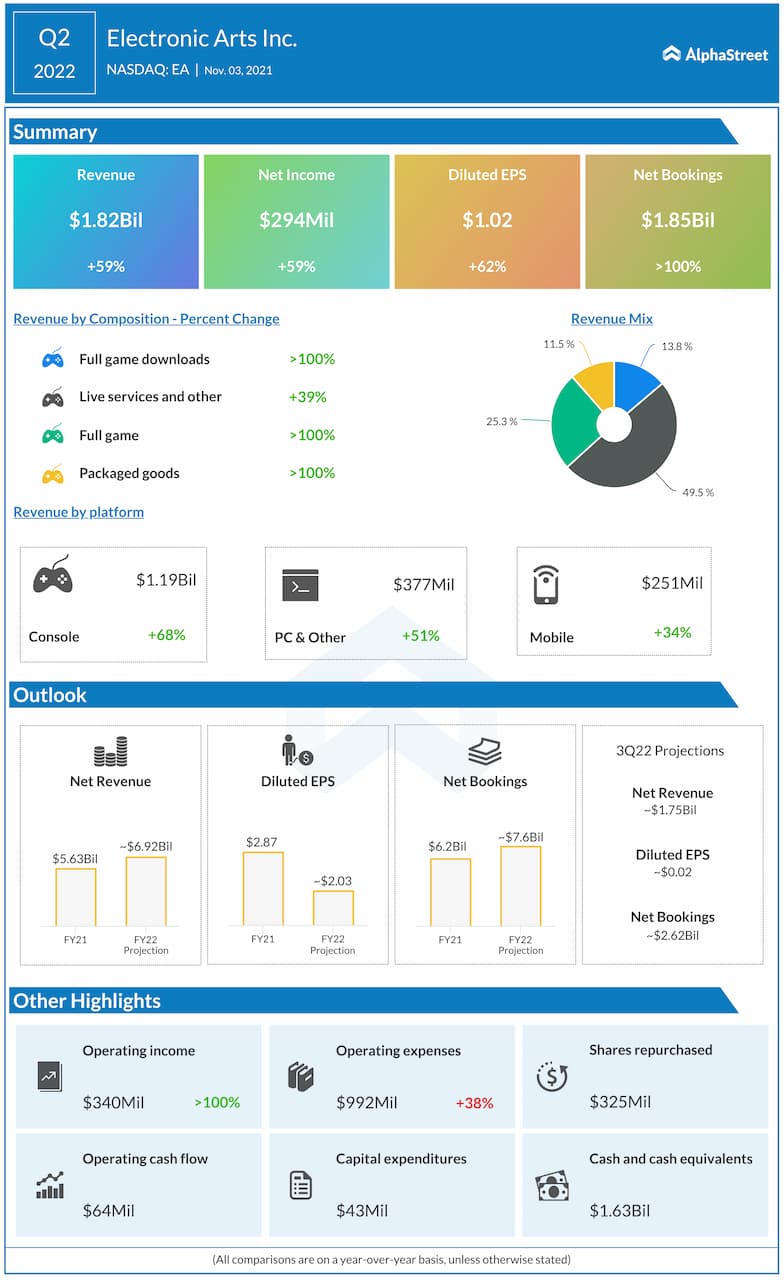

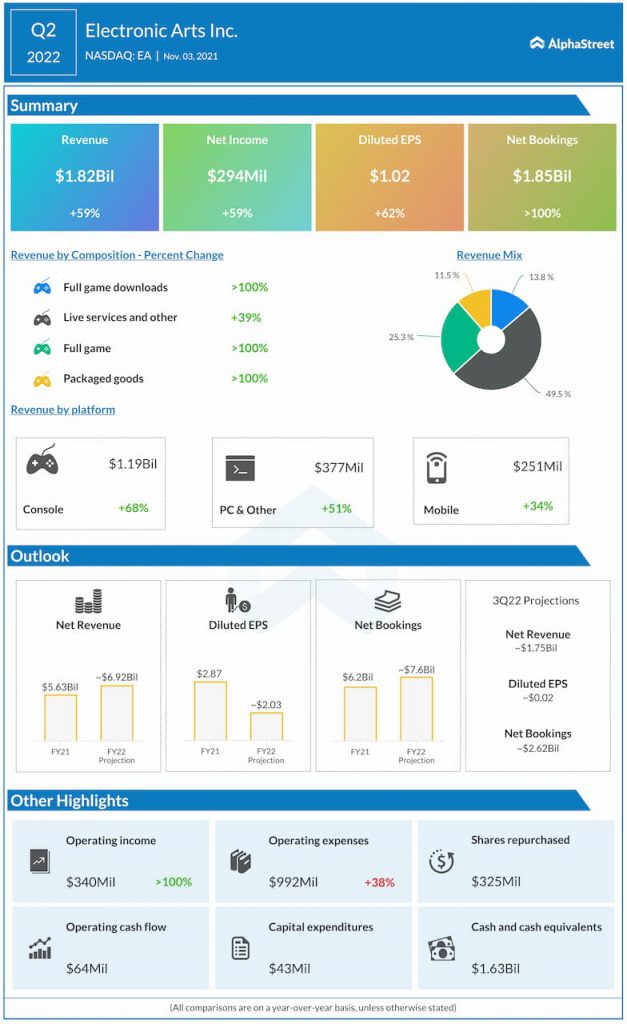

Shares of Electronic Arts Inc. (NASDAQ: EA) were up 2% on Thursday, a day after the company delivered strong results for the second quarter of 2022. Total revenue grew 59% year-over-year to $1.82 billion while earnings rose 62% to $1.02 per share, beating expectations. Net bookings more than doubled from last year amounting to $1.85 billion.

These numbers came above EA’s own guidance and gave the company confidence to raise its guidance for the full year. EA anticipates a strong holiday season based on the momentum it is seeing across its portfolio of games and live services.

For the third quarter of 2022, EA expects net revenue of approx. $1.75 billion, EPS of approx. $0.02, and net bookings of approx. $2.62 billion. For the full year, the company estimates revenue to be approx. $6.92 billion, EPS to be approx. $2.03, and net bookings to be approx. $7.62 billion.

EA is focused on creating games and content that will drive user growth and engagement. As part of these efforts, the company is working on three key areas that will help drive growth this year:

Blockbuster franchises

The first area of focus is the expansion of its blockbuster franchises. EA continues to see strong performance from its leading franchises such as Apex Legends and Battlefield. In Q2, Apex Legends net bookings grew over 150% year-on-year. The title has yielded over $1.6 billion in net bookings life to date and has already surpassed the company’s expectations for the year.

