Healthcare conglomerate UnitedHealth Group (NYSE: UNH) is preparing to publish fourth-quarter results on Friday. Over the years, the company has constantly innovated and diversified its portfolio through acquisitions, which helped it stay relevant in the rapidly changing healthcare landscape.

Though UnitedHealth’s stock pulled back after hitting an all-time high two months ago, it has returned to the growth path. It is estimated that the upswing will continue, and the stock looks poised to reach new highs in the coming weeks. Analysts’ positive estimates for the upcoming earnings adds to the optimism surrounding the stock.

Buy UNH?

The shares have gained an impressive 15% in the past six months. UNH currently has a dividend yield of 1.4% which is broadly in line with the S&P 500 average. Over the years, the company has grown its dividend constantly, eliciting significant interest among those looking for retirement income. The stock has the potential to reward investors handsomely in the long term.

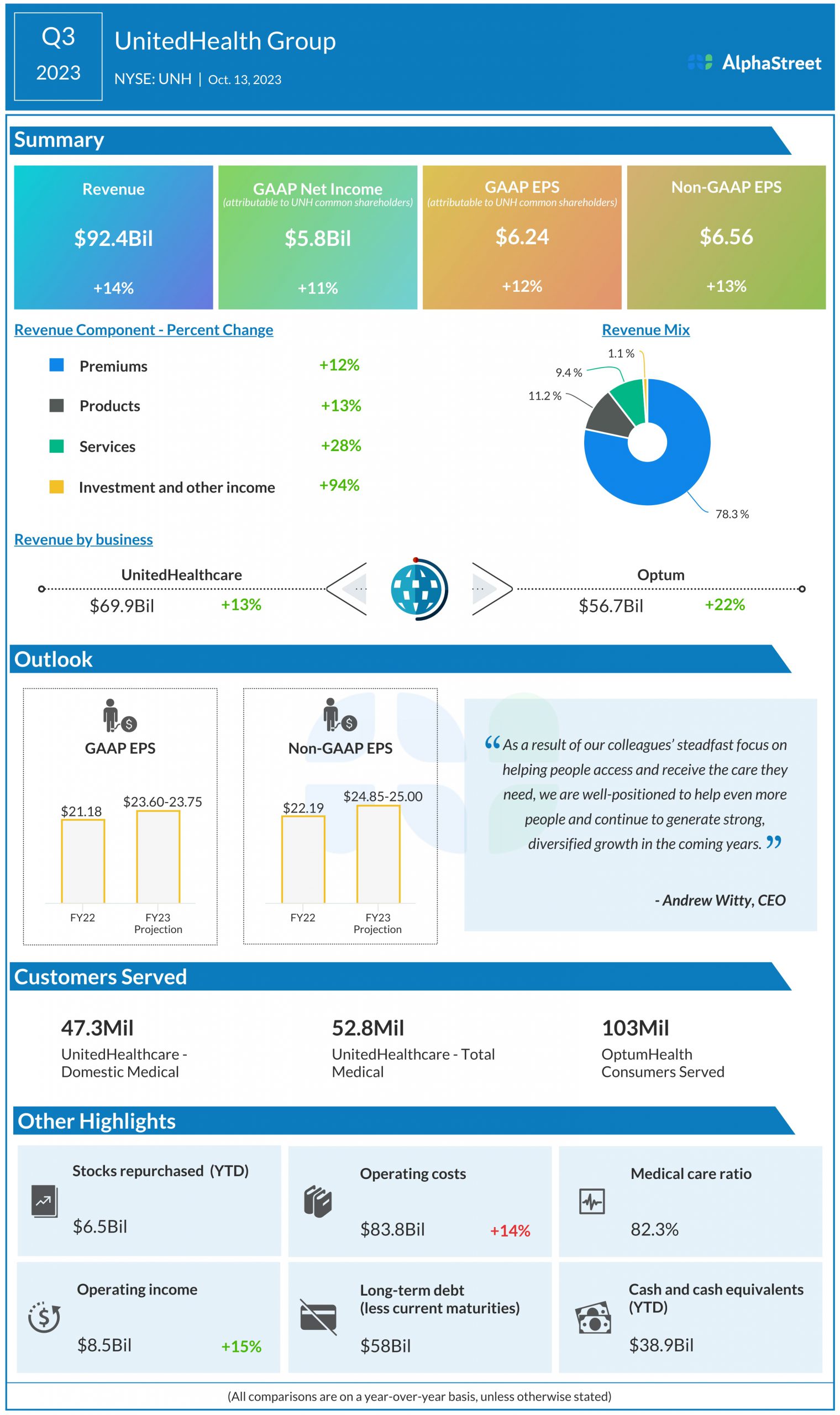

It is estimated that the company served 900,000 additional patients last year under value-based care arrangements at Optum Health and nearly one million new consumers across UnitedHealthcare’s Medicare Advantage offerings. Encouraged by the stable customer growth, the management recently raised its full-year earnings per share guidance to $24.85-$25.00.

Value-based Care

UnitedHealth’s long-term strategy of delivering value-based care, which promises high-quality clinical outcomes at lower costs, will continue to increase patient engagement. Of late, the company has been making significant investments to boost its capabilities in providing superior care at affordable costs. Optum, the healthcare services arm that includes the OptumRx, Optum Health, and Optum Insight businesses, witnessed exceptionally strong growth in fiscal 2023.

“We continue to expand the reach of our community pharmacies and our diverse specialty and infusion offerings are growing double digits. Driving this expanding market demand is the enormous pressure facing employers, health plans, governments, and others to manage and respond to manufacturer list pricing. The services offered by Optum Rx and others are the only counterbalance to drug company pricing,” said UnitedHealth’s CEO Andrew Witty at the Q3 earnings call.

When the health insurance provider reports fourth-quarter results on January 12, before the opening bell, the market will be looking for adjusted earnings of $5.98 per share, vs. $5.34 per share it earned in the corresponding period of fiscal 2022. The positive outlook reflects an estimated 11% annual growth in Q4 revenues to $92.14 billion.

Promising Data

In a rare feat, the company has consistently delivered bigger-than-expected, or in-line, quarterly earnings for more than a decade. In the fourth quarter, the core Premiums business expanded 12%, driving up total revenues to $92.4 billion which is above consensus estimates. Revenues of the other main operating segments – Products and Services – also grew in double digits. As a result, adjusted earnings rose 13% from last year to $6.56 per share in Q3.

After making steady gains in recent weeks, UnitedHealth’s stock is experiencing some weakness ahead of the earnings. It traded almost flat for most of Tuesday’s session.