As the proliferation of smartphones continues, users are constantly looking for ways to make their mobile experience unique. Zedge, Inc. (NYSE: ZDGE) has carved a niche for itself as a one-stop shop for all mobile personalization solutions. The New York-based company has expanded its subscriber base consistently in recent years.

In an exclusive interview with AlphaStreet, Zedge’s chief executive officer Jonathan Reich provided valuable insights into the various aspects of the business.

Did the pandemic affect the business of Zedge in any way, and how do you look at the future of smartphone personalization?

Initially, Covid-19 negatively impacted the business as pricing in the advertising market collapsed due to advertising budget cuts in response to the ‘shelter in place’ orders. As such, we promptly instituted a hiring freeze and cut back on discretionary spending. In addition, from an operational perspective, we successfully undertook a ‘remote first’ work environment. We made the necessary investments to ensure that we had the tools to enhance communications and manage our workflow efficiently since our team wasn’t sitting together in the office.

Over time, the market started to recover. We benefitted from increased mobile usage, continued work in optimizing our ad stack, and the investment we made in streamlining operations resulting in improved top and bottom-line growth.

We look at the future of smartphone personalization with conviction due to the dramatic growth in both the creator economy and NFTs. Zedge Premium, our marketplace, lends itself to benefit from the proliferation of platforms and tools that democratize the creator economy, while NFTs open the door for new product and revenue possibilities. Finally, as the metaverse moves from concept to reality, we believe Zedge will be well-positioned to continue enabling users to express their personality in virtual worlds, just as they do on their devices today.

Also read: ZeroFox CEO James Foster: IDX deal will be incrementally valuable to company, clients

Zedge has grown far beyond ringtones and wallpapers. Please tell us about your growth plans in terms of new offerings.

In August, we acquired Emojipedia, the source of all things emoji. This acquisition was accretive from the outset and added approximately 8 million MAU to our business, not to mention a leading, well-respected and coveted brand name. Emojipedia is currently only available in English, and we plan on localizing it to support additional languages. Furthermore, we are currently redesigning the website and researching how to evolve the service into the world of native mobile apps.

The Shortz beta was our first entry into the entertainment space. Shortz is an entertainment app for short-form fictional stories, consumed through a text-like interface or podcast format. What we’ve done here is invested in analytics to unlock the best customer/product fit. This enables us to be smarter with our investment in Shortz by having better demographic data to target user groups and having better information on what content will resonate with different users. In addition, we believe the market is viable, as two more established players in the same space were recently acquired for several hundred million dollars each.

We also have several new products initiatives in development, and we anticipate releasing ’Proof of Concepts’ during this calendar year, so keep an eye out for these. Finally, we are always on the lookout for complimentary M&A, which could also provide us with new offerings.

