Not surprisingly, the store operator witnessed a steady pickup in the demand for its low-cost merchandise in recent months. The trend is expected to continue in the foreseeable future, supported by the company’s growing digital capabilities and the government’s stimulus package. Initial estimates show that sales and customer base continued to grow in the early weeks of the current quarter. The management is looking for earnings growth of more than 10% in the long term.

Steady Uptick

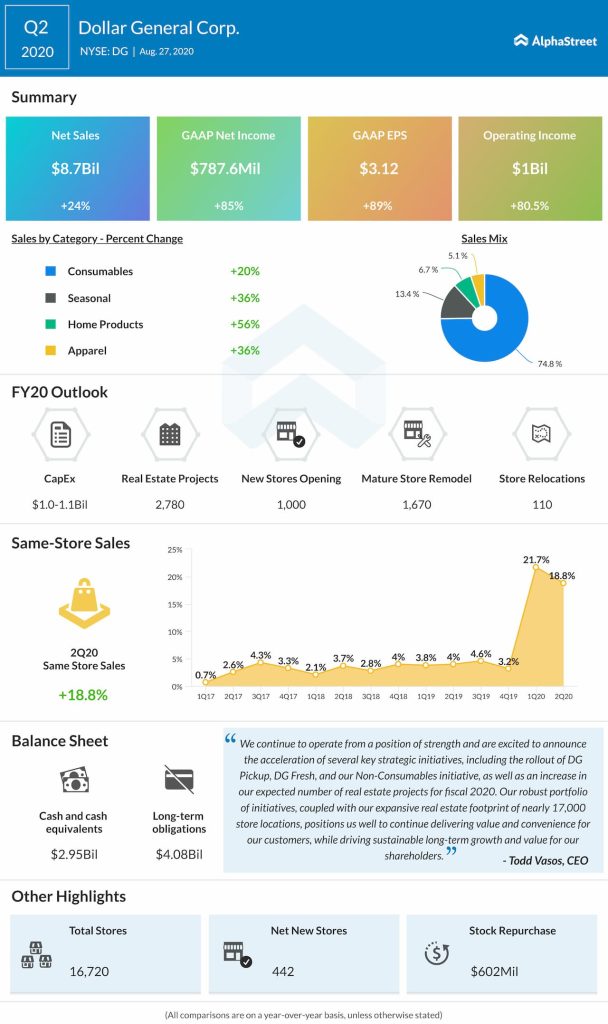

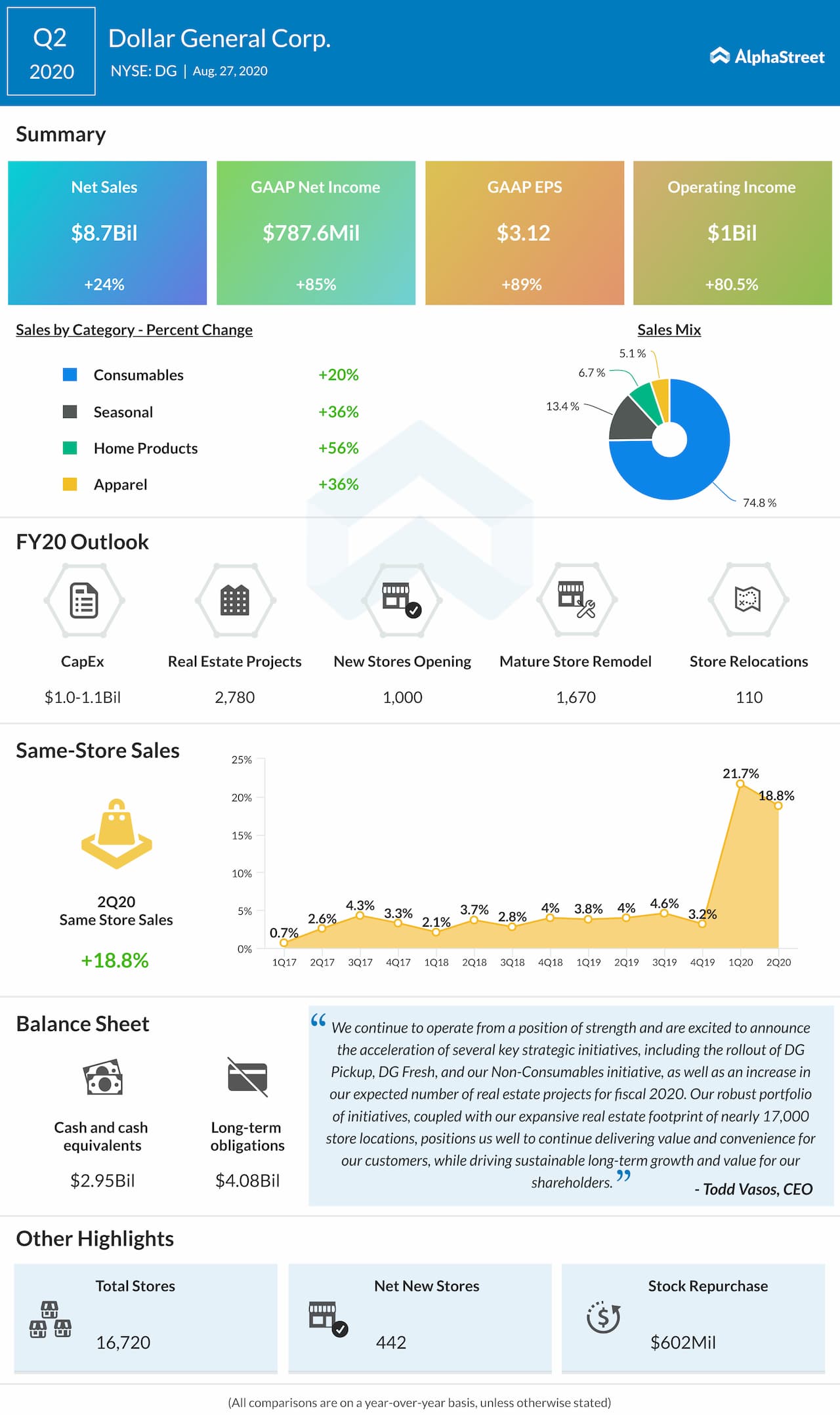

Since the market conditions have not changed much in the last few months, the company anticipates maintaining the sales momentum in the second half of the year. There is a slew of expansion initiatives in the pipeline that includes major real estate projects with a focus on expanding the store network. Dollar General is banking on its strong cash flow to meet the growth targets, after increasing the share buyback authorization.

Buy DG?

The company’s shareholders are a happy lot, with the stock setting new records consistently this year and crossing the $200-mark. Going by experts’ bullish outlook, the stock is on its way to scale new heights this year and become an attractive investment option. The company’s fundamentals are strong and the valuation looks just perfect, which is enough reason to keep an eye on the stock.

During his interaction with analysts during the post-earnings meeting, Dollar General’s CEO Todd Vasos announced plans to expedite the growth initiatives in response to the volume growth, such as the launch of DG Pickup, DG Fresh and the Non-Consumable Initiative (NCI). “We believe NCI will continue to be a meaningful sales and margin driver as we move forward and a very — and I’m very excited about the additional opportunities to further leverage our success in learnings with this important initiative,” he added.

