Online travel agency Expedia Group, Inc. (NASDAQ: EXPE) is preparing to publish its fourth-quarter results, weeks after chairman Barry Diller ousted CEO Mark Okerstrom and took charge of the company. The results will be released on Thursday at 4:00 pm ET.

Market watchers see a 4% decrease in fourth-quarter earnings to $1.19 per share on revenues of $2.76 billion, which represents an 8% annual growth.

It is estimated that the main business segments, Core OTA and Vrbo, maintained their strong momentum in the December-quarter, supported by the steady expansion of the lodging portfolio. The travel portal has been constantly updating its offerings and taking steps to enhance customer experience.

Outlook

Vrbo, the accommodation listing segment that is a key growth driver, has constantly witnessed new property additions and the trend is estimated to have continued in the to-be-reported quarter. Meanwhile, the struggling Trivago business might record another decline in revenues, restricting the overall top-line growth.

Related: MakeMyTrip Q3 2020 Earnings Snapshot

ADVERTISEMENT

The estimated decline in earnings primarily reflects the uptick in operating costs, including those related to promotional activities and payment processing. Also, unfavorable foreign exchange rates will likely weigh on the bottom-line.

Q3 Outcome

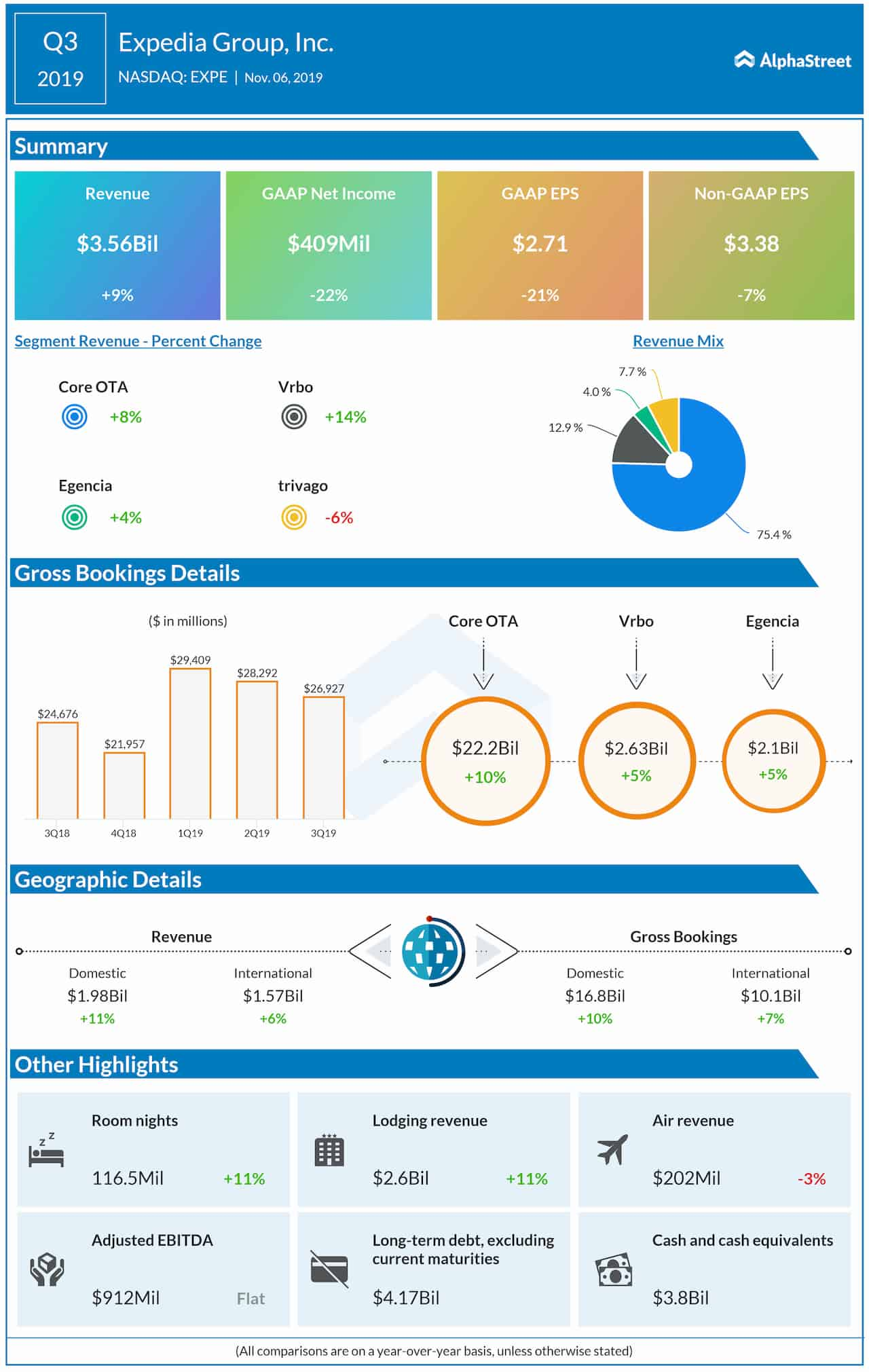

In the third quarter, earnings dropped 7% annually to $3.38 per share on revenues of $3.56 billion, which is up 9% year-over-year. All the key business segments registered growth, reflecting the solid increase in gross bookings.

Competition

Among others, TripAdvisor (TRIP) will be publishing its fourth-quarter results Wednesday after the closing bell, with analysts predicting a modest increase in earnings despite a 3% decline in revenues.

Also see: Expedia Q3 2019 Earnings Conference Call Transcript

Expedia shares are yet to recover from the massive loss suffered in the post-earnings selloff a few months ago. The stock stabilized towards the end of 2019 and continued the trend this year. It has lost around 14% in the past twelve months.