Shares of Facebook Inc. (NASDAQ: FB) were up 7% on Thursday, rallying on the back of a strong quarterly earnings announcement that smashed market expectations. The stock has gained 20% since the start of this year. Here are the high and low points from the social media giant’s first quarter 2021 earnings report:

Top and bottom line growth

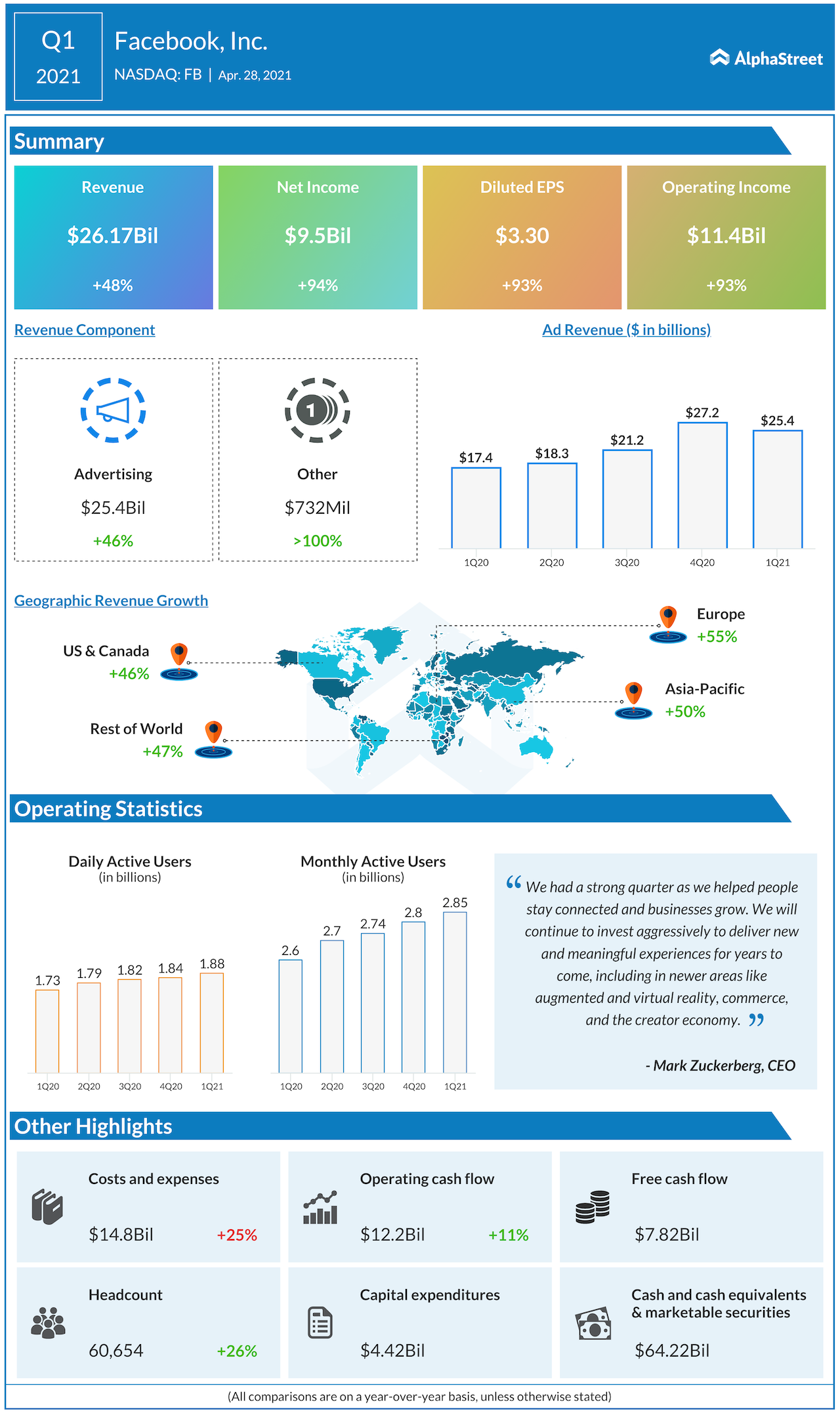

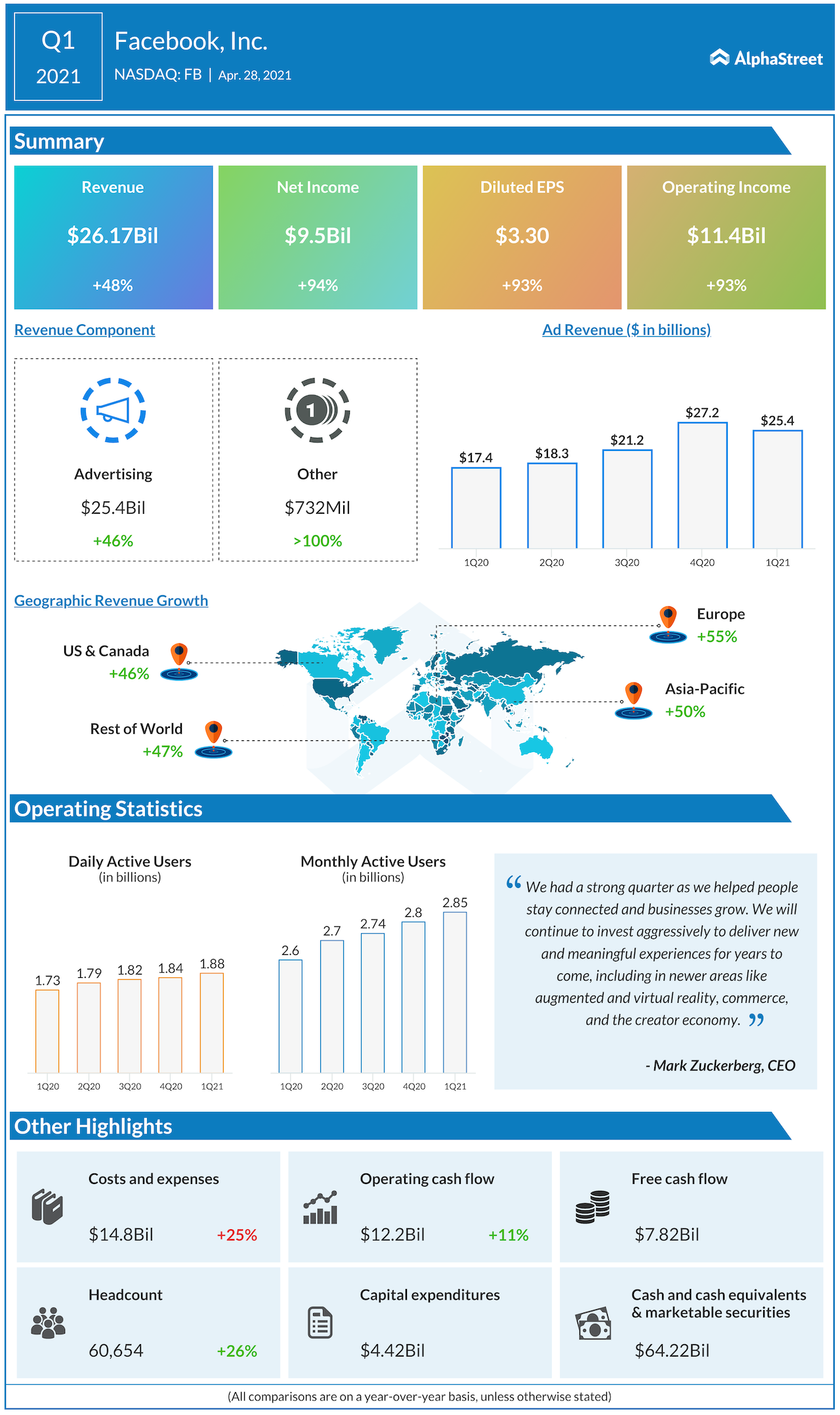

In Q1, Facebook’s total revenues grew 48% year-over-year to $26.1 billion while profits jumped 93% to $3.30 per share. Both numbers came in way ahead of analysts’ projections.

User growth

Despite all the controversies surrounding it, Facebook’s user base has continued to grow steadily over the years. Daily active users (DAUs) on the platform grew 8% to 1.88 billion in Q1 while monthly active users (MAUs) rose 10% to 2.85 billion. On its quarterly conference call, Facebook stated that more than 2.7 billion people now use one or more of its apps each day and more than 200 million businesses use its tools to reach customers.

During the COVID-19 pandemic, Facebook witnessed a spike in engagement levels not just from people looking to stay connected with dear ones or for entertainment but also from scores of small businesses that moved their operations online after they had to close their stores. This growth in ecommerce has also driven higher engagement for Facebook. More than 1 billion people visit Marketplace every month.

Advertising

