Dividend Hike

Experts are bullish on HAL’s future prospects and see the value increasing by a fifth in the next twelve months. Earlier this year, the company hiked its dividend by 33%. Going forward, the healthy cash flows should allow it to continue returning cash to shareholders. Moreover, the energy giant’s long-term fundamentals are pretty strong and it is investing aggressively in the business, generating handsome returns that translate into earnings growth.

Encouraged by the uptick in oil and gas prices, energy producers who constitute most of Halliburton’s clientele are raising their capital spending, which bodes well for the company. The growing need for drilling capacity — after a period of low activity as producers slashed capital spending due to pandemic-related uncertainties and low oil prices in recent years — is driving demand for Halliburton’s equipment and services.

Q2 Report Due

Halliburton’s second-quarter report is slated for release on July 19, before the opening bell. It is estimated that June-quarter profit rose sharply to $0.75 per share from $0.49 per share in the prior-year period. Market watchers are looking for a 16% increase in revenues to $5.86 billion.

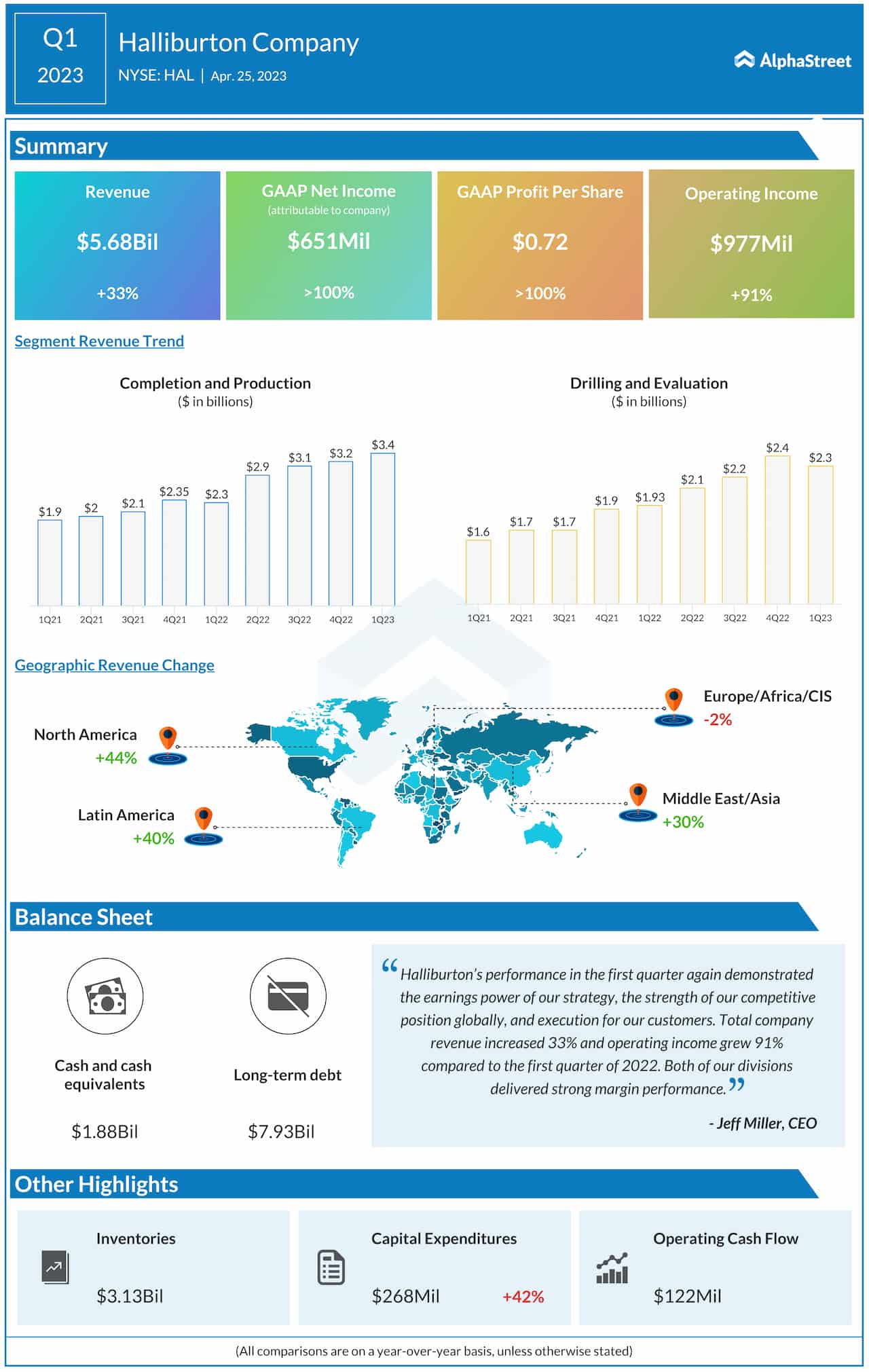

