The high inflation and weak consumer confidence have pushed some retailers into a crisis at a time when the sector is recovering from the pandemic-induced slowdown, and Best Buy Co., Inc. (NYSE: BBY) is one of the badly affected businesses.

The Minnesota-headquartered consumer electronics retailer is all set to report second-quarter results on August 29. The performance of the company’s stock has not been very encouraging lately, and the weakness persisted ahead of the earnings announcement. On Tuesday, BBY traded slightly below its 52-week average. Over the years, the company has raised its dividend regularly, and the stock is offering a good yield of 4.8% currently.

Market Trend

Though markets have almost returned to the pre-pandemic state, people are cautious in their spending, especially when it comes to purchasing discretionary items. Economic uncertainties and the squeeze on consumers’ spending power might remain a drag on Best Buy’s business in the near term. The management bets on its initiatives to attract customers to the stores and online platform. The share of sales under the buy online – pick in-store mode has stayed above 40% consistently in recent quarters.

From Best Buy’s Q1 2024 earnings call:

“As we look to the rest of the year, we expect the macro environment to continue to pressure demand in our industry this year. However, our guide for the year implies that we expect year-over-year comp performance to improve as we move through the year, and relapse the comparable sales declines we experienced last year. Based on what we can see right now, we continue to believe that calendar 2023 will be the bottom for the decline in tech demand.”

Q2 Report on Tap

Best Buy will be reporting second-quarter results on August 29 before the opening bell. Analysts’ consensus earnings estimate is $1.06 per share, which is well below the $1.54/share profit reported in the year-ago quarter. It is estimated that July-quarter revenues declined around 8% year-over-year to $9.52 billion.

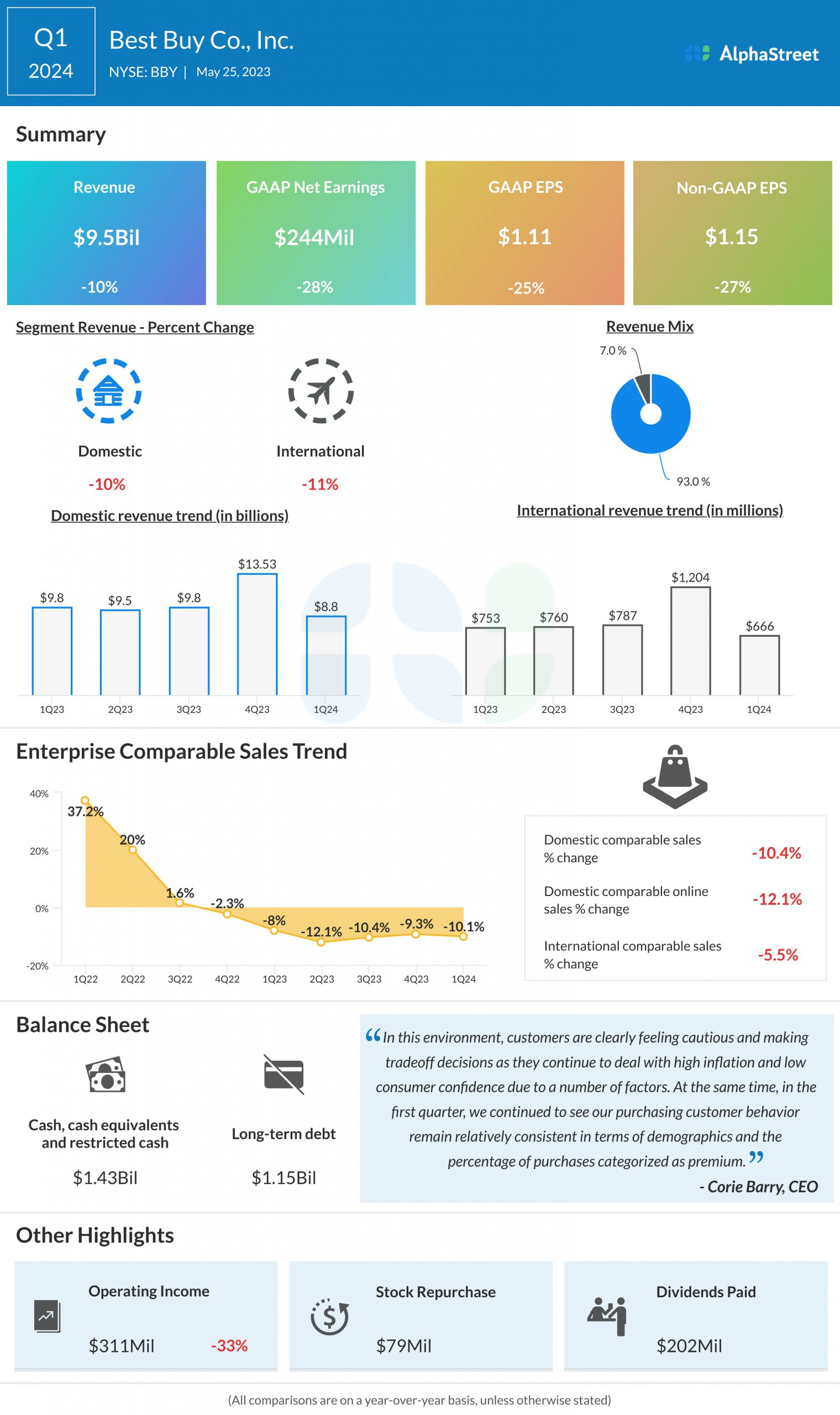

The company has a good track record of delivering results that beat estimates. Earnings topped expectations for the fourth straight quarter. In the first three months of fiscal 2024, however, adjusted profit dropped 27% year-over-year to $1.15 per share. Sales declined in double digits in both the domestic and international markets, resulting in a 10% dip in first-quarter revenues to $9.5 billion. The top line also missed the Street view. There was a 10.1% fall in comparable store sales, with all the segments experiencing weakness.

BBY closed Tuesday’s session sharply lower, after slipping into a two-month low. The stock is down 7% since the beginning of the year.