These changing trends have led to several retailers reconsidering their store strategies as they think about trimming their store fleet and moving those resources into digital channels to take advantage of the growing demand for online shopping. Apparel companies have also witnessed a shift in trends with regards to their assortment with some categories seeing more demand than others.

Assortment

As more people stayed indoors and moved to working from home during the pandemic, apparel companies saw higher demand for categories such as casualwear while others like dresses saw demand drop.

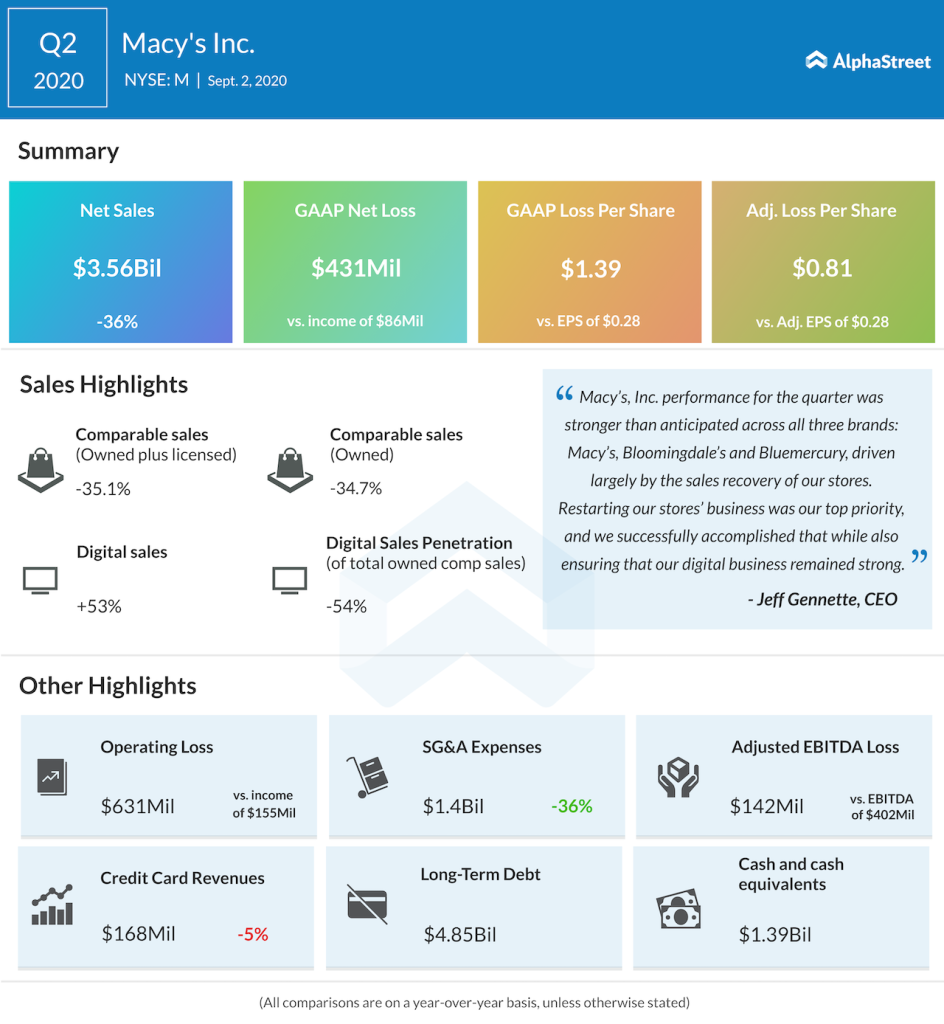

In its most recent quarter, Macy’s Inc. (NYSE: M) saw strength in its home, activewear and sleepwear categories, with activewear benefitting from an increased preference for active and healthy lifestyles and people working out at home as gyms remained closed. Categories such as dresses and men’s tailored saw softness as people mostly stayed indoors and worked from home.

American Eagle Outfitters Inc. (NYSE: AEO) recorded strong results in its Aerie brand in leggings, sports bras, comfy tees and fleece while the AE brand saw good momentum in jeans and bottoms. The company also launched a new activewear brand OFFLINE expecting to take advantage of the growing demand for active apparel.

AEO sees further growth potential for OFFLINE in the $16 billion women’s active apparel market and also sees opportunity in categories like swim, lounge and intimates which represent a combined $40 billion addressable market.

Abercrombie & Fitch Co. (NYSE: ANF) saw double-digit sales growth in shorts, knit tops, skirts and swim in the women’s division coupled with strength in tees, shorts and jeans in the men’s division.

G-III Apparel Group Ltd (NASDAQ: GIII) was able to grow and capture market share in almost all its major categories such as sportswear, coats, dresses, athleisure, jeans and swimwear. The company is seeing demand accelerate in the athleisure category and it has also rolled out jeans lines in three of its power brands that are in line with the current casual and active lifestyle. Athleisure and jeans are expected to be key growth areas going forward.

Stores

Most of the retailers witnessed massive momentum in their digital channels as more people started to purchase online. This trend is expected to continue in the near-term which has led companies to re-evaluate and reorganize their store footprint and to invest more in omnichannel capabilities.

Macy’s is focusing on building its omnichannel experience. With regards to its stores, the company is putting certain additional investments on hold but it continues to benefit from its previous investments such as the upgradation of stores under the G150 strategy.

Over the next two years, the company plans to open several smaller format off-mall Macy’s stores and continue the expansion of Bloomingdale’s The Outlet. Macy’s believes that its namesake brand and Bloomingdale’s have high potential off-mall and in smaller formats.

Meanwhile, American Eagle Outfitters is evaluating its fleet and plans to close more stores over the coming years and reduce fixed costs related to these stores based on the success it saw in its digital channel during its most recent quarter. The company expects to close 40-50 locations at the end of this year.

AEO has almost 250 leases expiring this year and a similar number next year along with an average lease term under 3.5 years. Its flexible lease portfolio will allow it to quickly exit unprofitable locations.

Abercrombie & Fitch plans to allocate half of its capital spending to stores and the other half to digital investments. While the company feels stores are important for the omnichannel experience, it also believes they have to make sense in terms of size, location and economics. Abercrombie continues to open and close stores based on this strategy.

The company has over 200 leases that will come due by the end of this year and it will work with its landlords to find mutually beneficial deals. The retailer continues to evaluate all its options in terms of remodelling its stores or closing them.

G-III Apparel is restructuring its retail operations and will close all of its 110 Wilsons Leather and 89 G.H. Bass locations. The company has reached early lease termination agreements with its landlords and expects to incur a total charge of around $100 million related to this restructuring.

Many of the trends seen during the pandemic are expected to continue even after the crisis subsides and retailers are making changes to their operations accordingly and these restructuring efforts are expected to pay off over the long term.