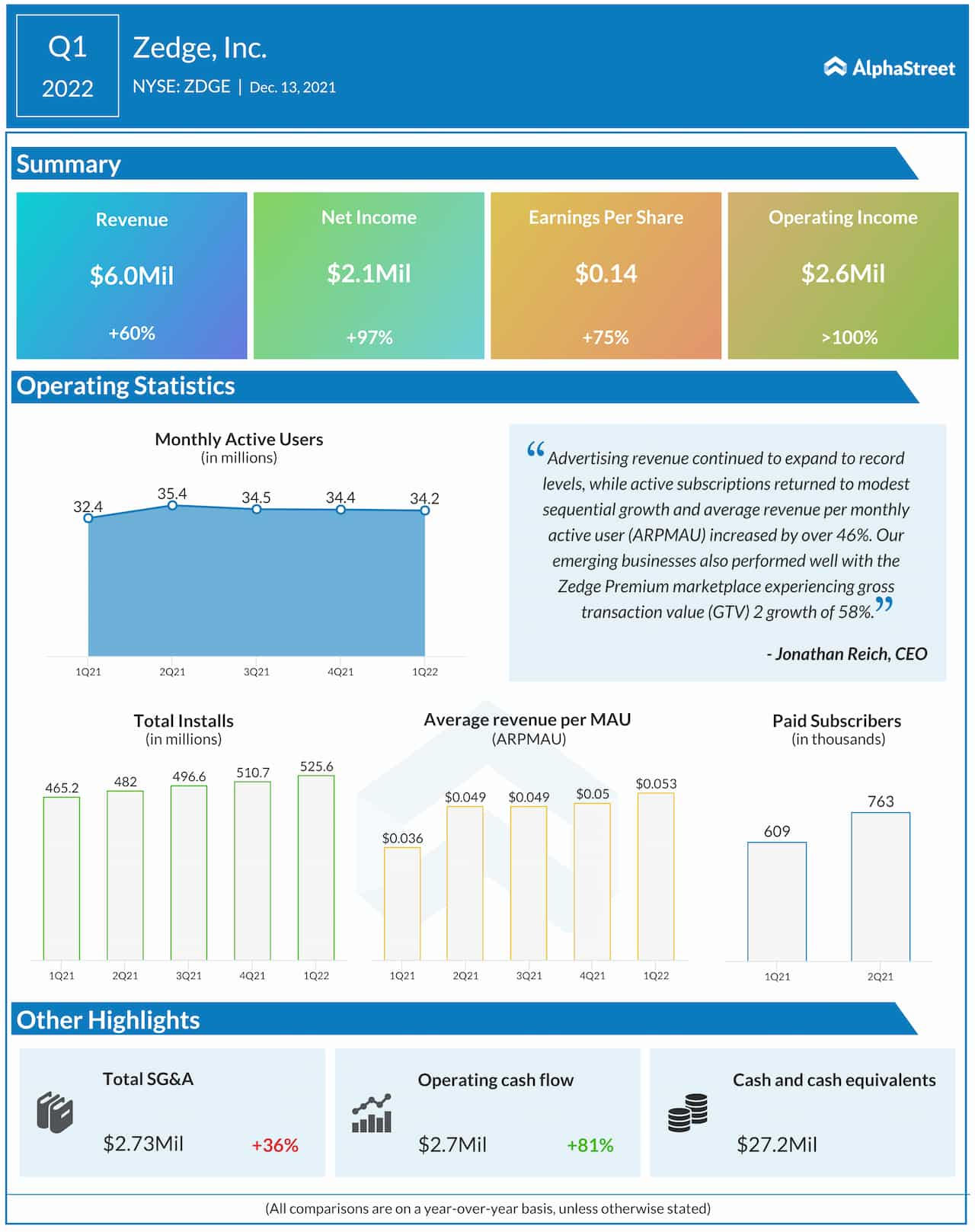

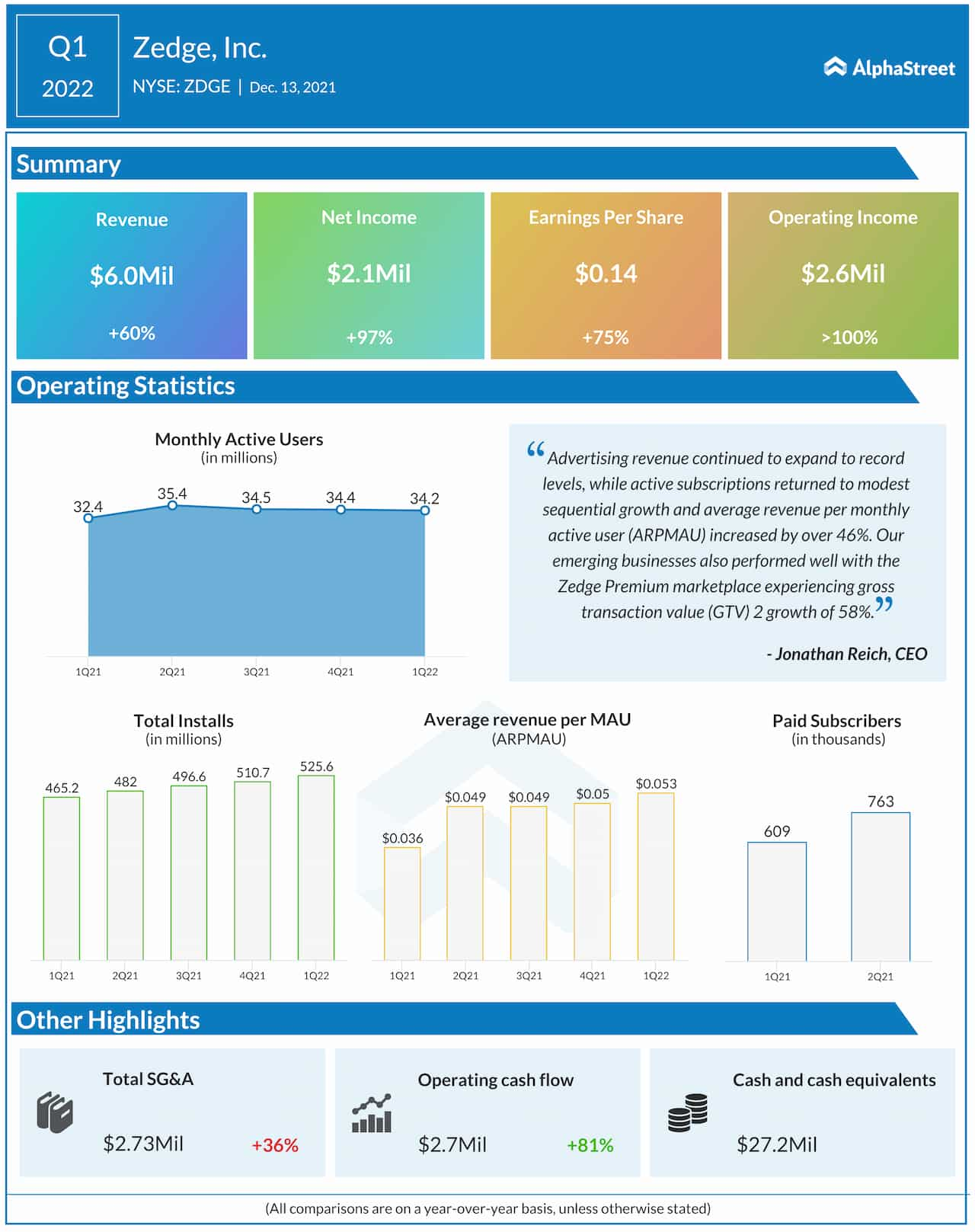

How do you expect to achieve the revenue growth target of 25-30% this year; do you see any specific growth driver?

We expect growth during fiscal 2022 to come from a couple of areas. The largest is better monetization of our 43 million MAU. We are constantly optimizing our ad stack to increase our premium CPMs, and as we add more users, this will continue to grow. Additionally, we are in the process of turning the Zedge app into a more social and community-friendly offering and have been rolling out these features since later last year. We believe this will help boost MAU growth, especially in well-developed markets, where our user base has not been growing. We have also been investing in paid user acquisition and will continue to optimize this investment provided we generate a positive return on investment. As previously mentioned, Zedge Premium is a focus area for us due to the explosive growth in the creator economy and the potential offered with NFTs. We are also exploring ways to enhance our Zedge+ subscription offering. Finally, the addition of Emojipedia will also contribute to this growth.

Also read: Biofrontera sees TAM of $4 Bln for lead product Ameluz: CEO Erica Monaco

To what extent would recent initiatives like the acquisition of Emojipedia and the rollout of NFT offering help in improving overall monetization?

One of the things that attracted us to Emojipedia was its status as a premium and accretive asset with lots more runway to grow. As mentioned earlier, we are in the process of redesigning the user experience as well as rolling out multi-language support. In addition, we are exploring how we can introduce a native mobile app offering.

Our ‘NFTs Made Easy’ product was founded on the idea of providing a valuable and straightforward utility that benefits the myriad of creators that have little or no crypto experience while enabling end-users to purchase the content using in-app purchases. We also made it eco-friendly with no gas fees to the creator. For now, we’ve limited the rollout to a select group of artists, solely focusing on video wallpapers. Later this year, we will expand into other content types and introduce table stake features like limited editions, drop dates and auctions, and trading. We are extremely excited about this potentially disruptive product and look forward to seeing how it grows.

What is the management’s strategy for meeting future capital requirements since you keep investing in the business and pursue M&A deals to drive growth?

We have around $30 million on the balance sheet and virtually no debt. We also expect to generate around $10 million in cash this year, so we don’t have a great need for capital. That said, if we happen to find the right acquisition and it provides an opportunity to take Zedge to the next level of growth, it is possible we would need to raise cash.