CVS Health shares have been on the recovery path after falling to a seven-year low in mid-2019. However, the stock lost some momentum in recent weeks, after starting 2020 on an impressive note. It has gained 9% since the beginning of the year.

Outlook

If past performance is any indication, investors can expect another earnings beat from the company next week. That would give the stock a much-needed boost in the post-earnings session. While the stock looks an attractive investment option ahead of the announcement, the market will be looking for promising updates on CVS’ acquisitions. Considering the uncertainty spurred by the coronavirus outbreak, shareholders will also be analyzing the new developments in the healthcare sector.

Pharmacy Services, the segment that provides pharmacy benefit management services and accounts for about two-thirds of total revenues, is expected to drive top-line growth this time too, mainly supported by the recent hike in drug prices.

Recovery

After a lull, sales have been improving since the company started thinking beyond brick-and-mortar stores and adopting a technology-driven business model focused on e-commerce, even as customers keep looking for more convenient ways to access healthcare.

Is CVS a Buy?

Analysts overwhelmingly recommend buying CVS Health stock, probably buoyed by the relatively low price and long-term growth prospects. The target price of $87, which represents a 23% upside, justifies the positive rating.

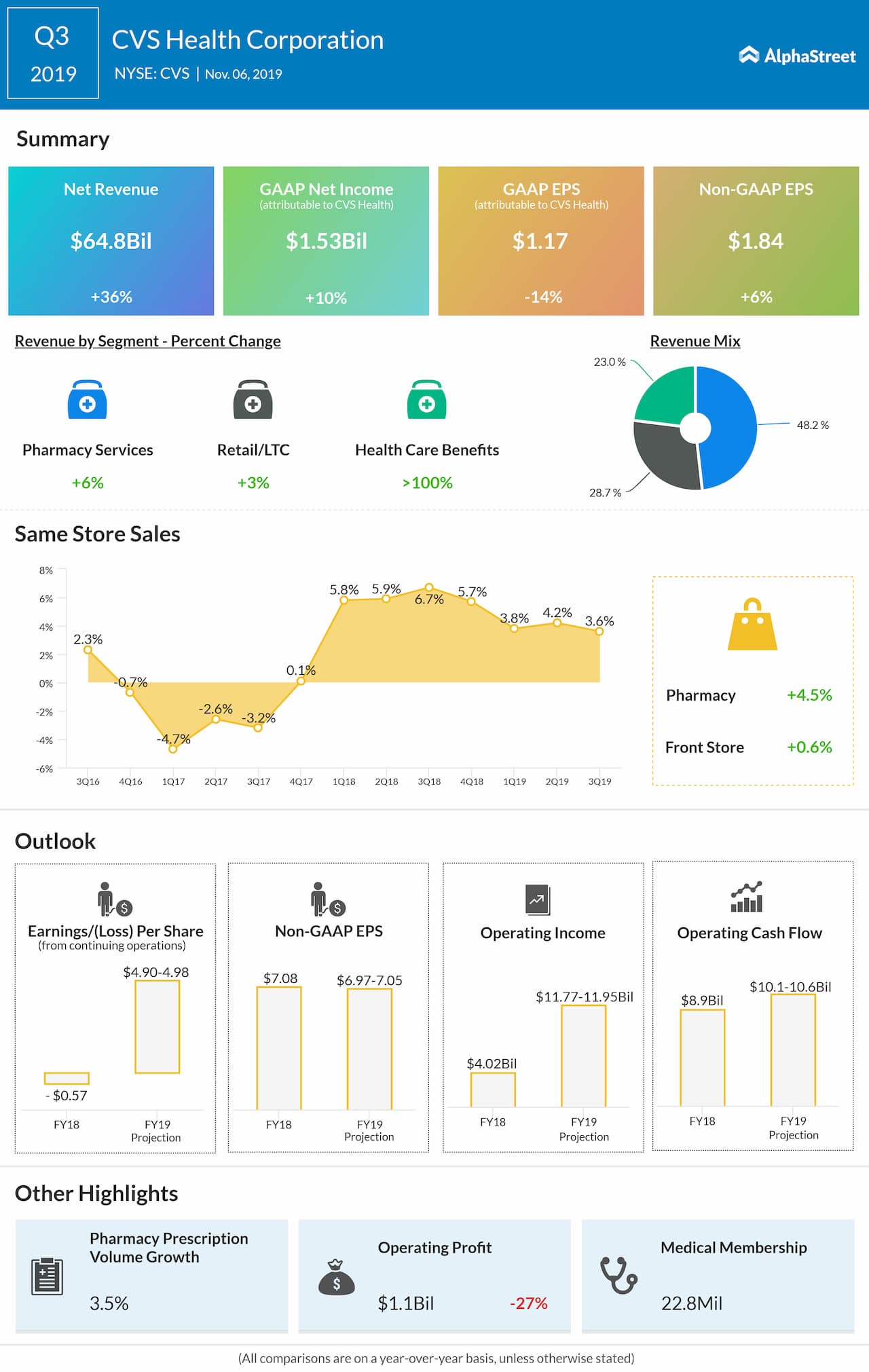

In the third quarter, another strong increase in comparable sales lifted revenues, which grew in double digits to $64.8 billion. Earnings, excluding special items, rose 6% annually to $1.84 per share and exceeded expectations. Encouraged by the positive results, the management revised up its earnings guidance for the full fiscal year.

Fellow drug-retailer Walgreens Boots Alliance Inc. (WBA) had a dismal start to its new fiscal year. A report published by the company last month revealed a 6% drop in first-quarter earnings to $1.37 per share on revenues of $34.3 billion.