Alibaba Group Holding Limited (NYSE: BABA) is expected to report second-quarter results this week, with analysts forecasting an increase in revenues and a decline in adjusted profit. As the company aggressively pursues its integrated cloud and AI development strategy, the number of customers using Alibaba Cloud for AI deployment has steadily increased.

The Stock

The performance of Alibaba’s stock on the New York Stock Exchange has been lackluster in recent years as it maintained a downtrend and struggled to regain strength. After peaking about four years ago, the share price declined sharply. Meanwhile, BABA got a much-needed boost a few weeks ago, driven mainly by positive signals from the Chinese economy, including the government’s stimulus package. However, it pared a part of those gains last month and the trend continued ahead of the earnings.

The China-headquartered e-commerce company is preparing to publish its second-quarter results on Friday, November 15, at 6:30 am ET. On average, analysts following the company forecast earnings of $2.07 per ADS for Q2, compared to $2.17 per ADS in the year-ago quarter. The consensus revenue estimate is $33.27 billion, which represents a 5.40% year-over-year increase.

Cloud Power

For Alibaba, its cloud business has been a bright spot for quite some time, with AI-enabled products boosting the share of public cloud revenue. While the company has expanded significantly over the years, it remains vulnerable to changes in the Chinese economy, which often experiences fluctuations. Alibaba has come under pressure from increased competition lately, especially in the e-commerce business.

“In TTG’s operational strategy, we attached great importance to rich and diverse product offerings while focusing on investing and enhancing shopping experiences. We continuously improve the efficiency and matching of products with user traffic and ensure stable and sustainable growth. As orders and GMV continue to grow, we are advancing monetization step by step, including the launch of our new marketing tool, Quanzhantui,” said Alibaba’s chief executive officer Eddie Wu while addressing analysts at the Q2 earnings call.

Q1 Results

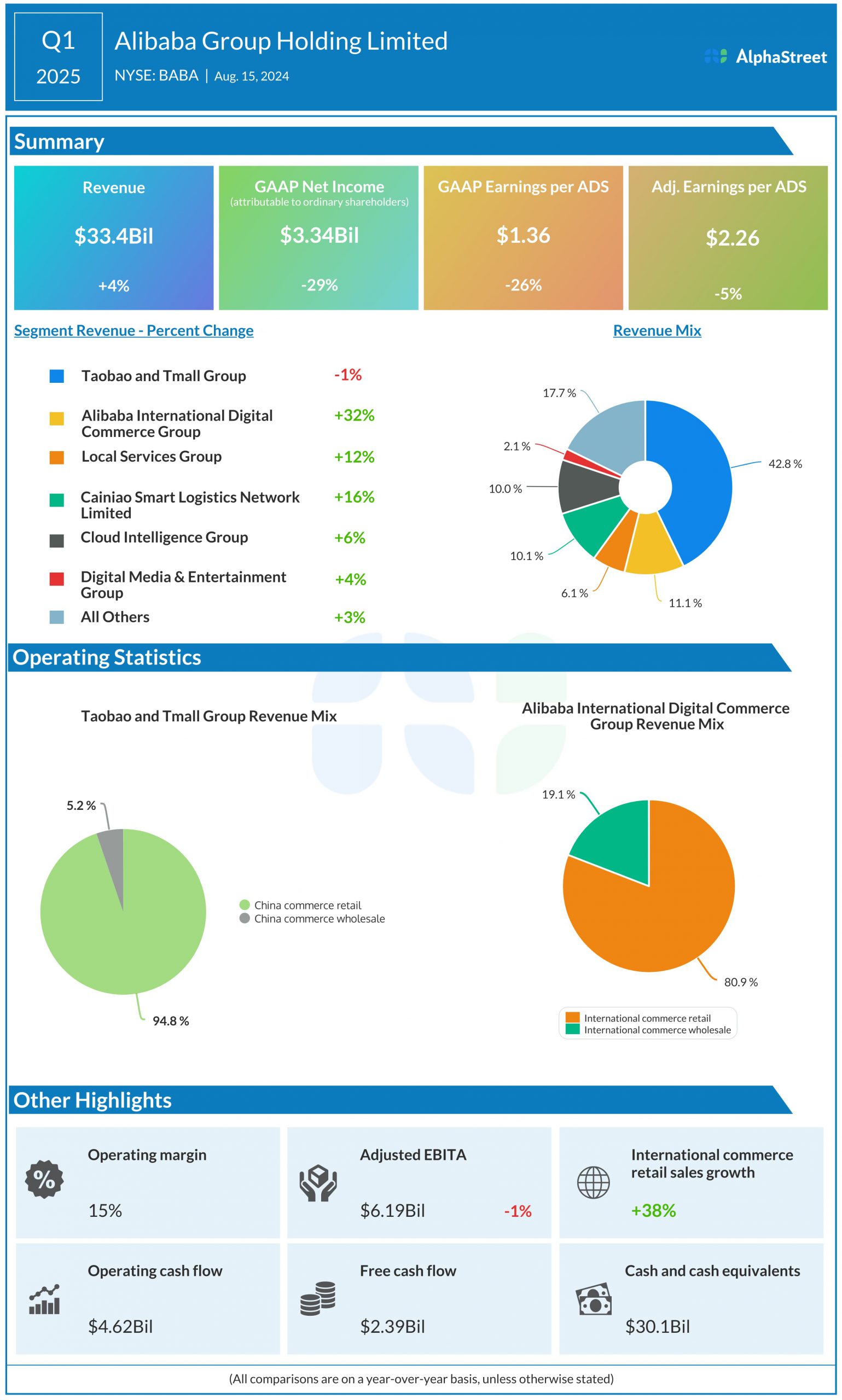

For the first quarter of 2025, Alibaba reported revenues of $33.4 billion, which is up 4% from the prior-year period. Weakness in the core Taobao and Tmall Group was more than offset by higher sales in the other operating segments. Meanwhile, adjusted earnings declined 5% year-over-year to $0.28 per ADS during the three months. Reported profit came in at $3.34 billion or $1.36 per ADS.

Alibaba’s stock gained an impressive 23% so far this year, reversing the downtrend it experienced last year. It traded up 1.5% on Monday morning.