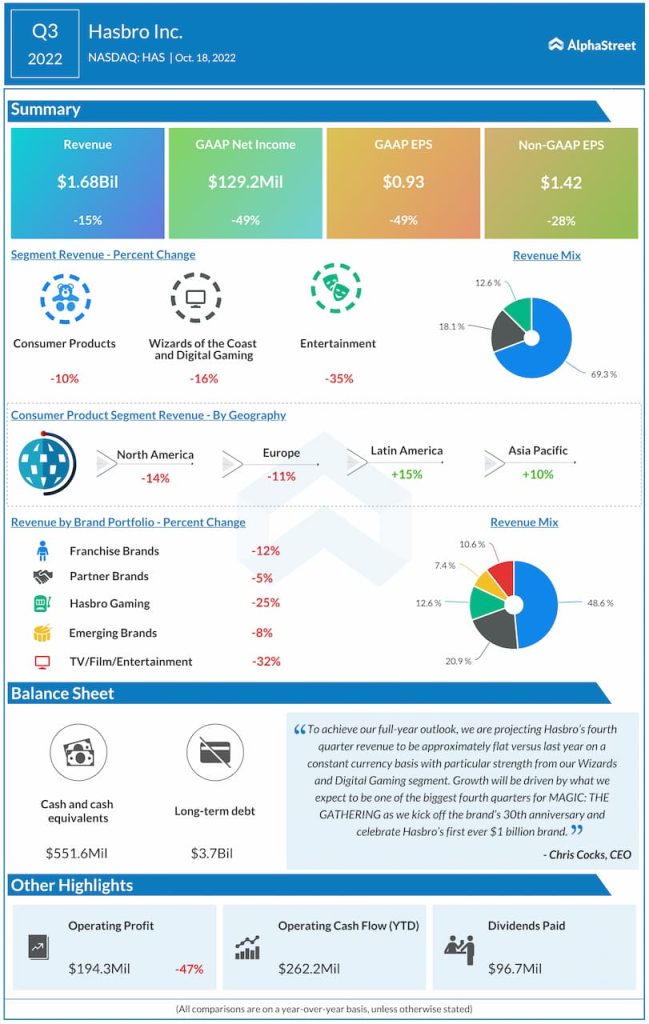

Quarterly numbers

The quarterly results were affected by the pressure of inflation on consumers. They were also impacted by the acceleration of Consumer Products shipments by retailers into the second quarter due to anticipated supply chain headwinds, as well as the releases of MAGIC: THE GATHERING and entertainment content being scheduled for the fourth quarter.

Category performance

Hasbro saw revenues decrease across all its segments and brands during the third quarter. Consumer Products, Wizards of the Coast and Digital Gaming, and Entertainment all recorded double-digit revenue declines.

Film & TV revenue decreased 26% compared to last year’s third quarter which had direct to streaming releases of films like Come from Away and Finch. Revenue from Family Brands dropped 78% versus last year as last year’s results included the release of the film My Little Pony: A New Generation while there were no releases this year.

Revenues declined across all brands as well with the highest drop of 32% coming from TV/Film/Entertainment, followed by Hasbro Gaming which fell 25%. The total gaming category, including all gaming revenue, totaled $508.6 million in Q3, which was down 23% YoY.

Blueprint 2.0

At its investor day earlier this month, Hasbro outlined its new strategy which involves focusing on its most valuable brands and driving high-margin growth among other things. A major focus area will be direct-to-consumer and digital. The company’s direct platform is set to become a $1 billion digital and ecommerce direct business with over 50 million accounts by 2027. Hasbro is also expanding its licensing with new and recent partnerships announced with Basic Fun and Lego.

Outlook

Hasbro expects revenue for the fourth quarter of 2022 to be flat compared to last year. The company expects a strong performance from its Wizards of the Coast and Digital Gaming segment driven by the MAGIC: THE GATHERING tabletop release schedule in Q4.

For the full year of 2022, Hasbro expects revenue to be flat to slightly down in constant currency and adjusted operating profit margin to be 16%. In Consumer Products, revenue is expected to decline in low single digits in constant currency compared to last year. Within the Wizards segment, revenue is anticipated to grow in the high single digits on a constant currency basis. In Entertainment, revenue is expected to decline mid-single digits as certain non-core businesses are divested and deliveries of some TV and film releases move to the first quarter of 2023.

Click here to read more on toy stocks