193.68 million. The top line was lifted by a 37% growth in subscription

revenue.

The company

reported adjusted earnings of $0.06 per share during the quarter, even as the

market was expecting a breakeven.

DocuSign also raised its full-year outlook for total revenues to a range of $910-915 million, while billings are estimated to be $1.01-1.03 billion.

The stock, which started trading in April last year, has gained a modest

4.5% in the trailing 52 weeks, despite its relatively strong operational

performance. During the year-to-date period, meanwhile, the stock is up 37%.

Analysts are quite bullish on the stock, which as a 12-month average price target of $11.18. This represents an 18% upside from the last closing price.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.