In Q1, Facebook’s advertising revenue rose 46% YoY to $25.4 billion, helped by a 30% increase in the average price per ad and a 12% increase in the number of ads delivered. The company saw a spike in ad revenue across all its regions with the highest growth of 53% coming from Europe. It also witnessed particular strength from small and medium-sized advertisers.

The strength in advertising was driven significantly by ecommerce and the company continues to invest in tools that help businesses improve their online store presence. Last year, Facebook launched Shops and now there are over 1 million monthly active Shops and over 250 million monthly Shops visitors. For the remainder of 2021, advertising revenue growth is expected to be driven mainly by price.

Slowdown in revenue growth

For the second quarter of 2021, Facebook expects its total revenue growth to remain stable or increase slightly compared to the first quarter as the company laps the slow growth seen during last year’s second quarter caused by the pandemic. In the second half of 2021, revenue growth rates are expected to slow down more rapidly as they lap periods of strong growth last year.

Regulatory concerns

Facebook expects to face challenges in 2021 from changes in the regulatory environment, particularly in Europe with regards to transatlantic data transfers. This is expected to have an impact on the company’s advertising business. Facebook also anticipates challenges from Apple’s (NASDAQ: AAPL) new iOS 14.5 update. These are expected to weigh on its Q2 results.

Click here to read the full transcript of Facebook’s Q1 2021 earnings conference call