Toy companies Hasbro Inc. (NASDAQ: HAS) and Mattel Inc. (NASDAQ: MAT) reported their fourth quarter and full-year 2020 earnings results this week. Both companies ended the year on a strong note with solid results for the final fiscal quarter and an upbeat outlook for the coming year. Let’s take a look at how each one fared:

General industry trends

According to a report by The Toy Association and The NPD Group, the market size for the total toy industry in the US in 2020 was approx. $32.6 billion, which represented a growth of 16.7% compared to 2019. In terms of super category, the largest increases were seen in games/puzzles, outdoor and sports toys, and building sets during the year.

On its quarterly conference call, Hasbro stated that, according to NPD, within The Child products, The Child Animatronic Edition was the Number One item in the Plush Category in North America and several other markets in the fourth quarter.

Mattel stated on its earnings call that according to the NPD, for both the fourth quarter and the full year of 2020, Barbie was the Number One overall toy property globally and the Barbie Dreamhouse was the Number One toy in the US.

Quarterly numbers

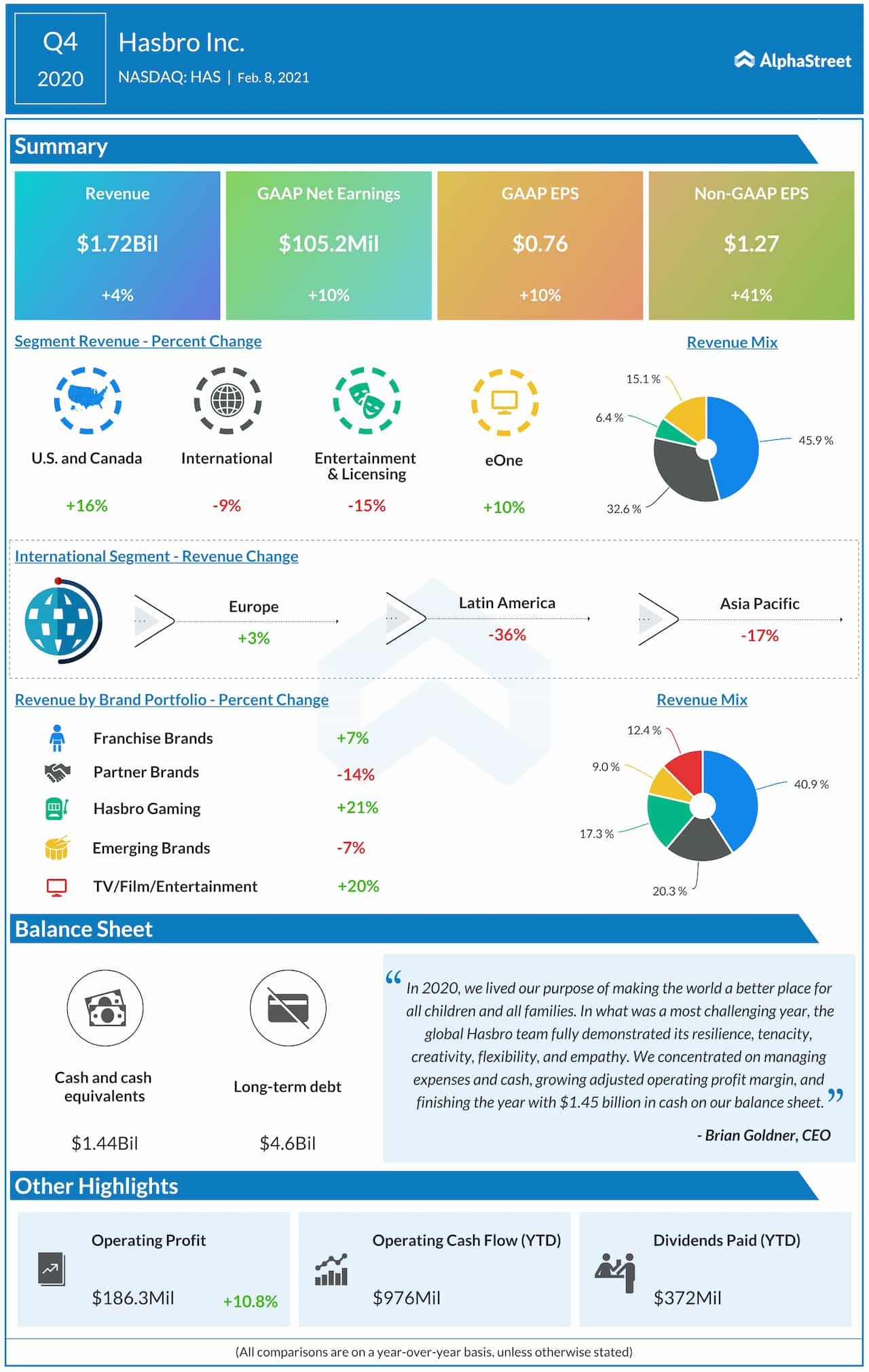

For the fourth quarter of 2020, Hasbro reported a 4% increase in total revenues to $1.72 billion and a 41% growth in adjusted EPS to $1.27 compared to last year. Both the top and bottom lines exceeded market expectations. Mattel also surpassed analysts’ estimates with a 10% growth in net sales to $1.62 billion and an adjusted EPS of $0.40.

Regional/Category performance

During the quarter, Hasbro’s US and Canada segment saw revenue growth of 16%, benefitting from gains in Franchise Brands, Hasbro Gaming and Emerging Brands. International segment revenues fell 9%, hurt by declines in Latin America and Asia.

Revenues in the Entertainment, Licensing and Digital segment declined 15% due to lower consumer products and entertainment revenues. eOne segment revenues increased 10% helped by the resumption of TV and film production.

Within brands, Hasbro Gaming registered the highest revenue growth of 21% followed by TV/Film/Entertainment at 20%. Franchise Brands grew 7% but Partner Brands and Emerging Brands reported declines.

For the full year, Hasbro reported revenue declines across all its segments except US and Canada and across all its brands except Hasbro Gaming.

Mattel reported a 13% sales growth in the North America segment and a 7% sales growth in the International segment in Q4. Sales in the American Girl segment rose 12%. Gross billings grew across all its segments driven by growth in Dolls, Infant, Toddler and Preschool, Action Figures, Building Sets, Games, and Vehicles.

Mattel’s strong performance was driven by Barbie, American Girl, Fisher-Price, Thomas & Friends, Hot Wheels, UNO, Star Wars: The Child plush and MEGA. For the full year, Mattel’s sales grew in North America and American Girl but fell in International.

Outlook

Hasbro is optimistic about its growth prospects for 2021 as it has new product lines along with planned increases in theatrical, television and streaming entertainment which are expected to help drive the business. The company is also investing in digital gaming and entertainment and plans to bring these to market.

Mattel expects to achieve a mid single-digit percentage increase in net sales in constant currency in 2021. Looking beyond 2021, the company remains confident in the strength of its Power Brands, catalog IP pipeline, and its entertainment partnerships. Mattel aims to continue increasing its market share as well as grow its net sales by mid single-digit percentages in constant currency in 2022 and 2023.

Click here to read the full transcripts of Hasbro and Mattel earnings calls