Like most of its peers, adopting the necessary safety measures and ensuring hassle-free store operation would be the main challenge facing Dollar General going forward. Those efforts, along with additional employee benefits, will add to the cost pressure during the remainder of the year.

Comps Surge in Q2

In the second quarter, earnings rose a whopping 89% to $3.12 per share, thanks to the record growth in comparable-store sales that was broadly in line with the double-digit increase recorded in the first quarter. Market watchers had predicted a much slower bottom-line growth. Interestingly, the sales volume at the non-consumables segment was unusually large.

The company added 442 new units to its store network during the quarter, which contributed to the 24% increase in revenues to $9 billion. The year-over-year sales growth was widespread across all business segments.

“We can’t speculate as to whether there will be additional government stimulus or, if so, to what degree, our business would benefit. Ultimately, we expect to see our comp sales trends moderate as we move through the back half, but believe we are very well positioned to deliver positive sales growth for the balance of the year even if broader economic conditions deteriorate.”

ADVERTISEMENTJohn Garratt, chief financial officer of Dollar General

Also read: Kohl’s is changing its strategy to deal with disruption

Dollar General’s shares experienced some volatility after the post-earnings rally, but stabilized this week. Currently hovering slightly above $200, the stock outperformed the market throughout this year, despite a short-lived selloff in the early days of the pandemic. It has gained 30% so far this year.