Fast food giant Domino’s Pizza, Inc. (NYSE: DPZ) is preparing to release operating results for the first three months of fiscal 2024. The world’s largest pizza chain ended the last fiscal year on a high note, registering record sales volumes even as it continues expanding digital capabilities and investing in innovation.

For the company’s shares, 2023 was a year of recovery and they maintained the momentum this year. Though the stock experiences fluctuations, it looks poised to go beyond the $500 mark in the coming months and set a new record. DPZ is one of the stocks that investors would want to buy and hold forever, thanks to the company’s strong brand value and proven business model.

Outlook

Domino’s will be publishing the first-quarter report on Monday, April 29, at 6.05 am ET. On average, analysts forecast a profit of $3.4 per share for the quarter, which represents a 16% increase from the year-ago period. Revenues are seen growing about 5% from last year to $1.08 billion in Q1. Interestingly, the company’s earnings beat Wall Street’s projections consistently in the past five quarters, while the top lines missed estimates each time.

While continuing to attract customers through popular offerings like the mix-and-match menu, recent initiatives like the partnership with Uber Eats and ramping up the loyalty program are driving sales lately. The liberal profit-sharing system, particularly for the supplies and ingredients delivered to franchises, helps Domino’s maintain a healthy and sustainable partner network.

Sales Trend

It is worth noting that the retention rate was excellent last year, with most of the franchises renewing their contracts. Meanwhile, consumer sentiment is expected to remain under pressure from inflation to some extent in the near term. That doesn’t bode well for the company, especially considering its relatively lower margins.

From Domino’s Pizza’s Q4 2023 earnings call:

“We are expecting our supply chain margins to be roughly flat for the year, barring any unforeseen shifts in the food baskets. We are expecting an increase in year-over-year supply chain margins in Q1 due to the expected negative food basket, followed by a slight moderation for the balance of the year. We expect supply chain margin dollars to grow in line with transaction growth throughout the year. We are estimating that rate of inflation across the system, inclusive of California will be in the mid-single digits, and this has been primarily driven by minimum wage increases.”

Key Numbers

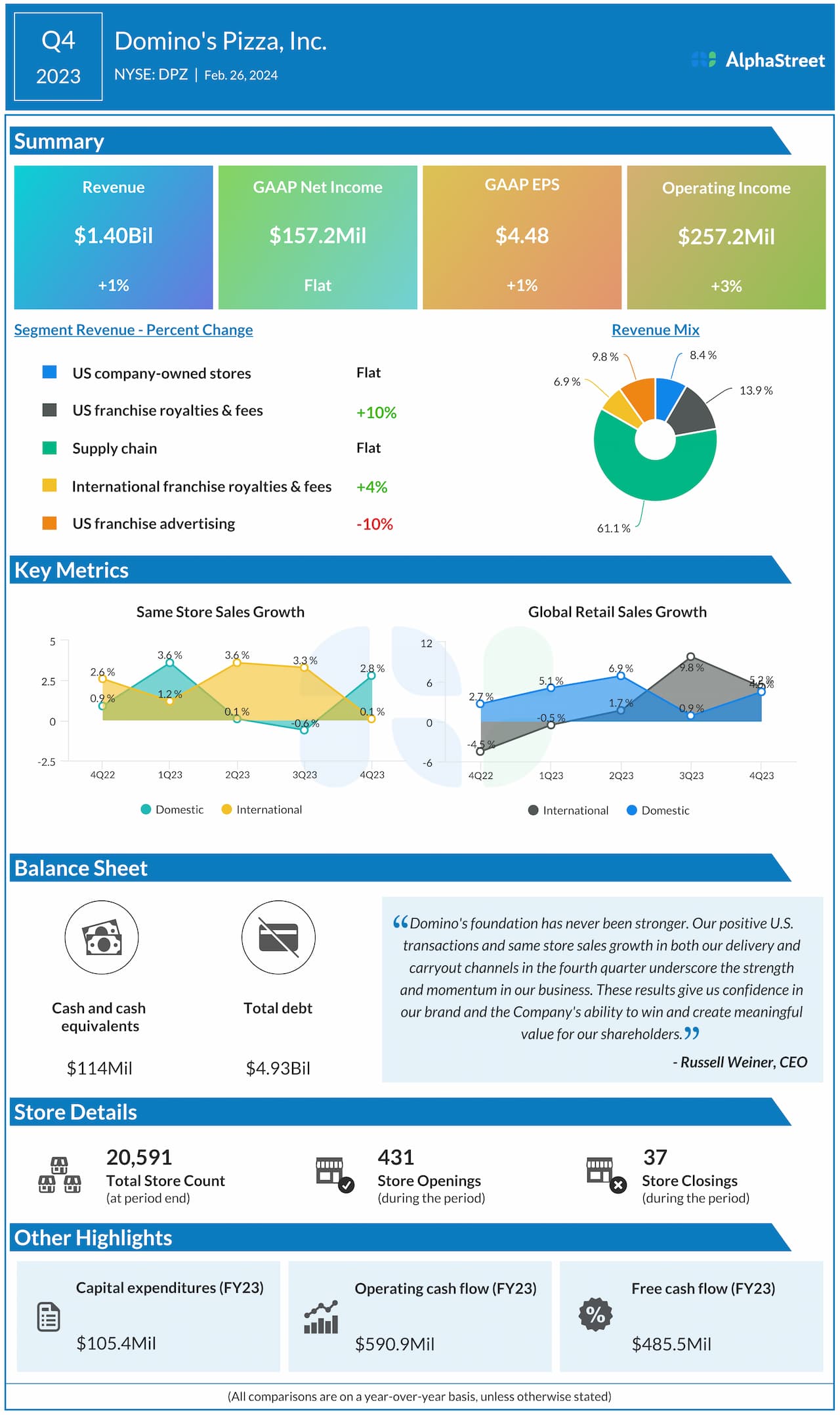

For the final three months of fiscal 2023, the company reported revenues of $1.40 billion, which is slightly higher than the number for the prior year quarter. Q4 profit edged up 1% year-over-year to $157.2 million or $4.48 per share. Domestic same-store sales and retail sales were up 2.8% and 5.2% respectively during the three months. The company has around 20,000 stores spread over more than 90 international markets.

Shares of Domon’s traded above their long-term average since the beginning of the year, gaining about 17% during that period. The stock made modest gains in the early hours of Wednesday’s session.