Valuation

Despite its gradual withdrawal from the 2021 peak, the stock looks almost fully valued. Together with the weak earnings estimates, the current valuation calls for caution. The market will be closely following this week’s earnings, looking for cues on where the company is headed. So, it would be a good idea to hold buying/selling decisions until that.

FedEx Corporation Q2 2023 Earnings Call Transcript

The economic and geopolitical backdrop is not favorable for FedEx – the Russia-Ukraine war continues to disrupt freight movement in that region while muted demand weighs on volumes in Asia, prompting the management to reduce capacity. Meanwhile, the recent improvement in yield is a bright spot as the trend is expected to continue. Earlier, the company had raised package delivery rates to revive margins.

Cost Reduction

Falling sales and softening profits made the company extend the cost-cutting drive it had initiated last year. The measures include capacity reduction and closure of certain offices, mainly focused on the Express division that is badly affected by the market headwinds. When the company releases third-quarter results on Thursday, after the official trading hours, the market will be looking for a sharp fall in adjusted earnings to $2.71 per share. The projection reflects an estimated 3.6% drop in revenues to $22.79 billion.

From FedEx’s Q2 2023 earnings call:

“As we look toward the back half, service improvement has translated into good momentum for our sales team. In addition, we have a robust pipeline aligned with our strategy, which includes small and medium, and European segment targets. In Q4, we will be lapping the impact of the beginning of the war in Ukraine as well as the air integration disruption we experienced in the region. As a result, our year-over-year volume comps will improve as we move through the back half of this fiscal year.”