Apex Legends has more than 100 million players and the company witnessed the highest level of in-game spending to date in this title during the second quarter. It was one of the most-watched titles on Twitch in Q2 with over 130 million hours of Season 10 content watched to date, up nearly 40% from the previous season. EA plans to bring Apex Legends to mobile later this year.

Battlefield also enjoys immense popularity. On its quarterly conference call, EA said 7.7 million players participated in the Battlefield 2042 Open Beta in October, including 3.1 million during the early access period. The company continues to add new features and experiences to drive engagement for these titles.

Sports

EA is solidifying its position in sports through new games and acquisitions. Its global football franchise had approx. 100 million players across all platforms in the first half of the year. Total players for EA SPORTS FIFA 22 were up 16% and new to franchise players were up around 50% YoY from launch. Net bookings were also up significantly from launch.

The company is seeing growth across the game with FIFA Ultimate Team engagement up 15% YoY. EA is working on bringing new features and modes to FIFA Mobile later this year. It is also seeing higher engagement in Madden NFL 22. The company’s portfolio that spans football, basketball, hockey, and baseball among others gives it ample opportunity to drive engagement and growth.

Live services

The third area is expanding live services across the company’s portfolio, mainly in mobile. In Q2, Star Wars Galaxy of Heroes surpassed 100 million players life to date. During the quarter, the company closed the acquisition of Playdemic, which brings the Golf Clash mobile game to its umbrella. The company is focused on driving growth through these new additions. EA expects live services to deliver approx. 70% of net bookings across 25 games in FY2022.