Revenue

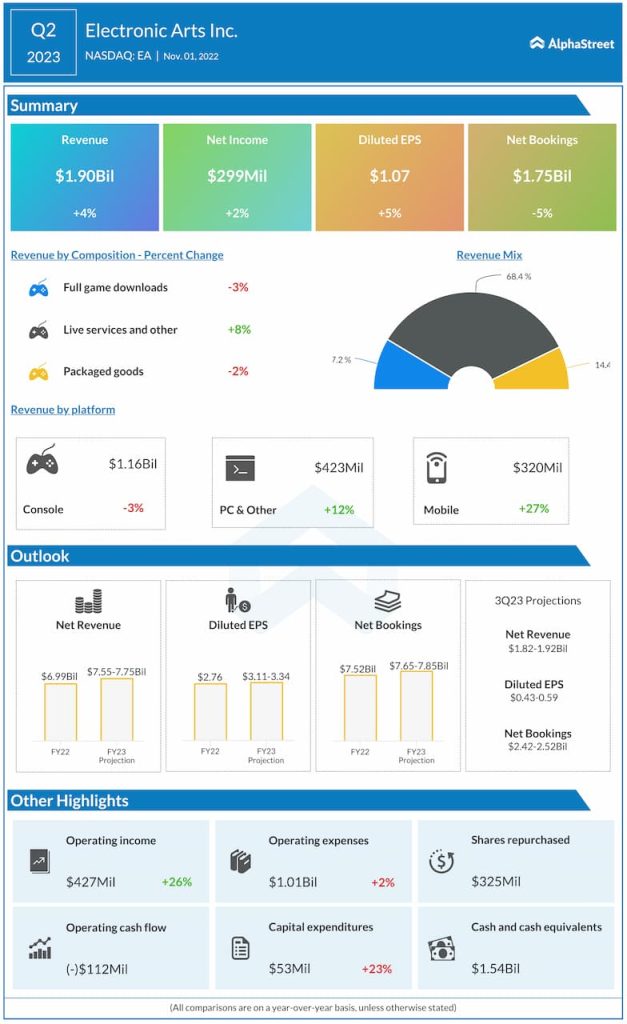

Live services and other revenue rose 8% during the quarter while revenue from packaged goods and full game downloads declined 2% and 3% respectively. For the third quarter of 2023, Electronic Arts expects revenues to range between $1.82-1.92 billion and for the full year of 2023, revenues are estimated to be $7.55-7.75 billion.

Profits

In Q2, EA’s net income increased 2% to $299 million while EPS rose 5% to $1.07. For the third quarter of 2023, the company expects net income to range between $120-164 million and EPS to be $0.43-0.59. For the full year of 2023, net income is estimated to be $871-934 million and EPS is projected to be $3.11-3.34.

Net bookings

Net bookings in Q2 2023 were $1.75 billion, down 5% from last year but in line with the company’s expectations. The main driver of net bookings during the quarter was the EA SPORTS portfolio. FIFA net bookings grew 6% in constant currency with a rise in engagement across all platforms. Live services net bookings were down 3% YoY due to the timing of the FIFA launch.

For Q3 2023, EA expects net bookings to be $2.42-2.52 billion, driven by its annualized franchises as well as the launch of Need for Speed Unbound in December. For FY2023, the company revised its net bookings guidance due to the persistent FX rate environment.

EA generates over half of its sales outside the US and with the strengthening of the US dollar, the company expects an FX impact of approx. $200 million to its bookings. This impact is expected to grow in the second half and into FY2024. Therefore the company now expects net bookings for the year to range between $7.65-7.85 billion, up 2-4% YoY.

Expenses

Total operating expenses rose 2% YoY to $1.01 billion in Q2 2023. For Q3 2023, operating expenses are expected to be $1.08-1.09 billion and for FY2023, operating expenses are expected to be $4.24-4.29 billion.

Click here to read the full transcript of Electronic Arts’ Q2 2023 earnings conference call