Commenting on the company’s performance in the overseas market, Halliburton’s CEO Jeff Miller said at the last earnings call, “Halliburton executed its strategy to deliver profitable international growth through leading technology offerings, improved pricing, and disciplined capital allocation. I expect international spending to grow high teens for the year 2023, with most new activity coming from the Middle East, Asia, and Latin America. I am confident in this outlook because we have a strong pipeline of awards, that will commence later this year and beyond. Our completion tool order book grew 40% year-on-year in the first quarter, which generally represents work delivered within the current year.”

Solid Results

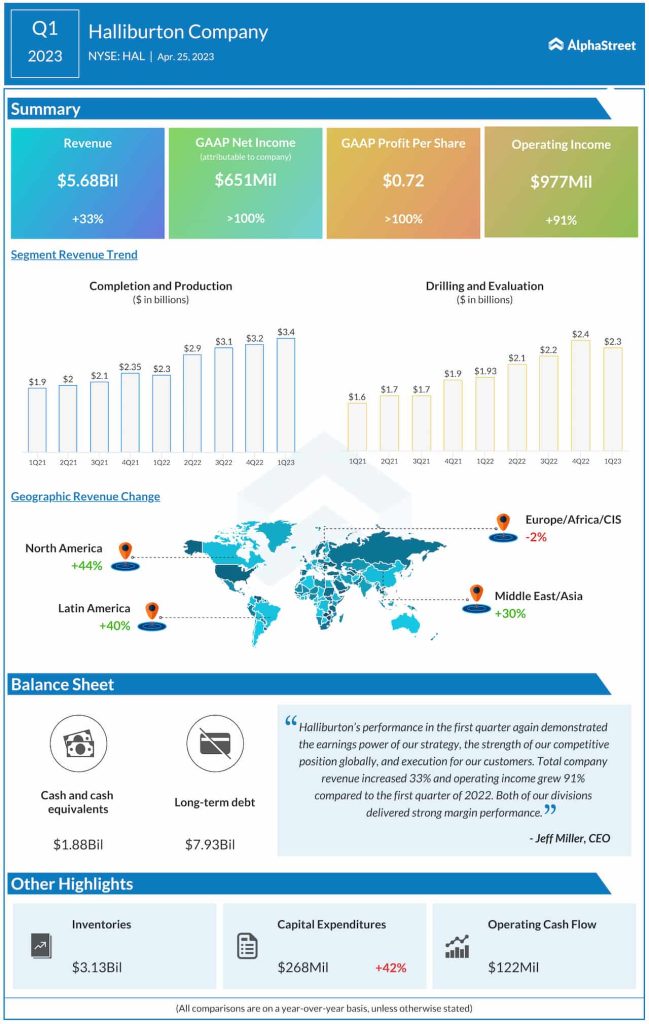

In the past decade, the company’s quarterly earnings did not miss estimates not even once. In the March quarter, net profit more than doubled to $651 million or $0.72 per share. Driving the bottom-line growth, revenues jumped 33% annually to $5.68 billion and topped expectations. Completion and Production revenue, which accounts for more than 60% of the total, grew at an accelerated pace, continuing the recent trend. There was double-digit growth in the key geographical segments except for Europe/Africa/CIS.

HAL started Tuesday’s session on a high note and traded up 3% in the early hours. In the past twelve months, the stock has gained an impressive 33%.