Financials

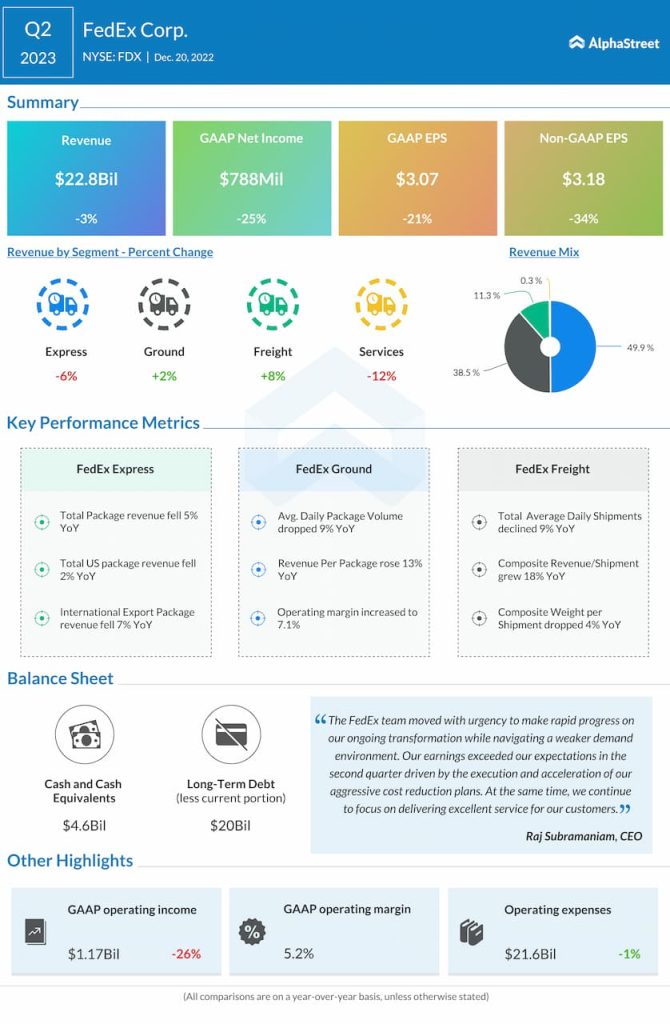

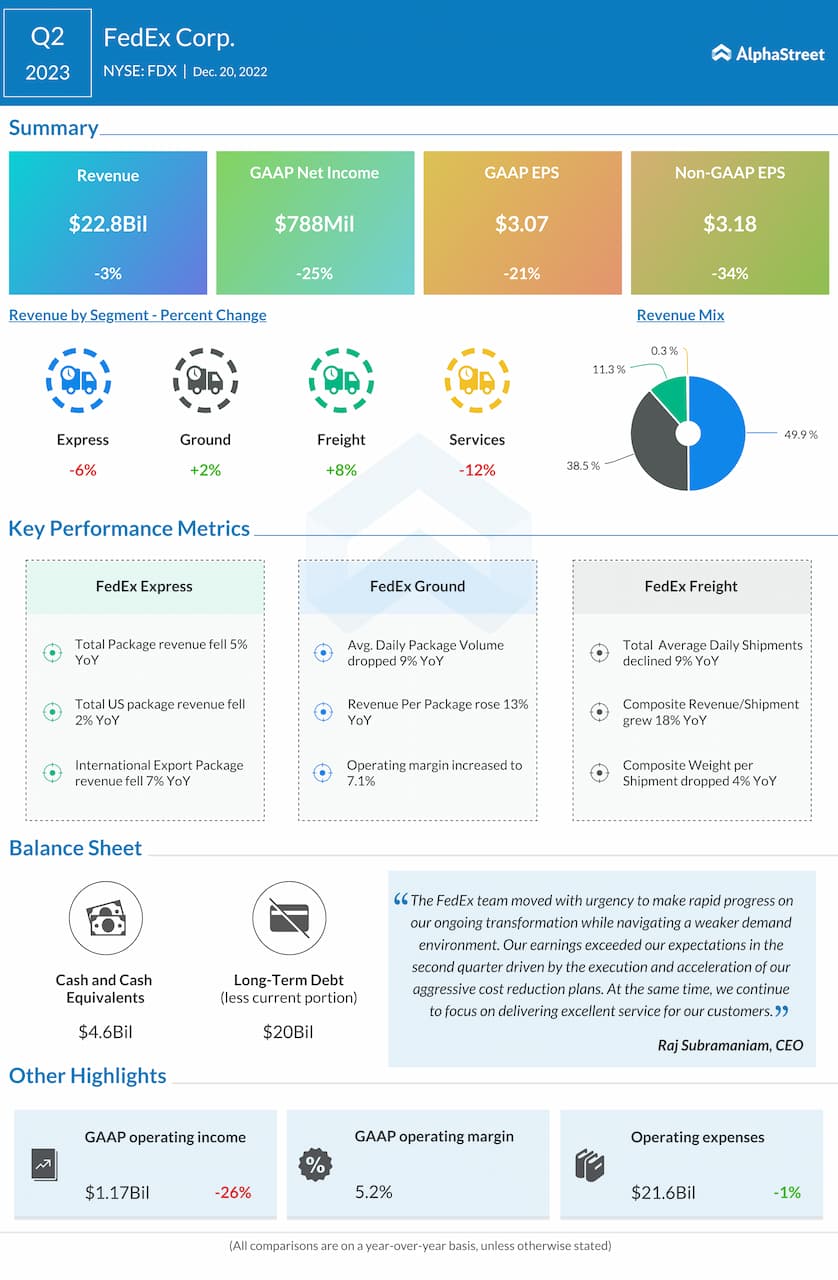

The company ended the first half of fiscal 2023 on a positive note, reporting bigger-than-expected earnings for the second quarter, which marked the second beat in a row after two consecutive misses. Net profit, adjusted for special items, plunged 34% year-over-year to $3.18 per share. At $22.8 billion, second-quarter revenues were down 3%. A contraction in the core Express segment was more than offset by growth in the Ground and Freight divisions.

UPS Q4 2022 Earnings: Key financials and quarterly highlights

FedEx’s shares declined on Monday and traded below $200 during the session, extending the recent weakness. It lost about 6% in the past thirty days alone.